- United States

- /

- Hospitality

- /

- NYSE:RSI

A Look at Rush Street Interactive's Valuation as Kyle Sauers Expands Leadership to President (RSI)

Reviewed by Simply Wall St

Rush Street Interactive (RSI) on October 15 announced that Kyle Sauers will take on the added role of President, expanding his responsibilities beyond his current position as Chief Financial Officer.

See our latest analysis for Rush Street Interactive.

RSI’s latest move at the executive level comes amid a wave of momentum for both the business and its stock. While the share price did pull back by 5.3% over the past week and nearly 15% in the past month, RSI’s 90-day share price return of 26.8% points to growing optimism. Looking further out, its 1-year total shareholder return of 71.7% and an eye-catching 350% total return over three years underscore just how much confidence has built up in the story. This reflects both operational execution and shifting market sentiment.

If the pace of change in RSI has you scanning the wider market for fresh opportunities, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

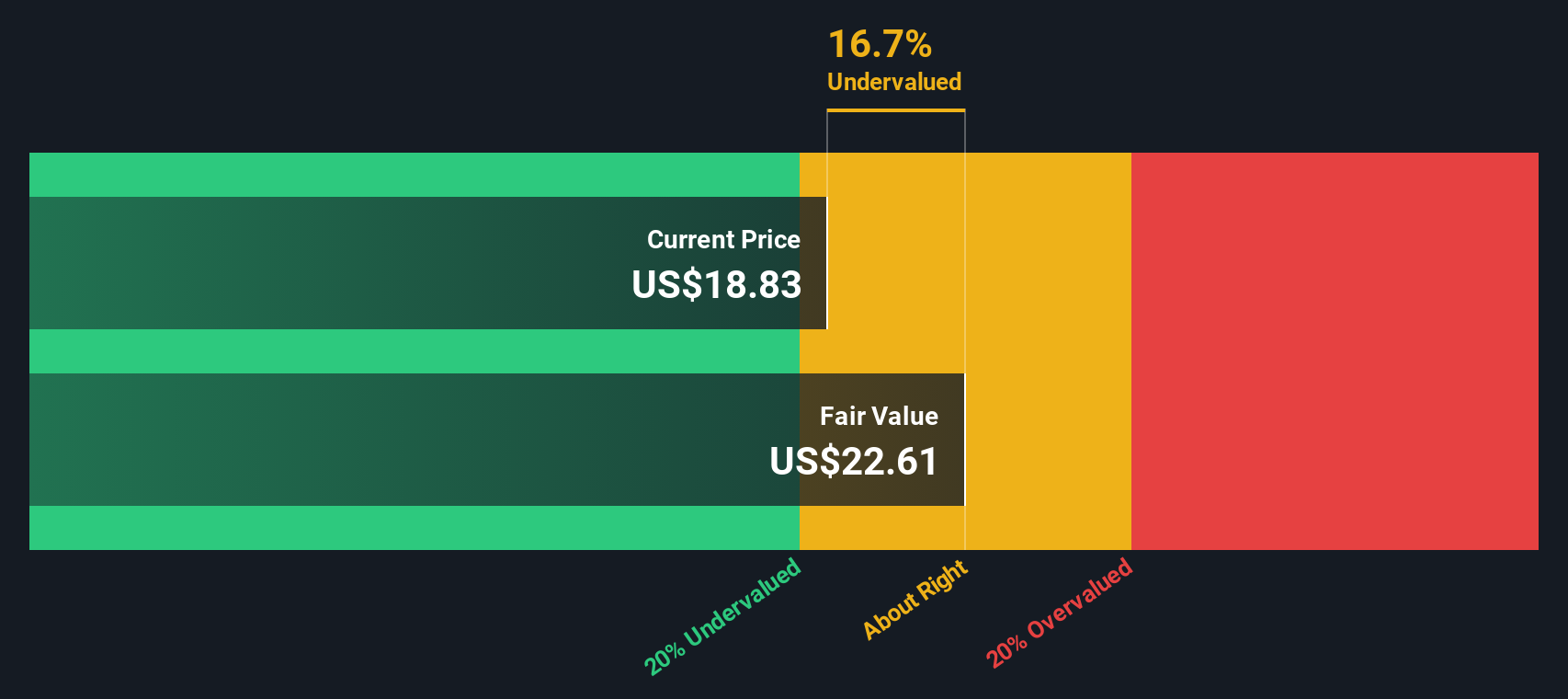

With shares hovering below analyst targets and a notable 44% discount to intrinsic value, the question now is whether Rush Street Interactive remains undervalued or if the market is already factoring in the next chapter of growth.

Most Popular Narrative: 12.2% Undervalued

With Rush Street Interactive’s latest close at $18.77, the narrative consensus points to a fair value of $21.38, suggesting there is real headroom left in the valuation. The recent price strength and bullish sentiment set the stage for a closer look at what is driving this optimistic outlook.

The digitalization of entertainment is accelerating migration from offline to online gaming, and with record-high monthly active users (MAUs) growing over 30% in North America and more than 40% in Latin America, Rush Street Interactive is well-positioned to capture this expanding addressable market, supporting sustained future revenue growth.

Want to know what is powering this valuation? One set of ambitious financial targets underpins the bullish outlook, hinting at record growth and bold expectations for margins and profits. Dive in and see which numbers analysts are betting on. These forecasts might just surprise you.

Result: Fair Value of $21.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, as with any growth story, heavy reliance on Latin American expansion and evolving regulations could present challenges to Rush Street Interactive’s optimistic projections.

Find out about the key risks to this Rush Street Interactive narrative.

Another View: Is the Valuation Really That Attractive?

While the consensus points to Rush Street Interactive trading at a discount, a glance at our DCF model paints an even more optimistic picture. Based on long-term cash flow projections, the SWS DCF model values RSI shares at $33.36. This means the current stock price could be well below what fundamentals ultimately justify. If true, could the market be underestimating the company’s real potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rush Street Interactive Narrative

If you have a different perspective or enjoy diving into the numbers yourself, there’s nothing stopping you from shaping a personalized view of Rush Street Interactive in just minutes and expressing your own take. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rush Street Interactive.

Looking for More Smart Investment Opportunities?

Unlock your next potential winner by tapping into exclusive stock lists loved by well-informed investors. Miss these ideas and you could miss the market’s next big move.

- Tap into high-yield potential and maximize income by targeting these 17 dividend stocks with yields > 3%, which consistently deliver attractive payouts above 3%.

- Catch the surge in cutting-edge sectors and get ahead of the curve by tracking these 24 AI penny stocks, which are pushing advancements in artificial intelligence and automation.

- Find outstanding value by targeting these 880 undervalued stocks based on cash flows, which stand out on cash flow analysis and could offer strong upside in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives