- United States

- /

- Hospitality

- /

- NYSE:RCL

Does Royal Caribbean’s 59% Surge Signal More Room to Run in 2025?

Reviewed by Bailey Pemberton

If you’re watching Royal Caribbean Cruises stock and wondering whether now is the right time to invest, you’re not alone. It has experienced quite a sail lately, grabbing the attention of both seasoned investors and first-timers. Over the past year, Royal Caribbean Cruises has charted an eye-popping 59.4% gain, with a particularly strong surge of 38.2% so far this year. Even though the most recent month saw a slight dip of 3.2%, the stock quickly found its sea legs and bounced back with a 5.4% rise this past week alone.

This kind of movement reflects more than just shifting tides. Investor optimism seems to be buoyed by a wave of good news for the cruise industry. Analysts have noted increased demand for leisure travel, with bookings staying strong into the busy cruising season. This has contributed to the stock’s remarkable 509.3% gain over three years. On top of this momentum, some investors are reassessing risk across travel stocks, betting that pent-up demand will continue to drive bookings and revenue growth.

Of course, price action tells only part of the story. To truly assess whether Royal Caribbean Cruises is undervalued, it is important to look deeper at how it compares to common valuation methods. Based on our valuation scorecard, Royal Caribbean Cruises earns a score of 5 out of 6, which indicates it appears undervalued in five key checks. Next, let’s break down what goes into that score and see how it measures up before exploring an approach that can give investors an even sharper perspective.

Approach 1: Royal Caribbean Cruises Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common valuation approach that estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. The DCF model aims to calculate what Royal Caribbean Cruises is really worth based on its ability to generate cash in the years ahead.

For Royal Caribbean Cruises, the latest reported Free Cash Flow (FCF) stands at $2.33 Billion. Analysts forecast strong growth over the next several years, with annual Free Cash Flow expected to rise steadily and reach $6.13 Billion by 2029. The first five years of these projections come from analyst estimates, while subsequent figures out to 2035 are extrapolated using growth assumptions. All cash flows are presented in U.S. dollars.

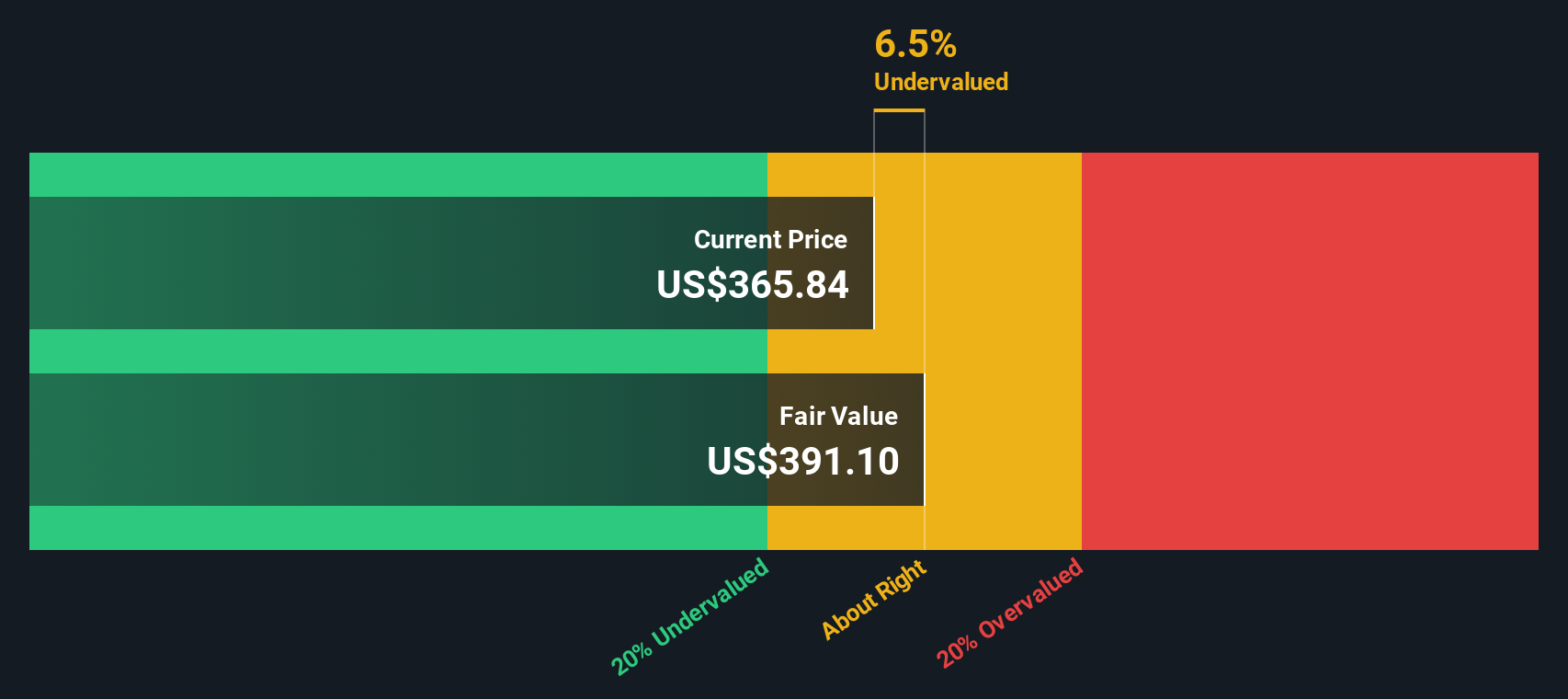

Using these inputs and Simply Wall St’s 2 Stage Free Cash Flow to Equity framework, the DCF model calculates an intrinsic value of $411.95 per share. When compared to the current share price, this implies that Royal Caribbean Cruises stock is trading at a 23.2% discount, meaning the shares appear undervalued at today’s levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Royal Caribbean Cruises is undervalued by 23.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Royal Caribbean Cruises Price vs Earnings

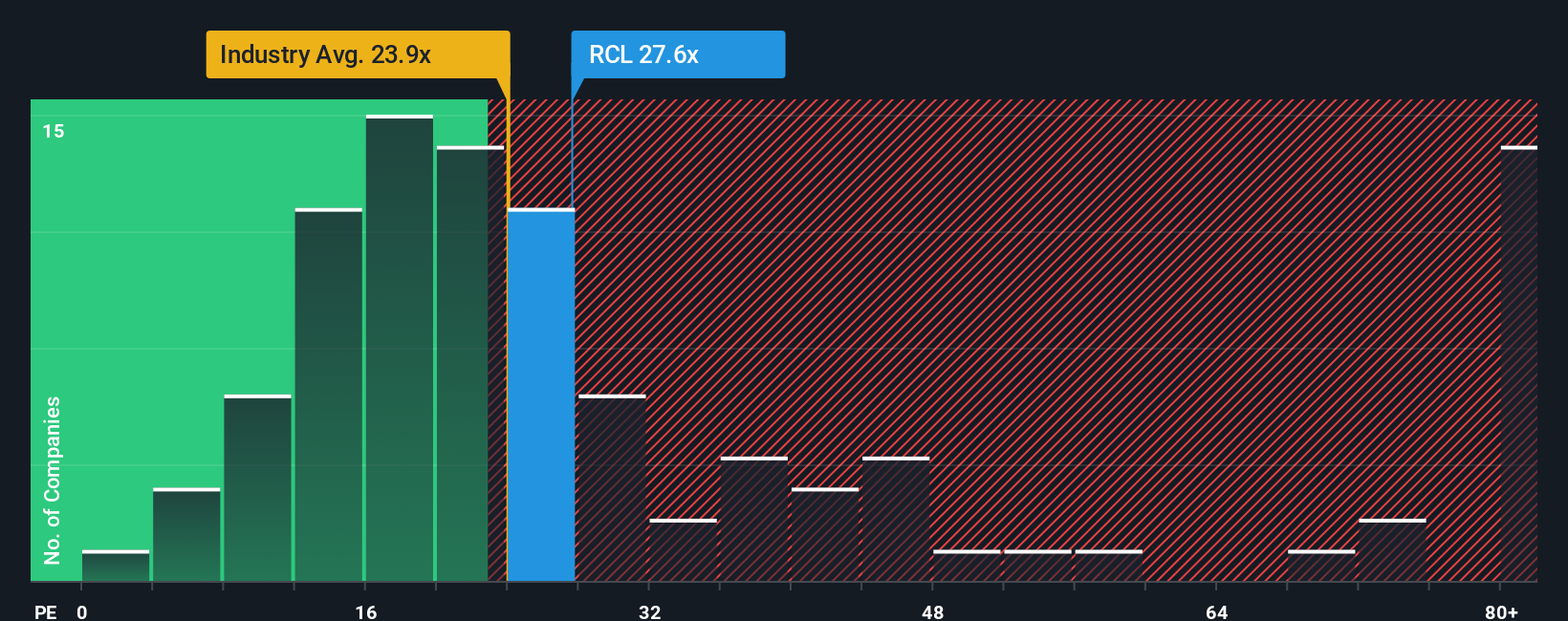

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Royal Caribbean Cruises because it directly compares a company’s share price to its earnings. This helps investors assess how much they are paying for each dollar of earnings today. Typically, higher growth companies or those with lower risk are expected to trade at higher PE ratios, while slower-growing or riskier companies command lower multiples.

Royal Caribbean Cruises currently trades at a PE ratio of 23.9x. When comparing this to the hospitality industry average of 23.9x and its peers at 29.0x, the company looks reasonably valued by traditional benchmarks. However, not all companies are identical, and earnings multiples should account for factors like profit margins, expected earnings growth, and risk profile, rather than just industry groupings.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio calculates the PE multiple Royal Caribbean Cruises should trade at based on a tailored blend of its expected growth, profitability, industry context, size, and risk. For Royal Caribbean Cruises, the Fair Ratio is 32.4x. Since the current PE of 23.9x is notably below this level, the analysis suggests the stock is undervalued relative to its true fundamentals, not just industry or peer averages.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Royal Caribbean Cruises Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are simple, interactive stories where you get to describe your own view of a company by outlining your expectations for its future revenue, earnings, and margins to see what you think the fair value should be. Each Narrative connects your perspective to a full financial forecast and an up-to-date fair value, linking the company's real story to the numbers behind the stock price.

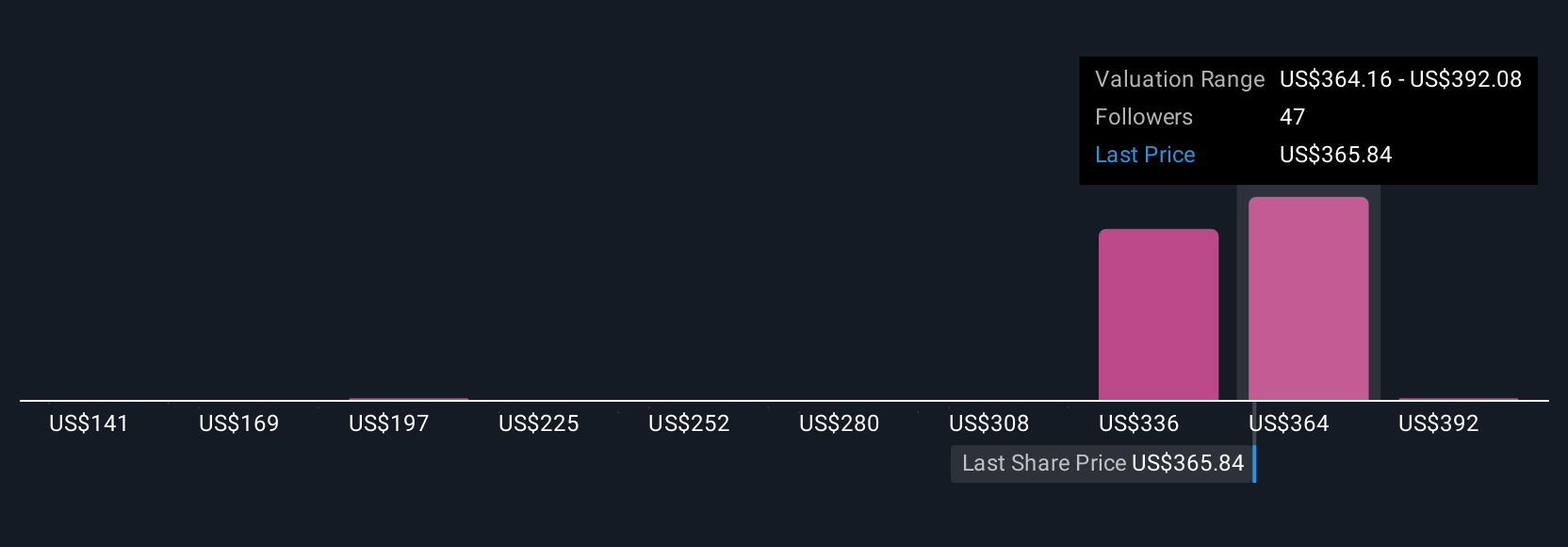

With Narratives, available directly on Simply Wall St’s Community page and used by millions of investors, you can easily decide whether Royal Caribbean Cruises is a buy, hold, or sell by comparing your Fair Value estimate with today’s Price. These forecasts are dynamic and update every time new information emerges, such as quarterly results or major news events. For example, some investors might believe that Royal Caribbean’s new ships and private destinations will continue driving significant growth, justifying a price target as high as $420 per share. More cautious perspectives, perhaps worried about consumer spending or macroeconomic risks, may value the stock at just $218. This practical tool helps you make more informed investment decisions that fit your own outlook and strategy.

Do you think there's more to the story for Royal Caribbean Cruises? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives