- United States

- /

- Hospitality

- /

- NYSE:PLNT

Planet Fitness (PLNT): Valuation Insights After 2025 Investor Day Growth Plan and Upgraded Guidance

Reviewed by Simply Wall St

Planet Fitness (PLNT) delivered a packed 2025 Investor Day, unveiling a multi-year growth plan that targets faster global club expansion, a modernized brand, and improvements to member experience. The company also raised its 2025 outlook after a strong quarter.

See our latest analysis for Planet Fitness.

Following its upbeat Investor Day, Planet Fitness saw renewed momentum as investors responded positively to raised full-year guidance and robust third-quarter results. The stock boasts a 12.4% one-month share price return, and over the past year, long-term shareholders have enjoyed an 11.2% total return. This highlights steady confidence in Planet Fitness’s growth narrative and outlook.

If you’re curious where investor enthusiasm might head next, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

But with Planet Fitness’s strong run and management’s ambitious forecasts, is there still room for upside, or has the market already baked in much of the future growth?

Most Popular Narrative: 15.2% Undervalued

Planet Fitness is currently trading below the narrative’s estimated fair value of $124.94, with the most recent share price at $105.91. The stage is set for bold expansion plans, profit margin gains, and competitive challenges to play a crucial role in shaping future returns.

Ongoing format optimization, with more strength equipment, redesigned layouts, and attention to user preference, is increasing club utilization and member satisfaction. This could improve retention and provide opportunities for pricing power, positively impacting both revenue and net margins.

Behind that ambitious fair value lies a surprising mix of aggressive top-line growth projections and margin upgrades that hinge on a new era of club formats. Wondering which financial levers are set to drive this surge, and what future earnings power the narrative is betting on? Find out what numbers and bold assumptions are fueling this valuation story.

Result: Fair Value of $124.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressures and uncertainty around member retention trends could quickly challenge Planet Fitness’s robust growth story and valuation narrative.

Find out about the key risks to this Planet Fitness narrative.

Another View: What Do Earnings Ratios Suggest?

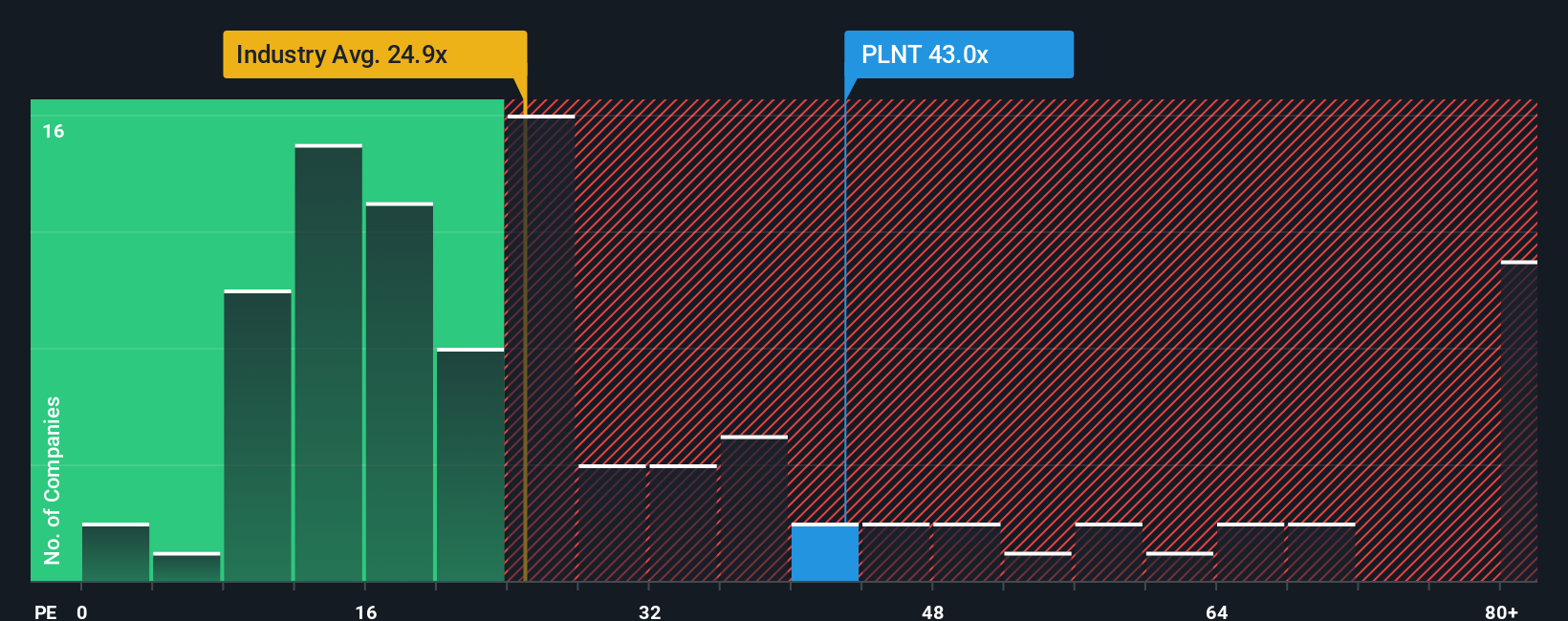

While the narrative’s fair value points to upside, the market is currently valuing Planet Fitness at a price-to-earnings ratio of 42.7x, which is much higher than both the Hospitality industry average of 21.1x and peer average of 24.6x. The fair ratio stands at 23.6x. This steep premium signals high growth expectations, but it also means the share price could be vulnerable if those expectations are not met. Will investors continue to pay up, or is a reality check ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Planet Fitness Narrative

If the current view doesn’t fit your perspective or you’d rather crunch the numbers yourself, you can easily shape your own take in just a few minutes with Do it your way.

A great starting point for your Planet Fitness research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. Open the door to game-changing stocks and uncover trends before the crowd by using these unique screeners.

- Boost your portfolio by tapping into attractive yields and long-term income from these 16 dividend stocks with yields > 3% with payouts above 3%.

- Stay ahead of the curve by targeting innovation leaders in artificial intelligence across healthcare, robotics, and more with these 25 AI penny stocks.

- Capture potential upswings by investigating undervalued companies positioned for growth using these 886 undervalued stocks based on cash flows based on discounted cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives