- United States

- /

- Hospitality

- /

- NYSE:RSI

Why Rush Street Interactive (RSI) Is Up 37.1% After Raising 2025 Revenue Guidance and Posting Record Highs

Reviewed by Simply Wall St

- Rush Street Interactive recently reported second quarter 2025 results, posting record highs in revenue and profitability, and subsequently raised its full-year revenue guidance to between US$1,050 million and US$1,100 million.

- This marked the ninth consecutive quarter of growth across key metrics, with North America and Latin America, particularly Mexico and Colombia, driving sustained momentum despite headwinds from increased taxes.

- We'll explore how the improved revenue guidance strengthens Rush Street Interactive's long-term growth outlook within its current investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Rush Street Interactive Investment Narrative Recap

To be a shareholder in Rush Street Interactive, you need to believe in the company’s ability to sustain strong revenue growth and achieve profitability in the fast-evolving online casino and sports betting industry, despite regulatory and tax headwinds. The recent raise in full-year revenue guidance reflects management’s confidence and directly supports ongoing momentum, but it’s worth noting that changes in taxation, particularly the proposed VAT in Colombia and New Jersey, remain the most important risk and could impact net margins in the short term if enacted.

The July announcement of raised full-year revenue guidance, following record Q2 results, stands out as the most relevant recent development. This increase to a US$1,050 million to US$1,100 million range signals management’s ongoing optimism despite cost pressures, reinforcing the company’s current operational trajectory and short-term growth catalysts, especially in North America and Latin America.

However, investors should also be aware that if tax proposals progress further, the impact on profitability could...

Read the full narrative on Rush Street Interactive (it's free!)

Rush Street Interactive's narrative projects $1.4 billion in revenue and $57.7 million in earnings by 2028. This requires 12.7% yearly revenue growth and a $49.3 million increase in earnings from the current $8.4 million.

Uncover how Rush Street Interactive's forecasts yield a $16.25 fair value, a 19% downside to its current price.

Exploring Other Perspectives

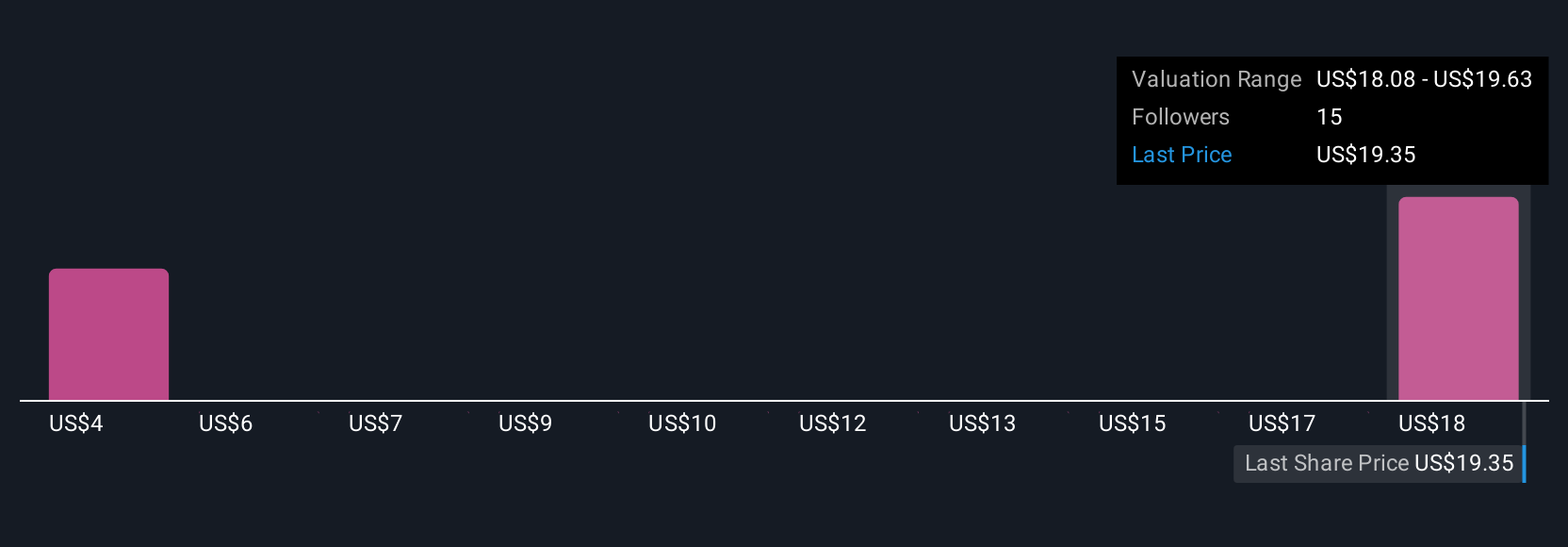

Simply Wall St Community members provided 2 fair value estimates for RSI ranging from US$4.12 to US$16.25. With such a broad set of opinions, consider how proposed tax changes could affect earnings and revisit your own outlook accordingly.

Explore 2 other fair value estimates on Rush Street Interactive - why the stock might be worth as much as $16.25!

Build Your Own Rush Street Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rush Street Interactive research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Rush Street Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rush Street Interactive's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives