- United States

- /

- Consumer Services

- /

- NYSE:UTI

Is Universal Technical Institute's (UTI) Convertible Bond Raise Reshaping Its Capital Structure and Investment Outlook?

Reviewed by Sasha Jovanovic

- In late October 2025, Universal Technical Institute, Inc. announced a significant private placement of unregistered unsecured convertible bonds to raise gross proceeds of KRW 52,000,000,000, with institutional participation from Seven Bridge No. 6 Unique Glass PEF and bonds convertible to common shares starting November 2026 and maturing in November 2030.

- This capital raise not only provides Universal Technical Institute with considerable new funding, but also introduces the potential for future equity dilution as the bonds convert into common shares.

- We'll explore how this convertible bond issuance could reshape Universal Technical Institute's capital structure and its investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Universal Technical Institute Investment Narrative Recap

To be a shareholder in Universal Technical Institute today, an investor needs to believe in the company’s ability to drive enrollment growth through campus expansion and program diversification, while managing risks tied to sector regulation and changing student preferences. The recent convertible bond issuance brings fresh capital to fuel expansion plans but does not materially alter the biggest near-term catalyst, accelerated new campus openings, nor the key risk, which remains the execution and returns from these growth initiatives.

Among recent company announcements, the October expansion of UTI’s Dallas campus stands out as directly relevant. This move reflects management’s active use of new funding to extend skilled trades offerings and broaden their student base, which could help sustain revenue growth, although converting this investment into consistent enrollment gains is subject to execution risk and market demand.

However, if revenue gains from new programs or locations fall short of these investments, investors should be aware that...

Read the full narrative on Universal Technical Institute (it's free!)

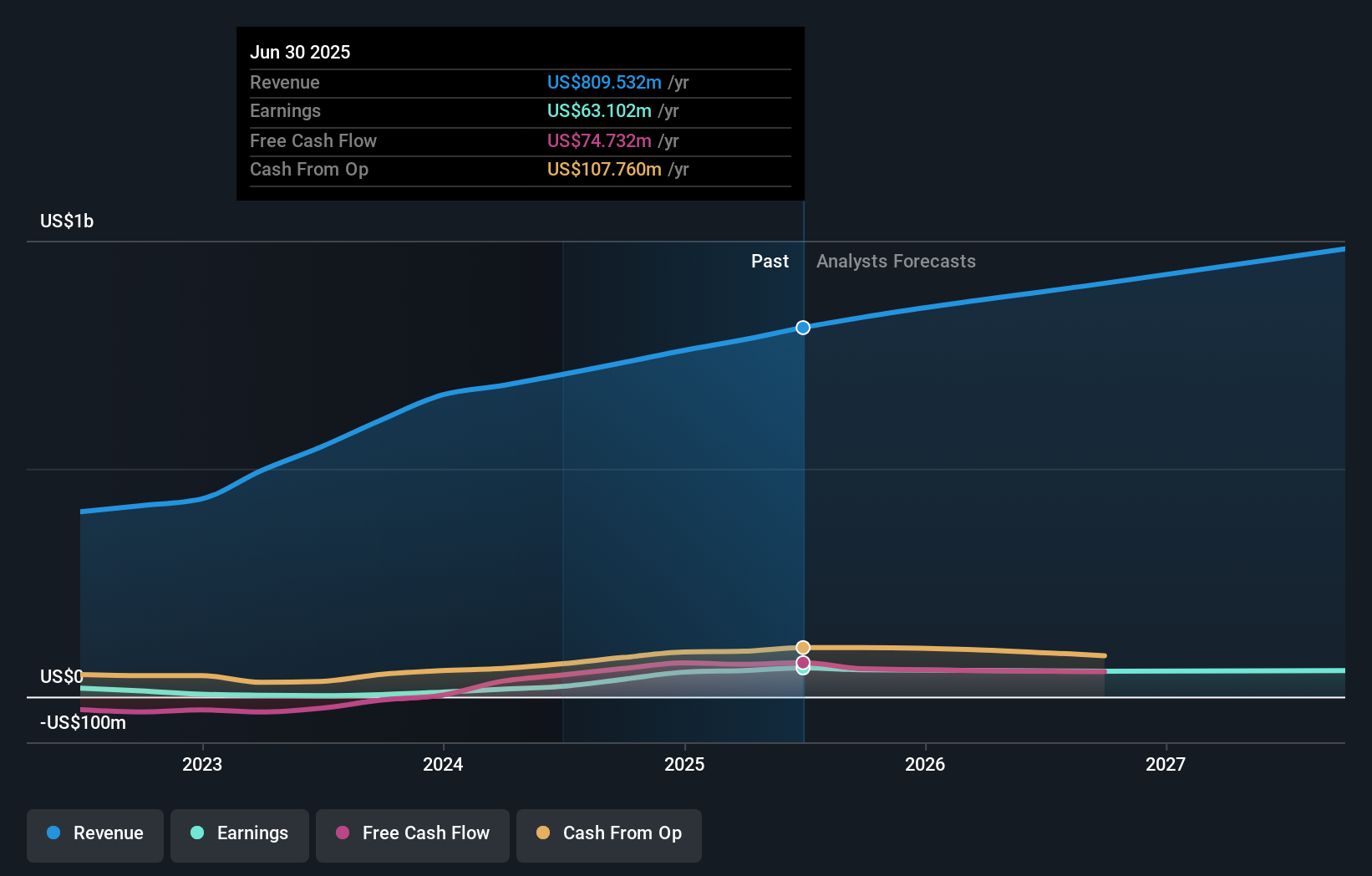

Universal Technical Institute's outlook forecasts $1.0 billion in revenue and $54.0 million in earnings by 2028. This implies an annual revenue growth rate of 8.9%, but a decrease in earnings of $9.1 million from the current $63.1 million.

Uncover how Universal Technical Institute's forecasts yield a $37.60 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered fair value estimates for Universal Technical Institute between US$18.07 and US$37.60, across two independent assessments. With expansion ambitions supported by private capital, opinions about sustainable returns and growth potential can vary widely, explore why different investors see the company so differently.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth as much as 27% more than the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives