- United States

- /

- Consumer Services

- /

- NYSE:UTI

A Look at Universal Technical Institute's Valuation Following Regulatory Approval for Accelerated Healthcare Expansion

Reviewed by Simply Wall St

The Department of Education has lifted important restrictions on Concorde Career Colleges, which allows Universal Technical Institute (UTI) to expand its healthcare-centered programs more quickly. Investors are watching closely because this regulatory approval redefines UTI’s growth outlook for 2025.

See our latest analysis for Universal Technical Institute.

UTI’s share price has shown solid momentum this year, with a gain of 15.6% since January and a remarkable 50.4% total shareholder return over the past twelve months. While short-term dips have appeared, the latest regulatory approval has clearly supported investor optimism about the company’s entry into the healthcare sector and its future growth potential.

If you’re interested in discovering more education and training companies riding similar growth waves, it’s worth exploring our See the full list for free..

With a strong run in the share price and upgraded growth prospects, the big question now for potential investors is whether UTI is trading at a bargain for future returns or if the market has already priced in these positive developments.

Most Popular Narrative: 21.9% Undervalued

Universal Technical Institute's most followed narrative puts its fair value at $37.60, well above the last close price of $29.38. The gap implies a significant potential upside if the outlined growth drivers deliver as anticipated.

Strategic investments in campus expansion, new program rollouts (notably in HVAC, aviation, and allied health), and digitization efforts are expected to support top-line expansion. In addition, the consolidation of core systems should facilitate operating efficiencies and drive long-term margin improvement beyond the near-term investment cycle.

Want to know what’s fueling the optimism among analysts? The narrative hinges on rapid revenue growth, shrinking profit margins, and a bold earnings outlook. What’s the story behind the ambitious future price-to-earnings multiple? Find out which surprising projections drive the valuation above market expectations.

Result: Fair Value of $37.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory setbacks or failure to attract students to new programs could challenge UTI’s growth outlook and put pressure on future earnings assumptions.

Find out about the key risks to this Universal Technical Institute narrative.

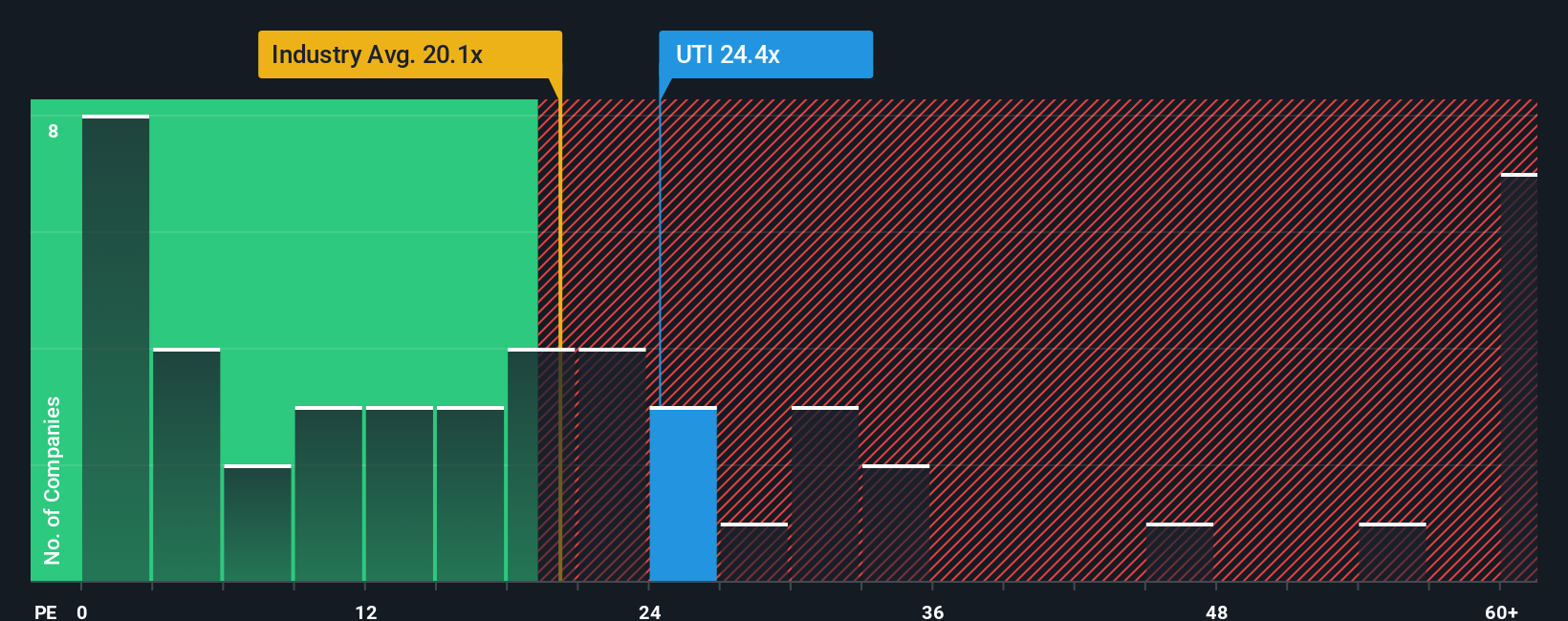

Another View: Valuation by Earnings Multiples

Looking through an earnings-based lens, Universal Technical Institute stands out as pricier than its industry peers. Its price-to-earnings ratio sits at 25.3x, compared to the peer average of 19.1x, and significantly above the fair ratio of 13.3x. This suggests the market expects a lot from future growth. Does this optimism set the bar too high, or is it justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Universal Technical Institute Narrative

If you see things differently or want to dive deeper into the numbers, you can quickly build your own Universal Technical Institute view. No expertise required. Do it your way

A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take action now and unearth stocks you might be missing, chosen for their unique strengths and growth trends, using the Simply Wall Street Screener.

- Capitalize on high yield by tapping into these 15 dividend stocks with yields > 3%, offering consistent payouts and attractive returns for steady income seekers.

- Catch the wave of innovation as you uncover these 26 AI penny stocks, where artificial intelligence meets breakout financial potential.

- Seize unmatched value with these 877 undervalued stocks based on cash flows, that analysts believe are trading below their true potential, before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives