- United States

- /

- Hospitality

- /

- NYSE:PLNT

Planet Fitness (PLNT): Examining Valuation Following Debt Refinancing and Balance Sheet Overhaul

Reviewed by Simply Wall St

Planet Fitness (PLNT) recently unveiled plans to refinance its debt, which includes issuing a new series of securitized notes and setting up an extra $75 million variable funding note facility. The move is designed to optimize balance sheet flexibility.

See our latest analysis for Planet Fitness.

Planet Fitness shares have been on a tear lately, highlighted by a recent 23.5% one-month share price return, as investors take a fresh look at the gym operator’s streamlined capital structure and potential for renewed growth. That surge builds on the company’s steady multi-year pace, with a five-year total shareholder return approaching 50%. This momentum reflects increased confidence in its resilience and strategic moves.

If Planet Fitness’s momentum and balance sheet refresh have sparked your interest, consider broadening your horizons and discover fast growing stocks with high insider ownership

With shares on the upswing and new financial maneuvers underway, is Planet Fitness currently trading at a bargain, or are investors already factoring in every bit of future growth potential?

Most Popular Narrative: 13.2% Undervalued

With the narrative’s fair value pegged at $128.94 and Planet Fitness closing at $111.97, the gap sets up an intriguing story about the drivers behind this outlook.

Ongoing format optimization, with more strength equipment, redesigned layouts, and attention to user preference, is increasing club utilization and member satisfaction. This could improve retention and provide opportunities for pricing power, positively impacting both revenue and net margins.

Curious about how a major revamp in club experience could impact profitability? The secret sauce behind this valuation is found in ambitious forecasts for both growth and improved margins. Want to see the aggressive targets and deep assumptions that underpin this bullish view? Uncover the details and see what could power Planet Fitness’s next breakout.

Result: Fair Value of $128.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could shift if heightened member attrition persists or if brand appeal among experienced gym-goers proves difficult to expand.

Find out about the key risks to this Planet Fitness narrative.

Another View: What Do the Ratios Say?

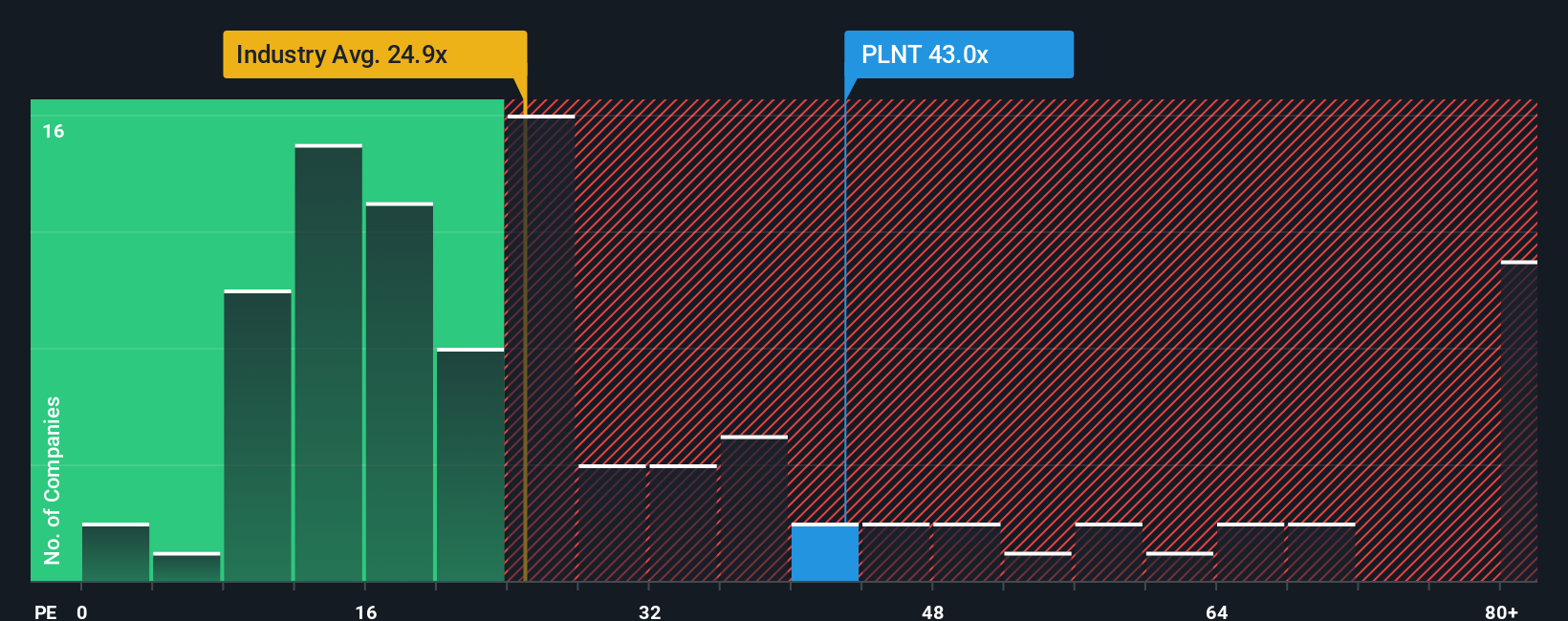

From a price-to-earnings perspective, Planet Fitness trades at 45.1x, which is notably higher than both the US Hospitality industry average of 21.4x and the calculated fair ratio of 23.9x. This puts Planet Fitness in the expensive camp on a traditional value basis and may signal heightened optimism already priced in. Does this premium set a high bar for future growth, or simply reflect its resilience?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Planet Fitness Narrative

If you see things differently or want to dig into the numbers yourself, shaping your own viewpoint is fast and straightforward. You can get started in just a few minutes. Do it your way

A great starting point for your Planet Fitness research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Smarter Stock Ideas?

Set yourself up for potential gains by scoping out vetted stock lists tailored to different investment themes. Opportunities are shifting quickly, so do not let standout picks slip past you.

- Unlock new value by checking out these 915 undervalued stocks based on cash flows, perfect for finding companies priced below their cash flow potential.

- Boost your passive income with these 15 dividend stocks with yields > 3%, highlighting top stocks with yields over 3% for steady returns.

- Catalyze your portfolio’s growth with these 25 AI penny stocks, featuring innovative businesses powering the AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026