- United States

- /

- Consumer Services

- /

- NYSE:UTI

Will UTI’s Leadership Moves Reflect a Stronger Growth Vision or Strategic Caution?

Reviewed by Sasha Jovanovic

- Earlier this month, Universal Technical Institute announced the appointment of Tod Gibbs as Campus President for its upcoming Atlanta campus, scheduled to open in 2026 pending regulatory approvals, and marked the 20th anniversary of its Sacramento campus, which has trained over 13,300 graduates in partnership with major employers.

- These events highlight UTI's continued commitment to expansion and industry partnerships, signaling an ongoing focus on workforce-oriented education and growth in new markets.

- We'll explore how appointing an experienced leader for the new Atlanta campus shapes Universal Technical Institute's long-term investment outlook.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Universal Technical Institute Investment Narrative Recap

To be a Universal Technical Institute shareholder, one needs confidence in the company’s ability to expand its campus and program footprint without overextending resources or risking regulatory setbacks. The appointment of an experienced leader for the planned Atlanta campus may support management execution, but it is unlikely to change the near-term enrollment catalyst or address the biggest risk: whether new investments in expansion can deliver sustainable returns if student demand softens or approvals are delayed.

Among the recent developments, the major expansion at UTI-Dallas stands out as the most relevant in context, accentuating the broader growth ambitions that the Atlanta leadership news supports. Both expansion moves highlight UTI’s bet on rising demand for skilled trades education as a catalyst, yet also intensify concerns about capital deployment and the importance of aligning new capacity with actual enrollment trends.

In contrast, what may concern investors most is not new announcements, but the potential for overcapacity if student demand does not keep pace with aggressive expansion plans…

Read the full narrative on Universal Technical Institute (it's free!)

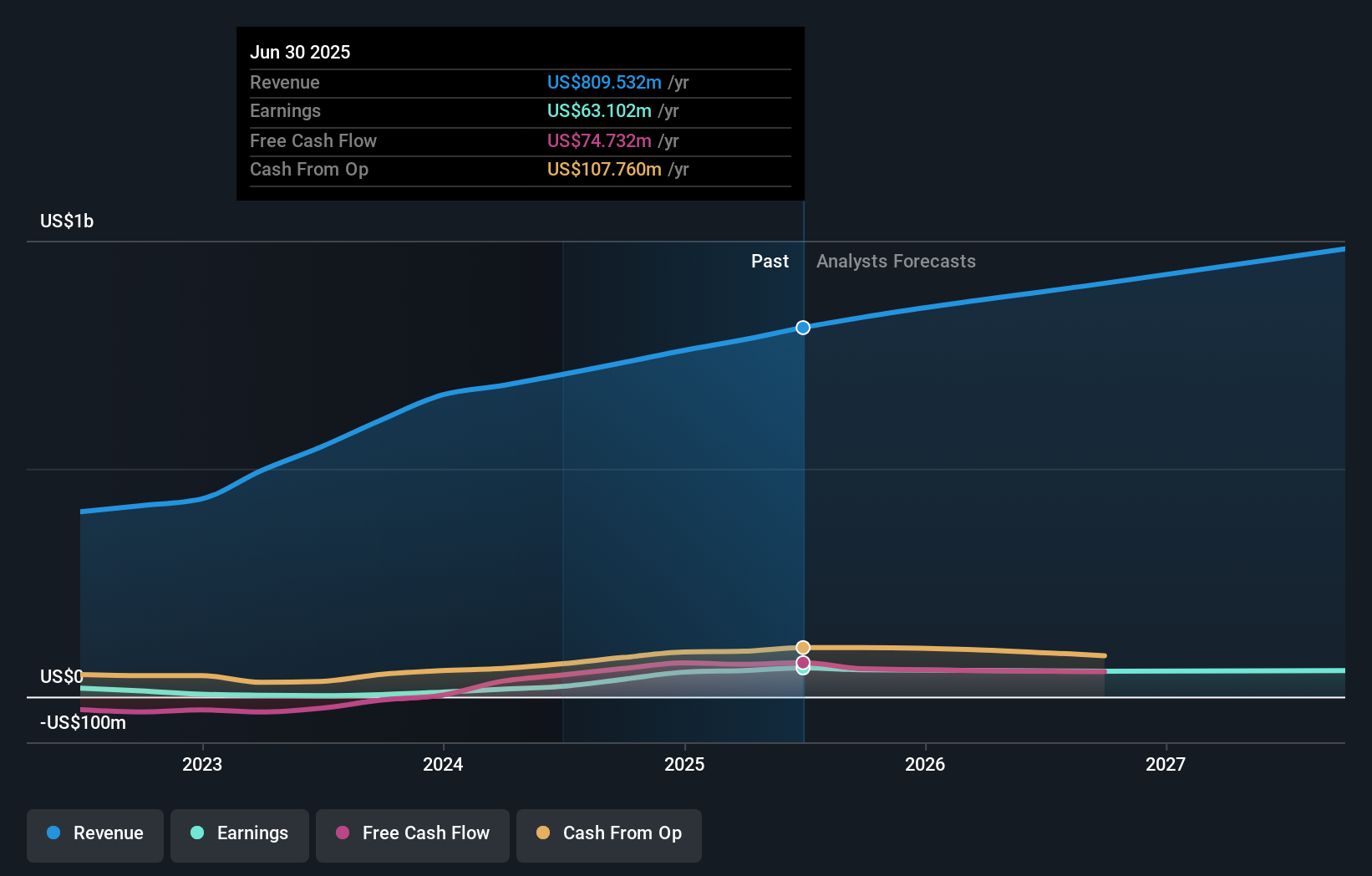

Universal Technical Institute's outlook anticipates $1.0 billion in revenue and $54.0 million in earnings by 2028. This projection is based on an 8.9% annual revenue growth rate, but actually expects earnings to decrease by $9.1 million from the current $63.1 million.

Uncover how Universal Technical Institute's forecasts yield a $37.60 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for UTI range from US$17.86 to US$37.60, highlighting dramatically different outlooks. With ambitious campus investments underway, question how enrollment growth will influence the company’s future performance and review multiple viewpoints.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth as much as 9% more than the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives