- United States

- /

- Hospitality

- /

- NYSE:PRKS

United Parks & Resorts (PRKS) Is Down 8.3% After Weak Results Despite New SeaWorld Expansion Plan

Reviewed by Sasha Jovanovic

- United Parks & Resorts, Inc. recently experienced a sharp downturn in stock performance against the backdrop of weak financial results, including a return on equity of 53.59% and bearish technical indicators.

- Meanwhile, the company is set to launch SEAQuest: Legends of the Deep at SeaWorld Orlando in 2026, featuring an immersive suspended ride vehicle designed to enhance the family guest experience.

- We’ll explore how investor concerns over diminishing profitability and efficiency now weigh on United Parks & Resorts’ overall investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

United Parks & Resorts Investment Narrative Recap

To own shares of United Parks & Resorts right now, an investor must have confidence in the long-term durability of demand for experiential attractions and the company’s ability to reinvigorate growth through new offerings, even as recent financial results show significant hurdles. The latest sharp stock downturn, triggered by weak earnings and a troubling -53.59% return on equity, has not materially changed the catalysts centered around upcoming attraction launches, but it does highlight more immediate risks around profitability and operational efficiency.

Among recent developments, SeaWorld Orlando’s announcement of the SEAQuest: Legends of the Deep ride, set for 2026, is particularly relevant. This investment aims to boost attendance by offering a fresh family experience, seeking to reignite visitor growth at the company’s flagship park, a central catalyst for United’s future performance, despite broader market concerns.

Yet, in contrast to the excitement around new attractions, investors should be aware of challenges such as declining per capita guest spending, which could point to...

Read the full narrative on United Parks & Resorts (it's free!)

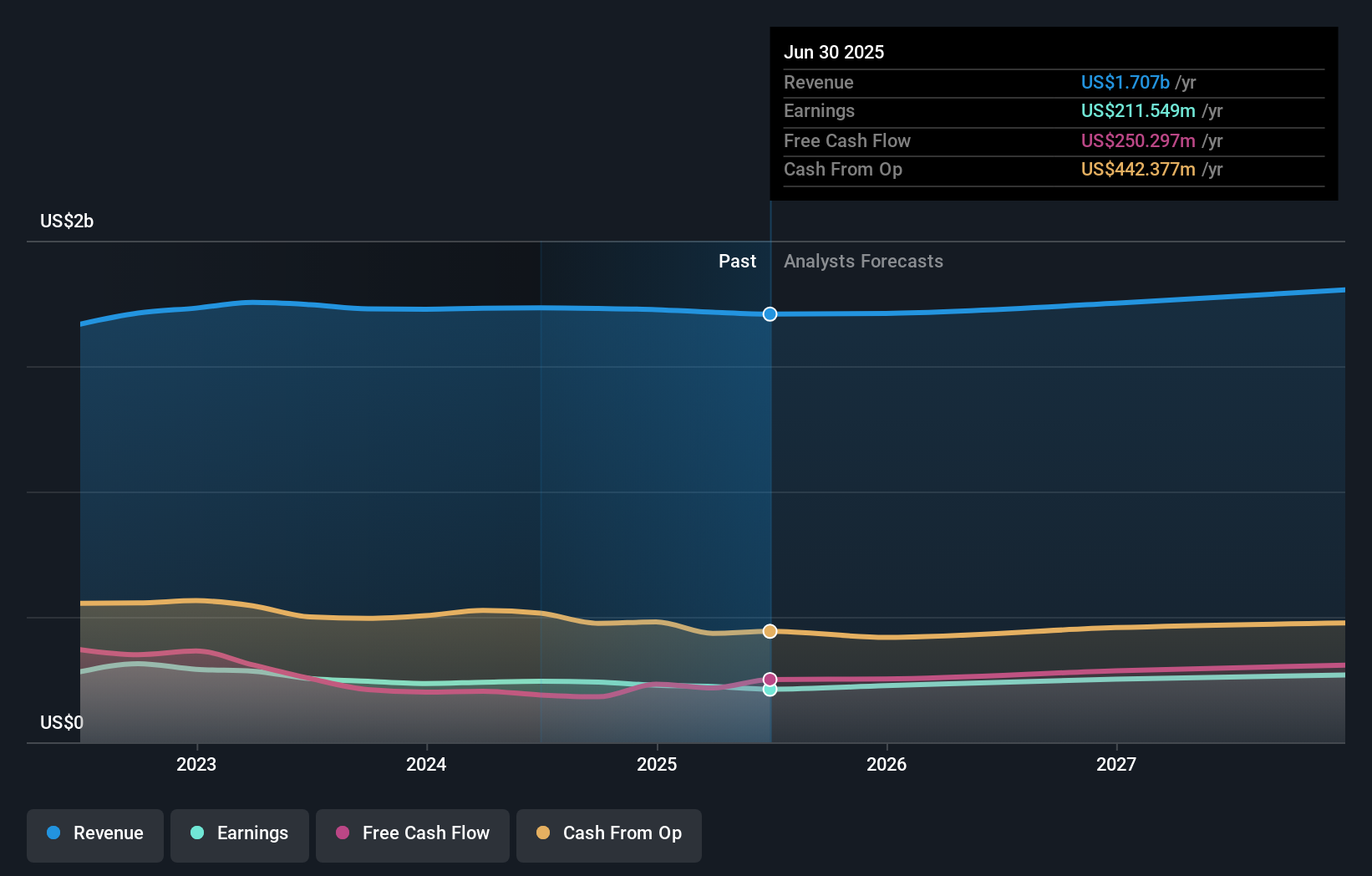

United Parks & Resorts is projected to reach $1.8 billion in revenue and $284.5 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 2.1% and a $73 million increase in earnings from the current level of $211.5 million.

Uncover how United Parks & Resorts' forecasts yield a $51.27 fair value, a 69% upside to its current price.

Exploring Other Perspectives

One estimated fair value of US$51.27 from the Simply Wall St Community presents a single point of view. Meanwhile, recent earnings weakness and heavy reliance on Orlando parks mean investor outlooks for United Parks & Resorts can vary widely.

Explore another fair value estimate on United Parks & Resorts - why the stock might be worth just $51.27!

Build Your Own United Parks & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parks & Resorts research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Parks & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parks & Resorts' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRKS

United Parks & Resorts

Operates as a theme park and entertainment company in the United States.

Undervalued with questionable track record.

Similar Companies

Market Insights

Community Narratives