- United States

- /

- Hospitality

- /

- NYSE:QSR

Assessing Restaurant Brands International (NYSE:QSR) Valuation Following Steady Year-to-Date Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Restaurant Brands International.

Restaurant Brands International’s share price has gained 4.8% year-to-date, and total shareholder return clocks in at 5.6% over the past year. The stock’s steady, if unspectacular, upward movement suggests that investors still see room for longer-term growth, given the competitive fast food landscape and ongoing shifts in consumer habits.

If you’re keeping an eye on market momentum, this could be a great time to broaden your search and discover fast growing stocks with high insider ownership

But does Restaurant Brands International’s recent climb reflect an undervalued opportunity? Or has the market already priced in the company’s future growth prospects, leaving little room for upside?

Most Popular Narrative: 12.2% Undervalued

With Restaurant Brands International last closing at $68.68 and the most widely followed narrative assigning a fair value of $78.25, the gap signals analyst conviction in continued upside despite recent volatility and moderate year-to-date gains.

*Rapid international expansion, particularly through the franchise-led model in markets such as China, India, Turkey, Japan, and Brazil, is driving double-digit unit and system-wide sales growth. This directly supports recurring, capital-light revenue streams and higher long-term earnings visibility.*

Curious what's fueling this ambitious valuation? The driving force is a blueprint for global growth, fueled by new markets, innovation, and a profitability target few quick-service chains ever reach. Which growth assumptions and profit margins are built into this narrative? The details inside reveal how analysts are justifying a price tag that exceeds today's trading range.

Result: Fair Value of $78.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation or unexpected challenges with international expansion could quickly dampen the company’s growth outlook and negatively affect valuation sentiment.

Find out about the key risks to this Restaurant Brands International narrative.

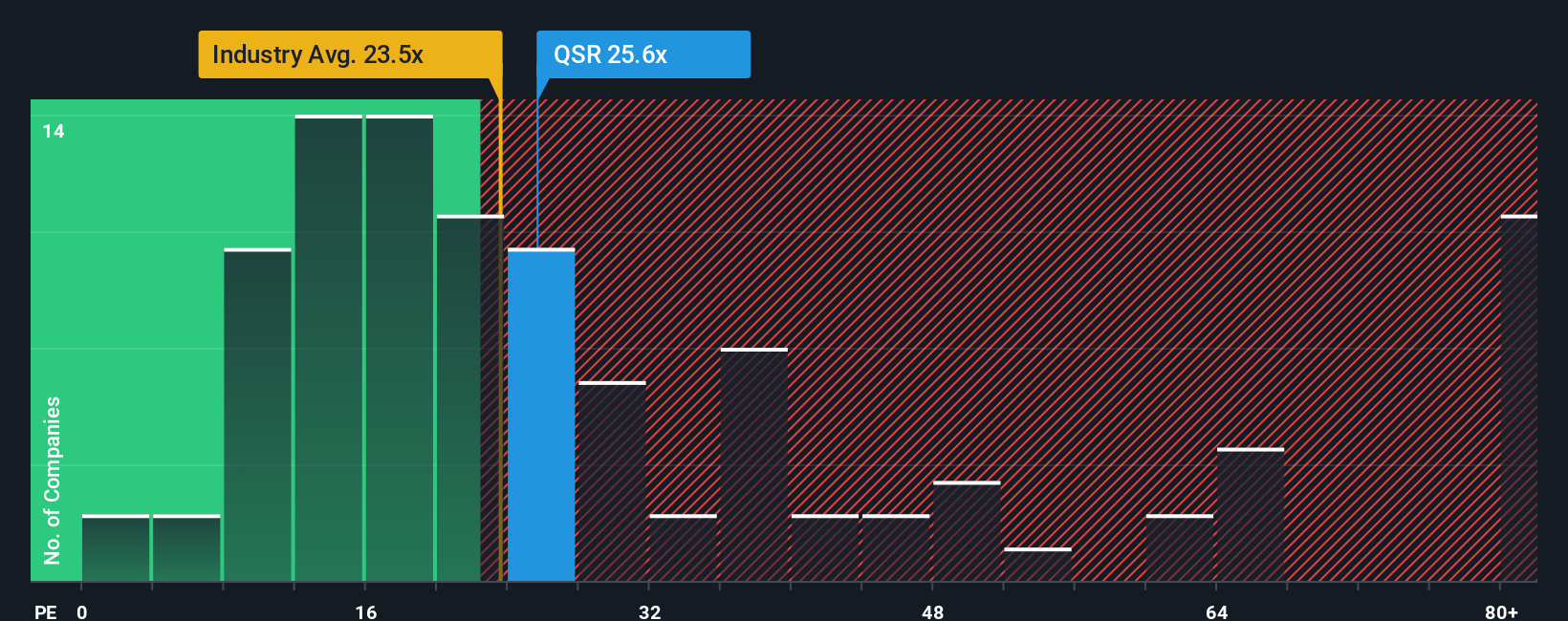

Another View: Multiples Tell a More Cautious Story

Looking at valuation through the lens of the company's price-to-earnings ratio, Restaurant Brands International trades at 24.2x, higher than the US Hospitality industry average of 21.1x and its peer group at 23.1x. While some see this as optimism about earnings growth ahead, it also signals less margin for error if growth falls short, especially with the market's fair ratio set at 28.9x. Is the stock simply expensive on today's numbers, or could a shift in sentiment push it closer to that fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Restaurant Brands International Narrative

If you find your outlook differs from these perspectives or want to dig deeper into the numbers on your terms, you can easily craft your own interpretation in just a few minutes. Do it your way

A great starting point for your Restaurant Brands International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Opportunities?

Don’t let your next big investment pass you by. Simply Wall Street’s Screener puts the hottest stocks, strategic sectors, and undiscovered gems right at your fingertips.

- Unlock exceptional yield and steady returns. Start with these 16 dividend stocks with yields > 3% for stable income-focused picks in today’s volatile markets.

- Tap into market potential by scanning these 886 undervalued stocks based on cash flows that analysts believe are trading below their intrinsic value due to overlooked growth or recent pullbacks.

- Capitalize on medical innovation by reviewing these 32 healthcare AI stocks making breakthroughs in AI-driven treatments and reshaping the future of healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives