- United States

- /

- Hospitality

- /

- NYSE:PLNT

Planet Fitness (PLNT) Is Up 6.5% After Hitting 20.7M Members and Announcing Aggressive Club Expansion

Reviewed by Sasha Jovanovic

- Planet Fitness recently reported its membership base has grown to 20.7 million, with Black Card membership reaching 66.1% and a record 3.7 million teens participating in its High School Summer Pass program, while management announced plans to open 160-170 new clubs in 2025 after surpassing 2,800 global locations.

- This highlights not only strong member acquisition and engagement, especially among younger demographics, but also management's belief in continued expansion through both marketing and club growth initiatives.

- We'll examine how Planet Fitness's robust membership gains and expanded club opening plans could influence its future growth expectations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Planet Fitness Investment Narrative Recap

At its core, the Planet Fitness investment story is about believing the company can sustain meaningful membership growth, increase member engagement, and efficiently scale its club footprint, even as attrition pressures rise from digital cancellations. The latest news of record High School Summer Pass participation and strong Black Card uptake reinforces the immediate growth catalyst, attracting and retaining more members, especially younger ones, without changing the most pressing risk tied to persistently higher attrition from easier online cancellations. For now, the membership surge supports growth hopes, but it does not materially reduce long-term attrition concerns.

Among recent announcements, management's plan to open 160-170 new clubs worldwide in 2025 is closely linked to the company’s expansion strategy. This expansion remains central to Planet Fitness’s growth ambitions, yet its success ultimately hinges on the company’s ability to draw new members at a faster pace than existing clubs experience elevated churn, especially as online cancellation gains traction.

However, investors should also weigh the potential for higher attrition rates, as even with record sign-ups, the ease of online cancellation could still...

Read the full narrative on Planet Fitness (it's free!)

Planet Fitness is projected to reach $1.6 billion in revenue and $312.8 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 11.6% and a $123.8 million increase in earnings from the current $189.0 million.

Uncover how Planet Fitness' forecasts yield a $124.94 fair value, a 15% upside to its current price.

Exploring Other Perspectives

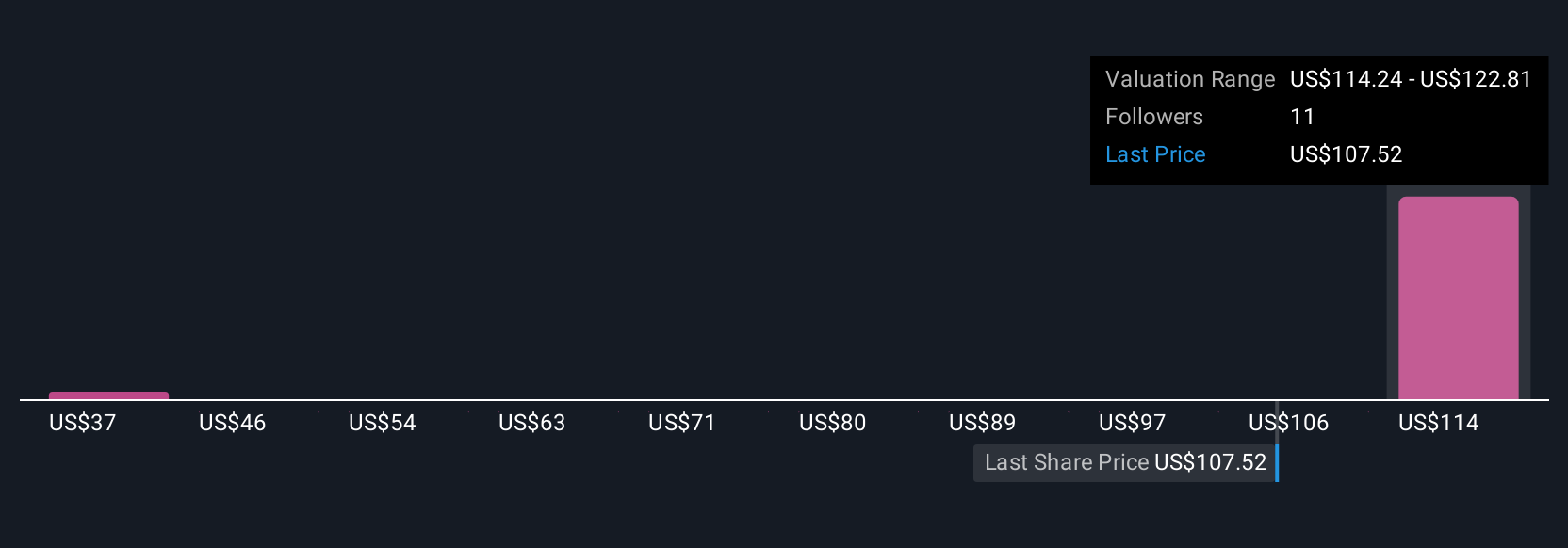

Simply Wall St Community members have shared three fair value estimates for Planet Fitness stock, ranging from US$37.05 to US$124.94. While franchise expansion drives optimism for many, there remains a risk that ongoing shifts in retention could impact performance in ways you need to consider, check out other views before making up your mind.

Explore 3 other fair value estimates on Planet Fitness - why the stock might be worth as much as 15% more than the current price!

Build Your Own Planet Fitness Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Fitness research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Fitness research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Fitness' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success