- United States

- /

- Hospitality

- /

- NYSE:RCL

Royal Caribbean (RCL) Margin Expansion Reinforces Value Narrative Following 56.3% Earnings Growth

Reviewed by Simply Wall St

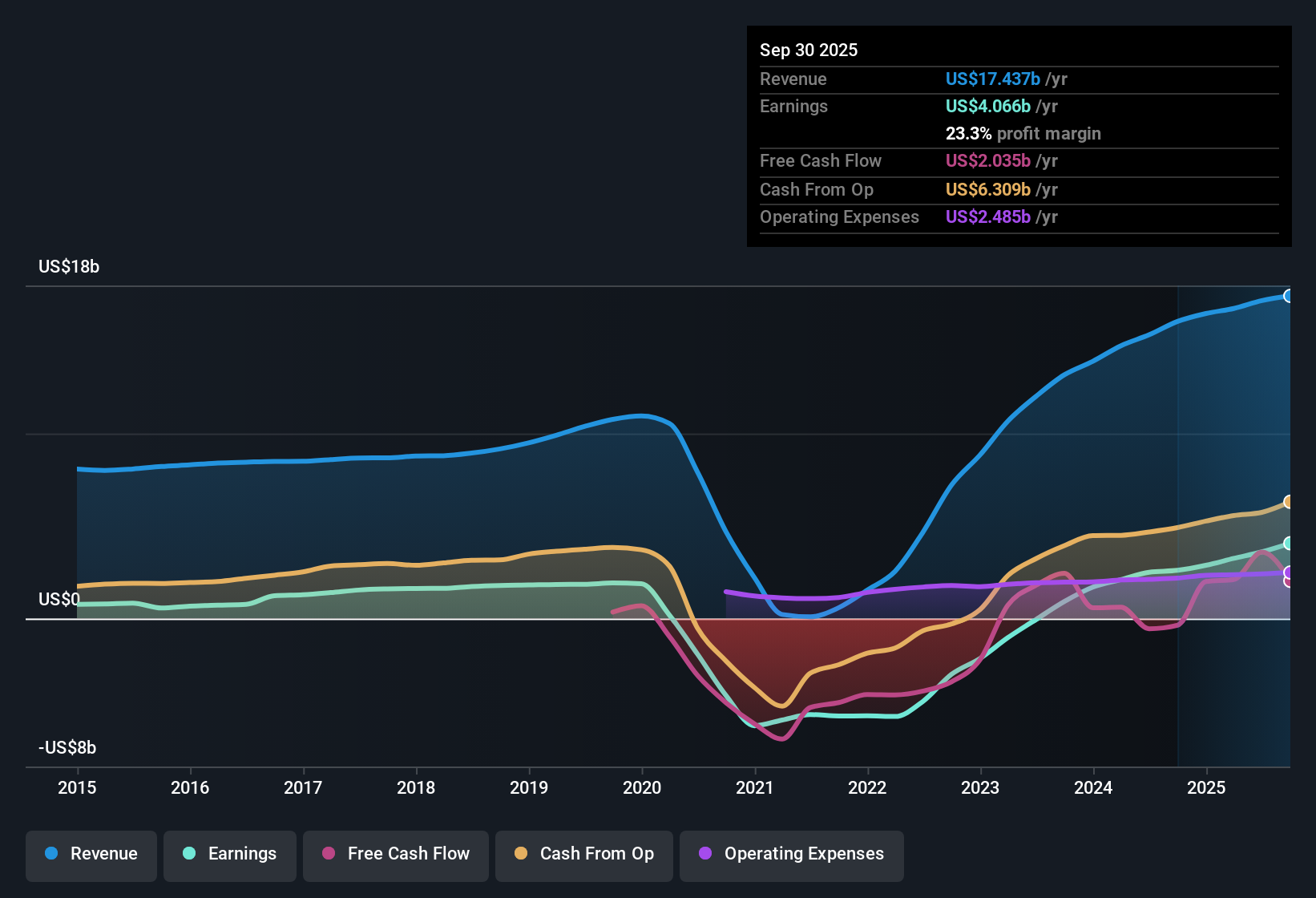

Royal Caribbean Cruises (RCL) reported a 56.3% increase in earnings over the past year, with net profit margins rising to 23.3% from 16.2% the prior year. Over five years, the company has averaged annual earnings growth of 67.4%, transitioning to profitability, with an outlook for revenue to grow 8.3% per year and earnings to increase by 12.1% annually. Investors are likely weighing these results alongside the company's price-to-earnings ratio of 18.8x, which is lower than both the US Hospitality industry average of 23.7x and the peer average of 28.4x. The share price currently sits below analyst targets and internal fair value estimates. Minor risks related to insider selling and some financial challenges remain, but solid profit growth and high margin quality are reinforcing Royal Caribbean's value-driven profile.

See our full analysis for Royal Caribbean Cruises.Now that the headline results are in, let's see how these numbers measure up to the main narratives shaping market sentiment and community views.

See what the community is saying about Royal Caribbean Cruises

Margin Quality Shines with 23.3% Net Profit

- Net profit margins have climbed to 23.3% from 16.2% last year, illustrating a significant step-up in earnings efficiency and cost control even as the company expands.

- Analysts' consensus view highlights that new ships, such as Star of the Seas and Celebrity Xcel, and enhanced guest experiences are fueling higher onboard spending and pre-cruise purchases, helping to accelerate per-passenger revenue.

- The consensus notes that yield growth between 2.6% and 4.6% is projected for 2025, suggesting strengthened pricing power as these investments take hold.

- Strong cash flow generation and an investment-grade rating are credited with supporting robust margins and providing flexibility to manage costs.

- Results like these are leading some analysts to argue that Royal Caribbean’s high-quality earnings make its profitability story more durable than many of its hospitality peers, especially with ongoing investments in fleet innovation.

- Investors can get the full lay of the land in the consensus narrative, which weighs these profitability improvements against upcoming market challenges. 📊 Read the full Royal Caribbean Cruises Consensus Narrative.

Insider Selling Flags a Minor Risk

- The principal minor risks in the regulatory filings relate to insider selling and a few concerns about the company’s financial position, even as major risks are not currently flagged.

- Consensus narrative notes the main caution for investors is Royal Caribbean’s exposure to consumer discretionary spending, which could slow during an economic downturn.

- Bearish arguments point to risks that declines in close-in bookings or price competition could erode yields, especially if macroeconomic conditions worsen.

- Analysts expect the company to navigate these headwinds due to moderate capacity growth, repeat guest loyalty programs, and flexible balance sheet management, but acknowledge the risk bears highlight if consumer confidence falls sharply.

Valuation Still at a Discount Versus Industry Peers

- Royal Caribbean’s price-to-earnings ratio is 18.8x, below both the US Hospitality industry average of 23.7x and the peer average of 28.4x. This indicates investors can buy growth at a cheaper multiple than comparable cruise operators.

- Analysts' consensus view contends that, at the current share price of $280.05, Royal Caribbean trades below both the consensus price target of $344.09 and the DCF fair value of $406.98.

- The small 1.8% difference between the share price and consensus price target signals most analysts see the stock as fairly priced, while the larger gap to DCF fair value may attract value-seeking investors.

- This ongoing valuation gap is a focal point in the consensus discussion, especially given Royal Caribbean’s track record of revenue and profit gains that outpace lower PE ratios.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Royal Caribbean Cruises on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle the market's missing? Take just a few minutes to turn those insights into your own story and help shape the conversation. Do it your way

A great starting point for your Royal Caribbean Cruises research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Royal Caribbean’s excellent margin improvements, the company still faces concerns around insider selling and a financial position that could be vulnerable if consumer demand drops.

If you want to find companies with stronger balance sheets and healthier financials to weather whatever comes next, check out solid balance sheet and fundamentals stocks screener (1985 results), which highlights companies that stand up even in tough markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives