- United States

- /

- Hospitality

- /

- NYSE:PLNT

Planet Fitness (PLNT): Valuation Spotlight After Hockey Canada Deal and Executive Leadership Addition

Reviewed by Simply Wall St

Planet Fitness (PLNT) just revealed a three-year partnership with Hockey Canada, stepping into the spotlight as the official fitness partner for the iconic organization. This collaboration signals a growing focus on Canadian community engagement and brand visibility.

See our latest analysis for Planet Fitness.

After a choppy few months, Planet Fitness’s announcement with Hockey Canada and the addition of a seasoned General Counsel seem to have shifted attention back toward its long-term potential. The 1-year total shareholder return stands at an impressive 21.5%, highlighting strong momentum when looking beyond recent share price pulls and short-term fluctuations.

If big-picture growth themes and leadership moves catch your interest, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With these strategic changes and a strong recent rebound, it raises a timely question for investors: Is Planet Fitness trading at a bargain given its ongoing growth initiatives, or has the market already accounted for its future gains?

Most Popular Narrative: 21.9% Undervalued

Market watchers are eyeing Planet Fitness’s fair value estimate of $122.81, which sits well above its last close of $95.96. Strong forecasts underpin this narrative and have set high expectations for the next phase of growth.

Ongoing format optimization, with more strength equipment, redesigned layouts, and attention to user preference, is increasing club utilization and member satisfaction. This should improve retention and provide opportunities for pricing power, positively impacting both revenue and net margins.

Curious what numbers justify such a bullish outlook? The secret lies in optimistic projections for earnings growth, margin expansion, and an industry-defying future valuation. Discover which moving parts analysts believe will propel Planet Fitness ahead of the pack.

Result: Fair Value of $122.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as higher member attrition from online cancellations or slowing franchise expansion could temper the optimistic outlook for Planet Fitness's growth trajectory.

Find out about the key risks to this Planet Fitness narrative.

Another View: What Do the Numbers Really Say?

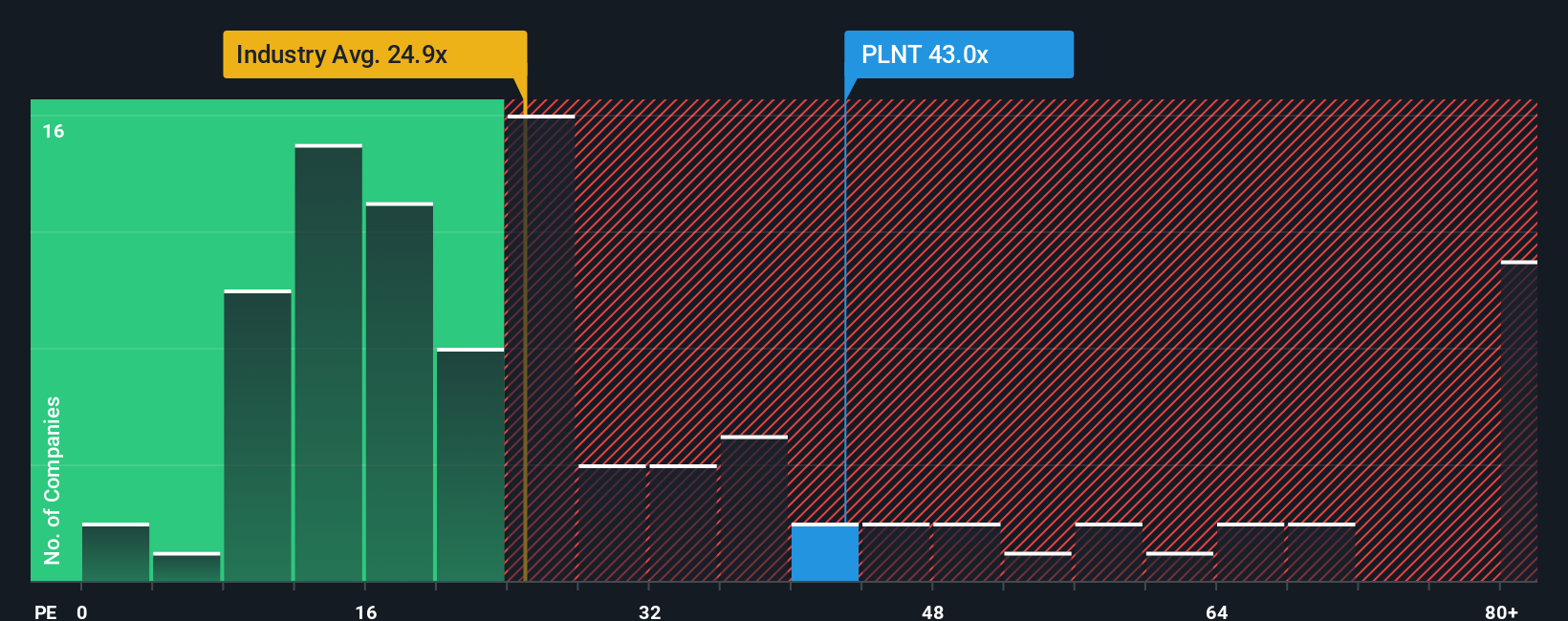

While analyst forecasts point to future upside, a glance at Planet Fitness’s current price-to-earnings ratio reveals a different side to the story. The stock trades at 42.6x earnings, which is significantly higher than both its industry peers at 24.3x and the average peer group at 30.3x. Even compared to its fair ratio of 25.4x, the premium is steep, which can add risk if market expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Planet Fitness Narrative

If you have your own perspective on Planet Fitness’s prospects or want to dig into the numbers firsthand, you can build your own narrative quickly. Do it your way.

A great starting point for your Planet Fitness research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great opportunities are always within reach if you use the right search tools. Don’t let new winners pass you by. Power up your portfolio with these tailored screens:

- Uncover exceptional value by checking out these 875 undervalued stocks based on cash flows with robust cash flows overlooked by the mainstream market.

- Tap into the energy of tomorrow’s technological innovators by starting with these 27 AI penny stocks that are changing industries through artificial intelligence.

- Secure steady portfolio income as you review these 17 dividend stocks with yields > 3% consistently delivering yields above 3% for savvy investors like you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives