- United States

- /

- Hospitality

- /

- NYSE:RSI

Ten Straight Quarters of Revenue Growth Could Be a Game Changer For Rush Street Interactive (RSI)

Reviewed by Sasha Jovanovic

- Rush Street Interactive recently reported third quarter revenue growth of 19.7% year over year, exceeding analysts’ estimates by 4.3% and marking its tenth consecutive quarter of sequential gains.

- This performance highlights not only continued momentum and market acceleration but also sustained success in player acquisition and engagement across key regions.

- We'll now examine how this exceptional run of consecutive revenue growth impacts Rush Street Interactive's broader investment narrative and future outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Rush Street Interactive Investment Narrative Recap

Shareholders in Rush Street Interactive are betting on continued strong player acquisition, high engagement, and operational excellence to maintain leadership in online gaming, especially amid rapid digitalization and regulatory expansion. While strong third-quarter revenue growth positively reinforces the near-term growth catalyst of market expansion and high user metrics, it does little to alleviate the key risk of regulatory shifts and increased tax liabilities in core and growth markets, which remain the single biggest threat to margin stability. One recent, highly relevant announcement is the company’s raised full-year revenue guidance of US$1,100 to US$1,120 million, reflecting management’s confidence in sustained momentum. The lift in guidance closely tracks with RSI’s streak of quarterly gains, giving the top-line story further credibility but not erasing the potential impact of future regulatory changes or tax actions that could affect profitability. Yet, even as revenue climbs, investors should not overlook the growing exposure to tax, regulatory risk, and the way these factors could abruptly shift RSI’s...

Read the full narrative on Rush Street Interactive (it's free!)

Rush Street Interactive's outlook anticipates $1.5 billion in revenue and $44.7 million in earnings by 2028. This is based on a 13.2% annual revenue growth rate and an earnings increase of $19.5 million from the current $25.2 million.

Uncover how Rush Street Interactive's forecasts yield a $22.86 fair value, a 28% upside to its current price.

Exploring Other Perspectives

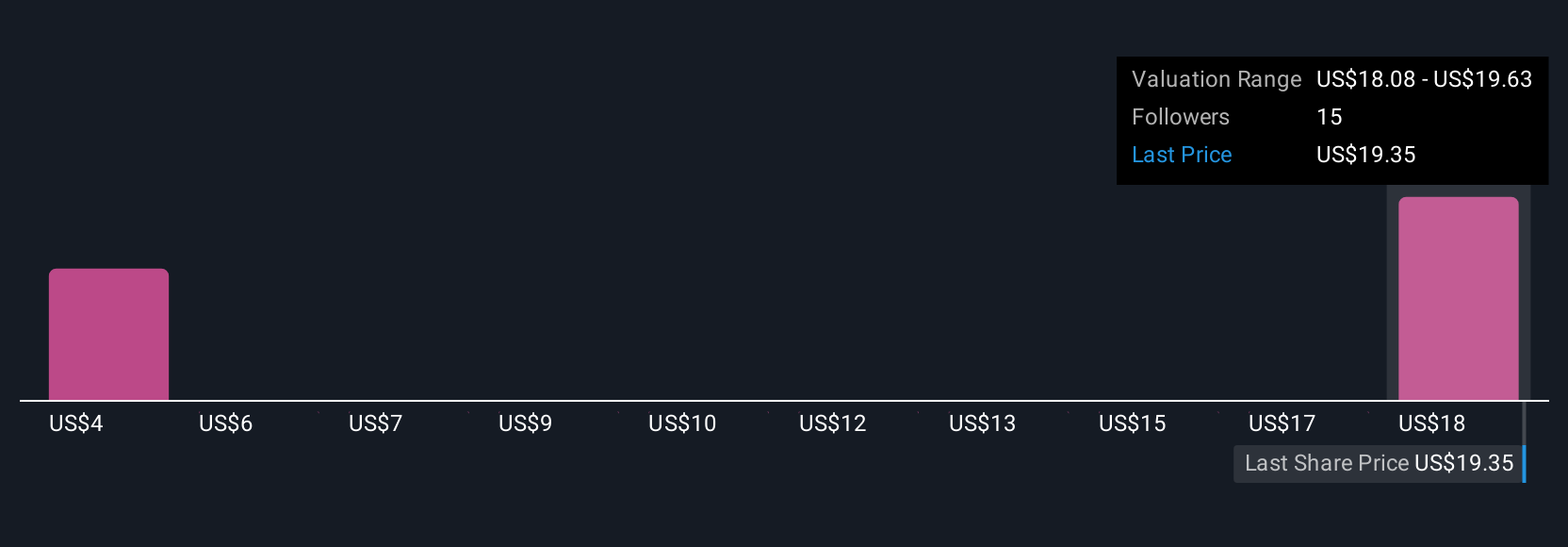

Fair value estimates from the Simply Wall St Community range from US$22.86 to US$27.01 across 2 investor perspectives. With ongoing legal and tax risks in key regions, these varied viewpoints show just how differently participants assess Rush Street Interactive's growth outlook.

Explore 2 other fair value estimates on Rush Street Interactive - why the stock might be worth just $22.86!

Build Your Own Rush Street Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rush Street Interactive research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Rush Street Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rush Street Interactive's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success