- United States

- /

- Hospitality

- /

- NYSE:TNL

Does TNL’s Steady Dividend Point to Resilient Cash Flow or Conservatism in Capital Allocation?

Reviewed by Sasha Jovanovic

- On November 12, 2025, Travel + Leisure Co. declared a quarterly cash dividend of US$0.56 per share, payable on December 31, 2025, to shareholders of record as of December 12, 2025, and published updated investor presentation materials emphasizing transparency and regular communication.

- Investor confidence has been further supported by the company’s strong third-quarter results, new institutional investment, and the continuation of its dividend policy, even as an officer sold shares during the period.

- We'll explore how Travel + Leisure’s consistent dividend reinforces its investment narrative and supports analyst expectations of sustained cash flow.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Travel + Leisure Investment Narrative Recap

For shareholders of Travel + Leisure, confidence in the company’s ability to sustain robust cash flow and deliver reliable dividends remains central to the investment case. The recent quarterly dividend affirmation and continued positive earnings provide near-term stability, but the biggest risk remains the persistent structural headwinds in the Travel and Membership segment, neither the dividend announcement nor recent investor updates appear to significantly alter this key risk or the most important short-term catalysts.

Of all the recent announcements, the release of updated investor presentation materials stands out, as it highlights the company’s ongoing commitment to transparency and proactive communication. This aligns with management’s efforts to reassure investors as Travel + Leisure works to diversify revenue streams and expand into new resort brands, both of which support confidence around the consistency of free cash flow that underpins its current dividend policy.

However, investors should not overlook that, despite the confidence signaled by the dividend, the company’s concentration in the US vacation ownership business means that...

Read the full narrative on Travel + Leisure (it's free!)

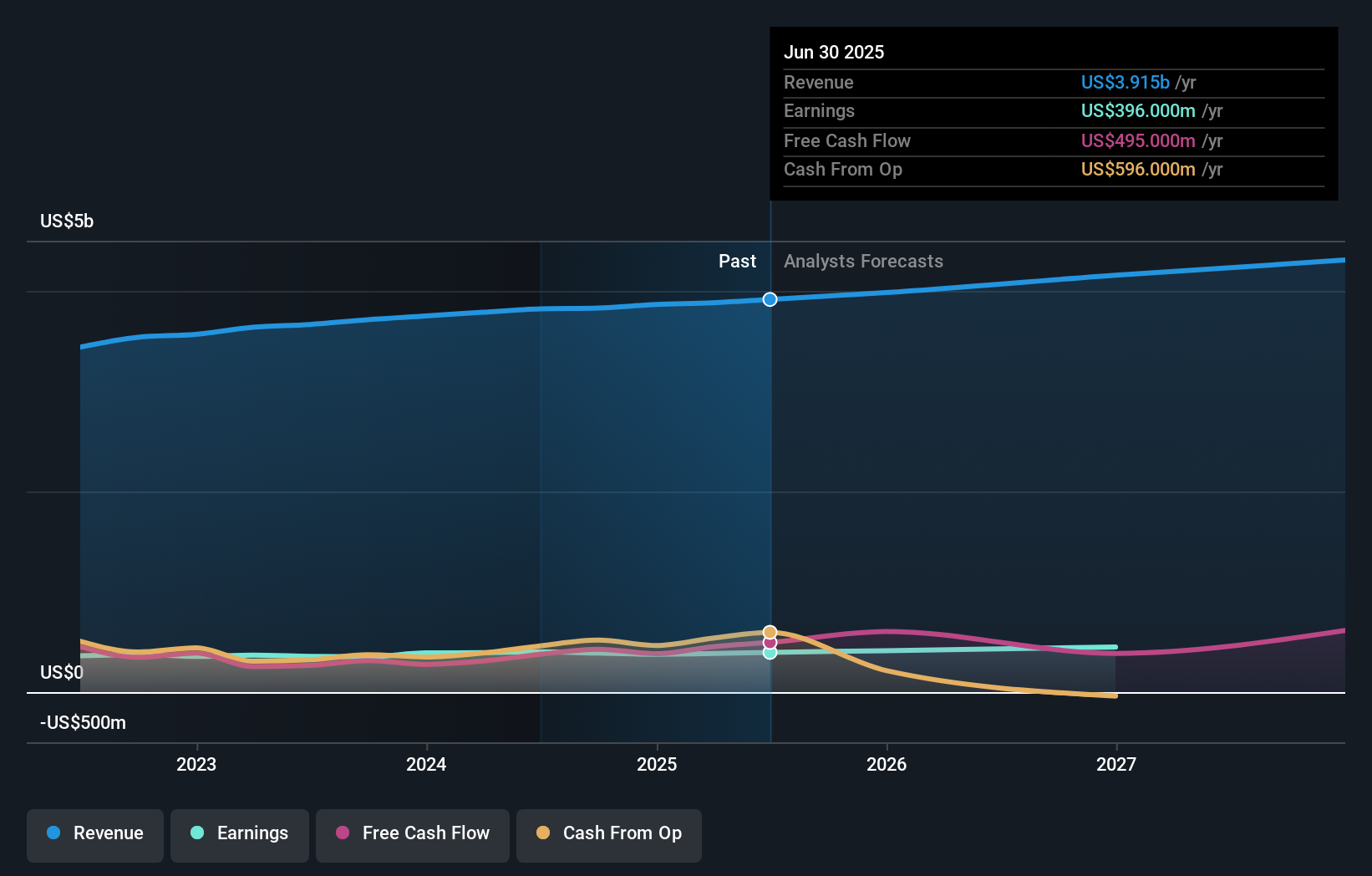

Travel + Leisure's outlook projects $4.4 billion in revenue and $506.9 million in earnings by 2028. This is based on a 3.9% annual revenue growth rate and reflects a $110.9 million increase in earnings from the current $396.0 million.

Uncover how Travel + Leisure's forecasts yield a $74.27 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Four community members from Simply Wall St provided fair value estimates ranging from US$43.13 to a striking US$61,186.95 per share. As you compare these wide-ranging views, remember continued industry headwinds in the Travel and Membership segment may weigh on future performance, making it essential to consider multiple perspectives before forming your own outlook.

Explore 4 other fair value estimates on Travel + Leisure - why the stock might be a potential multi-bagger!

Build Your Own Travel + Leisure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travel + Leisure research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Travel + Leisure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travel + Leisure's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travel + Leisure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNL

Travel + Leisure

Provides hospitality services and travel products in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives