- United States

- /

- Consumer Services

- /

- NYSE:UTI

How Universal Technical Institute’s New Electrical Programs Could Shape Its Growth Strategy (UTI)

Reviewed by Simply Wall St

- Universal Technical Institute recently announced the launch of four new electrical-focused programs at its Exton and Mooresville campuses, subject to regulatory approval, as part of a broader initiative to expand its educational offerings.

- This approach features a modular curriculum that allows students to specialize in areas such as robotics, wind energy, or electronics, supporting UTI's broader growth and campus expansion strategy.

- We'll examine how the rollout of these modular electrical programs could reinforce Universal Technical Institute's ongoing diversification and expansion narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Universal Technical Institute Investment Narrative Recap

To be a shareholder in Universal Technical Institute, you need to believe in the company’s expansion and diversification strategy, including frequent program launches and geographic growth, all aiming to support steady enrollment and revenue opportunities. The recent rollout of new electrical programs, pending regulatory approval, can play into this, but the most immediate catalyst remains UTI’s continued improvement in new student starts; conversely, the most significant near-term risk centers on unplanned operational costs from such frequent program and campus expansions, which could pressure margins if not well-managed.

The recent opening of new campuses in Atlanta and San Antonio is especially relevant, as these expansions align directly with UTI’s North Star strategy and work hand-in-hand with modular program launches like the new electrical offerings. Together, these moves illustrate the company’s ongoing focus on launching new programs and reaching new markets, which management and analysts cite as a key driver for revenue and profit growth, but also a source of potential cost overruns and operational complexity.

However, investors should also factor in the challenge of integrating new programs efficiently at scale and, in particular, the possibility that…

Read the full narrative on Universal Technical Institute (it's free!)

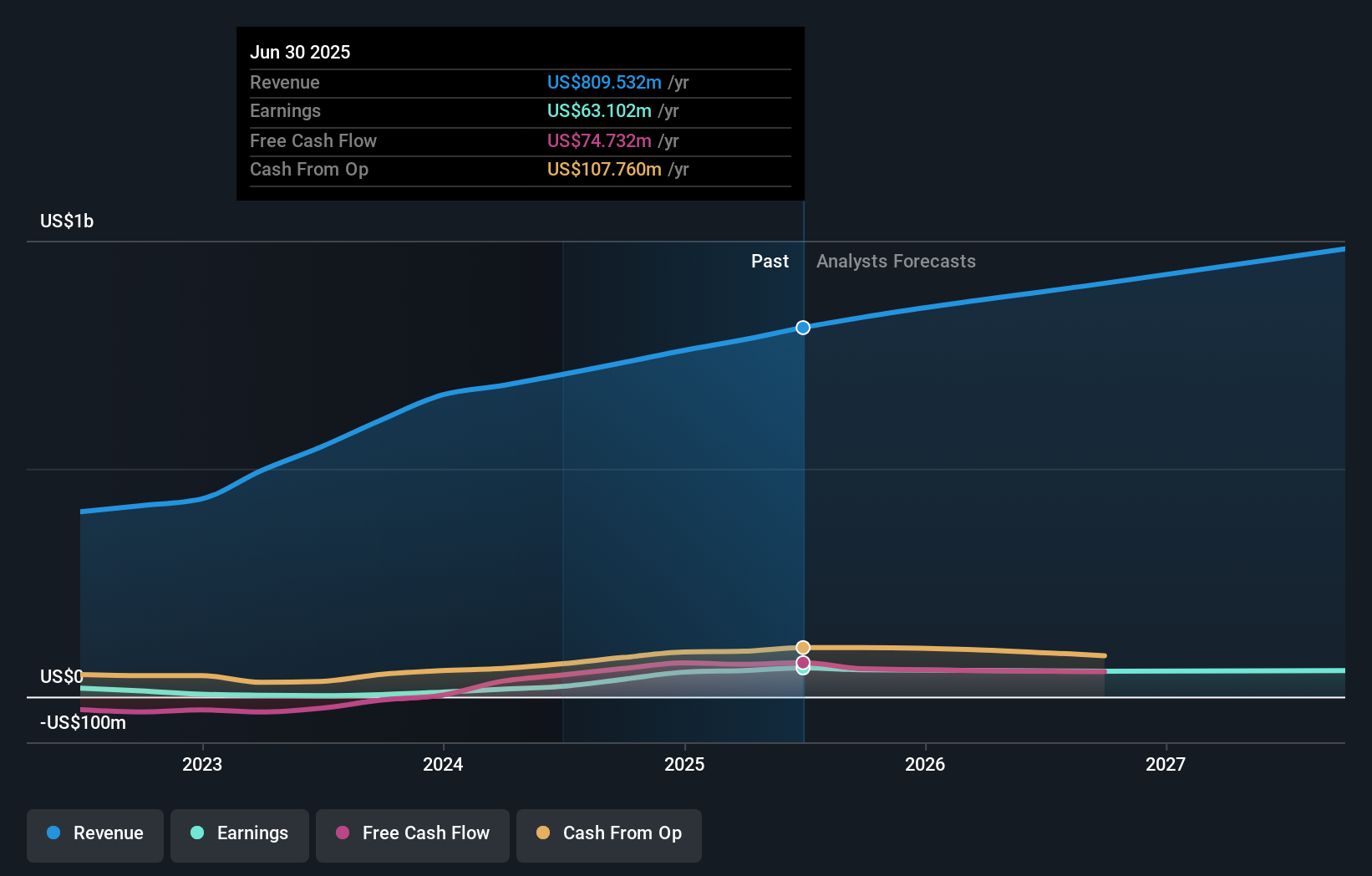

Universal Technical Institute's outlook anticipates $1.0 billion in revenue and $68.7 million in earnings by 2028. This scenario is based on an 8.7% annual revenue growth rate and an $11.3 million increase in earnings from the current level of $57.4 million.

Uncover how Universal Technical Institute's forecasts yield a $37.33 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates for Universal Technical Institute in a wide band from US$29.09 to US$37.33, reflecting two independent outlooks. Against this backdrop, the company's ongoing campus and program expansions stand out as a potential growth driver but also introduce unique operational cost risks for future performance.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth as much as 18% more than the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives