- United States

- /

- Hospitality

- /

- NYSE:RSI

Rush Street Interactive (RSI): Evaluating Valuation After Upbeat Q3 Results and Raised Outlook

Reviewed by Simply Wall St

Rush Street Interactive (RSI) delivered a strong third quarter, reporting increased online casino revenues, a higher number of monthly active users, and improved marketing efficiency. The company also raised its outlook for full-year revenue and EBITDA.

See our latest analysis for Rush Street Interactive.

Investors have taken note of Rush Street Interactive’s momentum, with the share price advancing more than 25% year to date and an impressive 58% total shareholder return over the past year. This signals growing confidence despite some recent volatility. The company’s upbeat guidance and accelerating user growth continue to fuel optimism about its long-term growth story.

If you’re scanning the horizon for other companies rapidly gaining ground, now’s a great time to broaden your view and discover fast growing stocks with high insider ownership

The question now is whether Rush Street Interactive’s recent surge has left its stock undervalued, or if the market has already run ahead and priced in all that future growth. Could this be a window for buyers, or is caution warranted?

Most Popular Narrative: 20.7% Undervalued

Rush Street Interactive's most followed narrative points to a fair value of $21.75 per share, which is notably higher than the last close price of $17.24. This outlook is rooted in projections of faster revenue growth and improved operating leverage, setting a bullish tone for its future prospects.

The digitalization of entertainment is accelerating migration from offline to online gaming. With record-high monthly active users (MAUs) growing over 30% in North America and more than 40% in Latin America, Rush Street Interactive is well-positioned to capture this expanding addressable market, supporting sustained future revenue growth. Ongoing legalization and regulatory acceptance of online sports betting and iGaming in North America and Latin America, evidenced by strong launches and growth in new markets like Delaware, Alberta (pending), and Mexico, provides a clear pathway for robust revenue expansion and geographic diversification in future periods.

Intrigued by the optimism behind this valuation? The narrative's assumptions hide a bold forecast built on massive user growth, ambitious international expansion, and a controversial future profit multiple. If you want to see which future milestones and numbers could propel the stock, even beyond analyst consensus, dive into the full analysis to uncover what truly drives this fair value.

Result: Fair Value of $21.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Latin American expansion and rising marketing costs could challenge Rush Street Interactive's growth trajectory if regulatory risks or competition increase.

Find out about the key risks to this Rush Street Interactive narrative.

Another View: Is the Stock Really a Bargain?

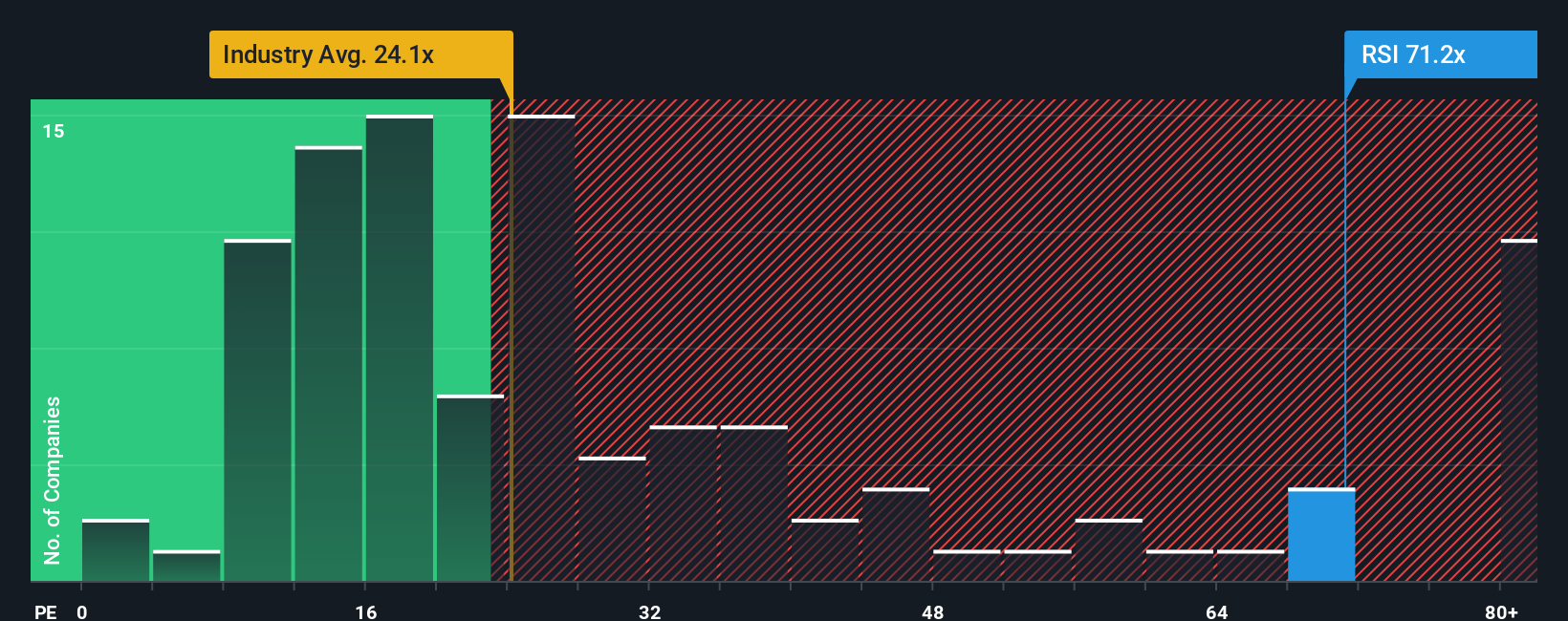

While some models suggest Rush Street Interactive is undervalued, examining its price-to-earnings ratio paints a different picture. At 56.1x, it is significantly more expensive than both industry peers (22.9x) and the broader US Hospitality sector (21.4x). The fair ratio stands at just 24.7x, highlighting a meaningful gap that could signal valuation risk. This raises questions about how much optimism is already priced in, or if the market is anticipating superior growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rush Street Interactive Narrative

If you have a different perspective or want to base your view on your own research, you can put together your own story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Rush Street Interactive.

Looking for more investment ideas?

Smart investors never stand still. Use the Simply Wall Street Screener to access fresh opportunities that match your goals and stay ahead of market trends. Don’t risk missing out on tomorrow’s top performers.

- Grow your passive income potential by sizing up these 16 dividend stocks with yields > 3% offering attractive yields above 3% and robust balance sheets.

- Get in early on tomorrow’s breakthroughs with these 24 AI penny stocks riding the AI wave and powering innovation across industries.

- Capture undervalued gems trading below their intrinsic value by targeting these 876 undervalued stocks based on cash flows based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives