- United States

- /

- Hospitality

- /

- NYSE:VAC

Is Leadership Shake-Up and CEO Exit Shifting the Investment Outlook for Marriott Vacations Worldwide (VAC)?

Reviewed by Sasha Jovanovic

- Earlier in November 2025, Marriott Vacations Worldwide underwent significant leadership changes, including the Board-requested resignation of CEO John E. Geller, Jr., and announced the planned retirement of Brian E. Miller, President of Vacation Ownership, following more than 30 years with the company.

- These executive transitions came immediately after the company reported a quarterly net loss, revised its earnings outlook downward, and saw analysts adopt a more cautious view of its performance and outlook.

- We'll examine how the CEO departure and resulting leadership changes affect the company's investment narrative and future prospects.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Marriott Vacations Worldwide Investment Narrative Recap

To be a shareholder in Marriott Vacations Worldwide, you need to believe new leadership can execute on a recovery in first-time buyer growth and improved financials, even amid ongoing leadership turnover. The sudden CEO departure and announced retirement of a key division president add some uncertainty, but the main short-term catalyst, continued growth in first-time owner sales, remains intact, while the biggest immediate risk is a slowdown in owner upgrades and the resulting squeeze on margins. At this stage, the executive changes may not materially disrupt the primary near-term catalyst, though they do highlight the company's sensitivity to stable leadership and succession planning.

Most relevant to these changes is the company's Q3 earnings announcement, which showed a net loss and prompted a downward revision of earnings guidance. This update puts renewed focus on the core risk of decelerating owner sales and margin compression, underscoring the importance of leadership stability for delivering on modernization initiatives and driving owner engagement.

On the other hand, investors should be aware that slowing owner sales could become harder to offset if...

Read the full narrative on Marriott Vacations Worldwide (it's free!)

Marriott Vacations Worldwide's narrative projects $6.3 billion in revenue and $355.3 million in earnings by 2028. This requires a 22.9% yearly revenue growth rate and an earnings increase of $96 million from the current earnings of $259.0 million.

Uncover how Marriott Vacations Worldwide's forecasts yield a $86.80 fair value, a 91% upside to its current price.

Exploring Other Perspectives

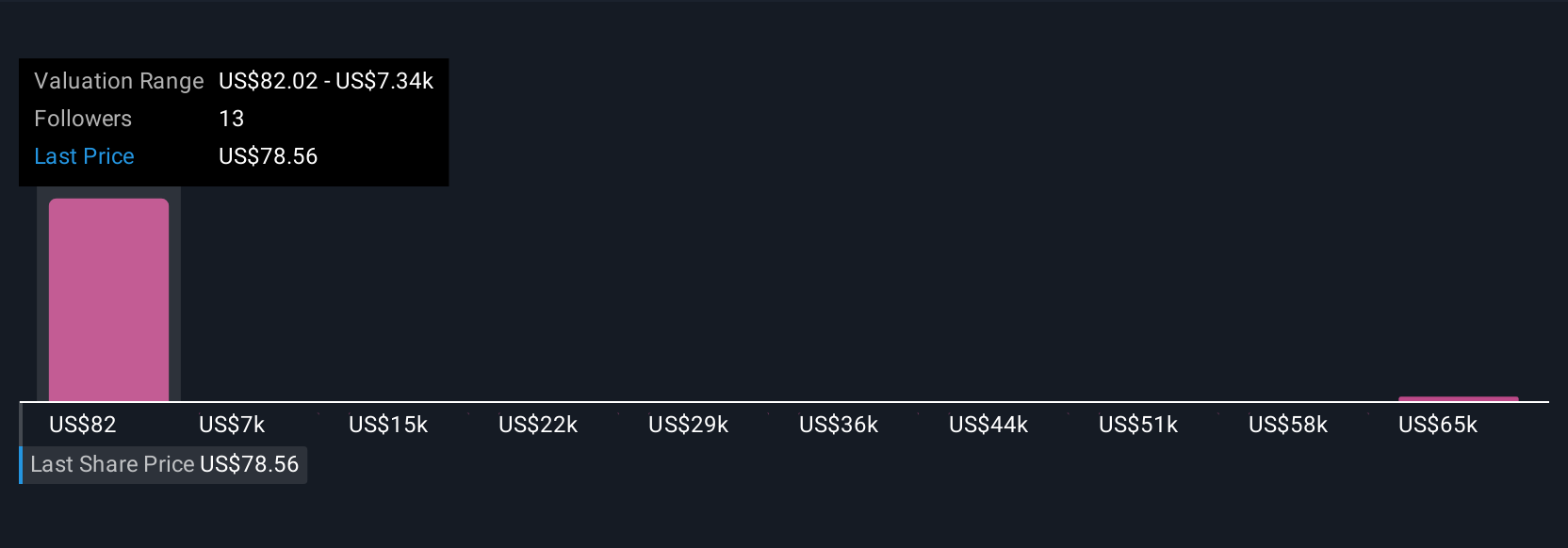

Six individual fair value estimates from the Simply Wall St Community range from US$82 to a striking US$72,681 per share. Owner sales growth remains pivotal for supporting the company's recovery and long term outlook, so consider how differing opinions reflect uncertainty about future performance.

Explore 6 other fair value estimates on Marriott Vacations Worldwide - why the stock might be a potential multi-bagger!

Build Your Own Marriott Vacations Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marriott Vacations Worldwide research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marriott Vacations Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marriott Vacations Worldwide's overall financial health at a glance.

No Opportunity In Marriott Vacations Worldwide?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAC

Marriott Vacations Worldwide

A vacation company, engages in the vacation ownership, exchange, rental, and resort and property management businesses in the United States and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives