- United States

- /

- Hospitality

- /

- NYSE:QSR

How RBI’s Stock Rally and Strong Cash Flow Projections Could Shape Its 2025 Outlook

Reviewed by Bailey Pemberton

If you have been eyeing Restaurant Brands International, you are definitely not alone. With the stock bouncing up 5.0% over the past week and a solid 9.1% in the last month, there is a new wave of interest from investors wondering if now is the time to jump in or hold tight. Even after some volatility in the broader restaurant sector, RBI has managed to deliver a return of 2.3% over the past year, and a hefty 45.3% gain across three years. That long-term lift, paired with its recent momentum, certainly raises a few eyebrows and questions about whether the growth is here to stay or if the market is simply re-pricing risk on familiar names.

So, how does the stock stack up in terms of value? Based on the latest checks, Restaurant Brands International earns a valuation score of 2 out of 6, with an extra point for each factor it passes as being undervalued. In other words, it clears two of the typical hurdles investors use to spot hidden value, but falls short on several others. This opens the door for debate: is the current share price justified, or could there be more upside (or downside) ahead?

If you are sizing up RBI as a potential buy, sell, or hold, you will want to see how it performs under the lens of different valuation methods. Before you make up your mind, let us break down those numbers and explore a smarter way to think about valuation that goes beyond the usual metrics.

Restaurant Brands International scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Restaurant Brands International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects future cash flows a company is expected to generate and discounts them back to their present value. This approach helps estimate what the entire company is worth today, based on expected future money-making ability.

For Restaurant Brands International, the latest reported Free Cash Flow stands at $1.26 Billion. Analysts estimate this figure will climb steadily each year, with projections showing Free Cash Flow reaching approximately $2.39 Billion by the end of 2028. For later years, forecasts are extended using reasonable growth rates, with projected Free Cash Flow hitting about $3.46 Billion in 2035. All amounts are expressed in USD ($).

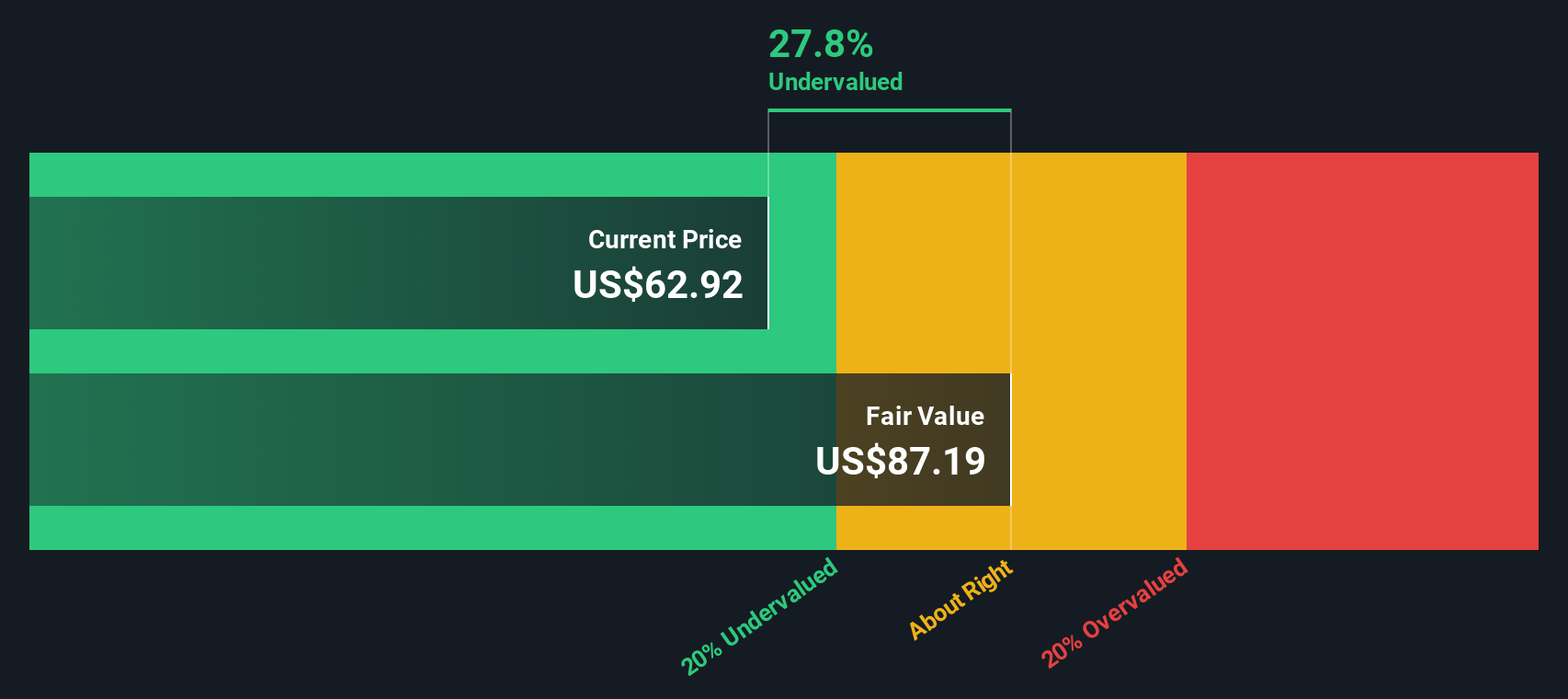

Applying the DCF model to these estimates produces an intrinsic value of $81.93 per share. Compared to RBI’s current share price, this calculation signals the stock is trading at a 15.9% discount to its calculated fair value. This may indicate that the market is underpricing the company’s long-term profit potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Restaurant Brands International is undervalued by 15.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Restaurant Brands International Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is widely used when valuing profitable companies, like Restaurant Brands International, because it links a company’s stock price directly to its underlying earnings. Investors generally rely on this multiple to gauge how much they are paying for current profits and to set expectations for future growth.

The typical or “fair” P/E ratio for a company can vary depending on several factors, including expected earnings growth and the risk profile of the business. In essence, companies with higher growth prospects or lower perceived risk often justify higher P/E multiples. Those with slower growth or more uncertainty tend to trade at lower ones.

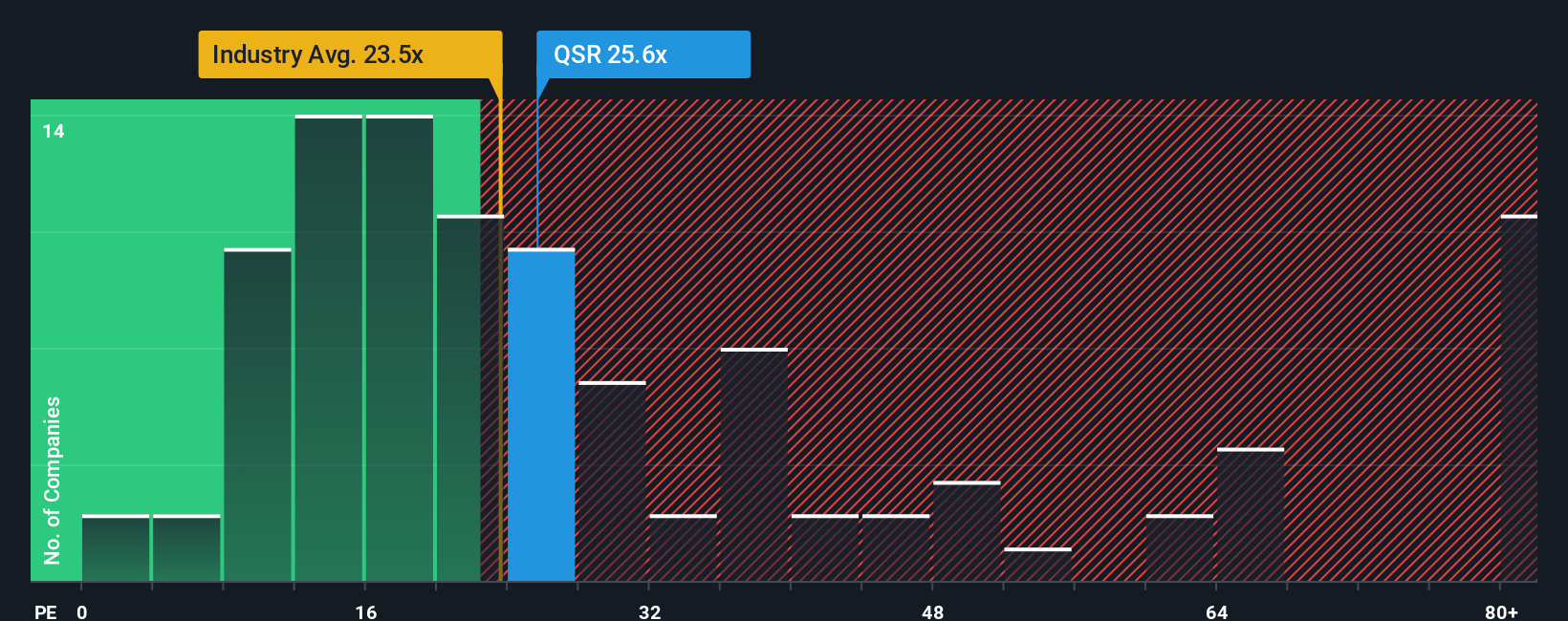

At the moment, Restaurant Brands International trades at a P/E ratio of 26.2x. This is just above the peer average of 25.6x and also higher than the Hospitality industry average of 24.9x. However, Simply Wall St’s Fair Ratio model, which estimates a fair P/E based on specific qualities such as the company’s earnings growth, profit margins, industry, and market cap, sets the Fair Ratio for Restaurant Brands International at 31.6x. This approach is more tailored than a simple comparison with peers or industry averages because it considers factors unique to RBI’s business profile and future outlook.

With the current P/E multiple of 26.2x below the Fair Ratio of 31.6x, the stock looks undervalued on this metric. This suggests the market may be underestimating the company's earnings potential relative to its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

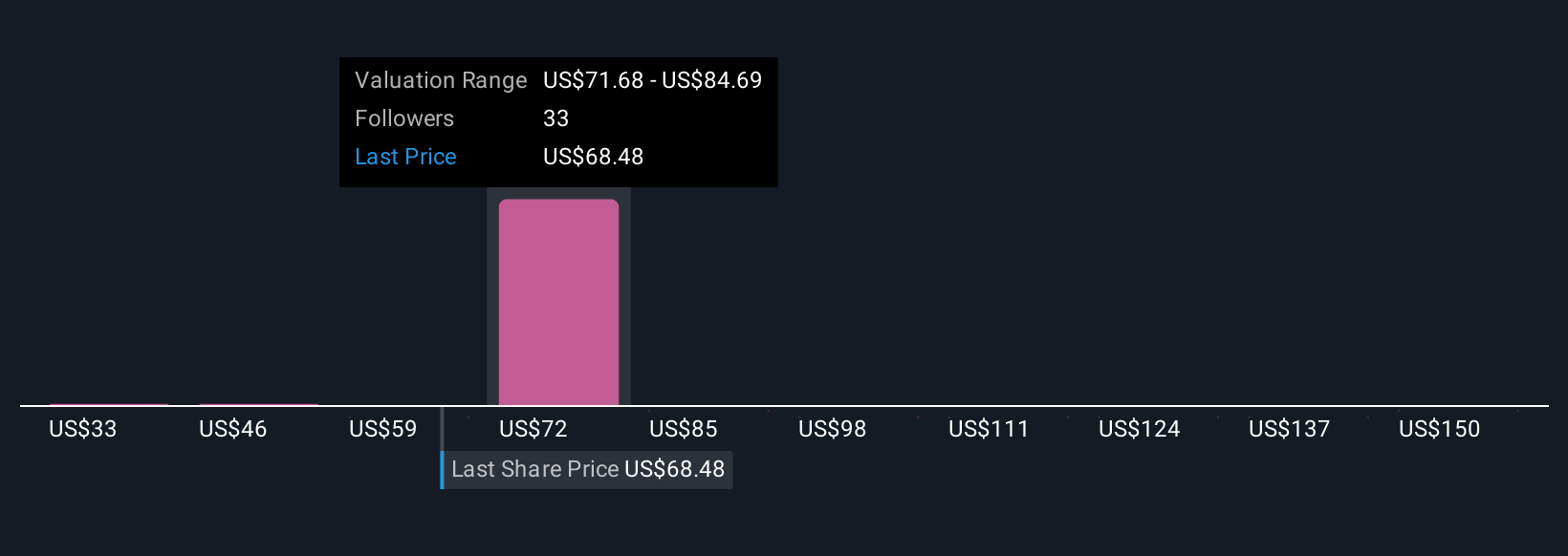

Upgrade Your Decision Making: Choose your Restaurant Brands International Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a concise story about a company that connects your view of its future, such as its revenue potential, margins, and growth drivers, to an actual financial forecast and then to a fair value estimate. Narratives take the numbers you believe in, or those shared by the community, and turn them into a business story with price context, making investment decisions more grounded and personal. On Simply Wall St's platform, millions of investors can easily explore and create their own Narratives through the Community page, using them as a practical tool to decide when to buy, sell, or hold based on the gap between fair value and current price. What makes Narratives especially powerful is that they update automatically as new information, like fresh earnings reports or breaking news, comes in, ensuring that your investment perspective stays current. For example, some investors see international franchising, digital transformation, and menu innovation as unlocking RBI’s value up to $93, while others are more cautious and set their sights at $60, showing just how powerfully different Stories and investment choices can be.

Do you think there's more to the story for Restaurant Brands International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives