- United States

- /

- Hospitality

- /

- NYSE:PLNT

How Investors Are Reacting To Planet Fitness (PLNT) Joining Fortune 100 and Teaming Up With Hockey Canada

Reviewed by Sasha Jovanovic

- Planet Fitness was recognized on Fortune's 2025 100 Fastest-Growing Companies list, following multi-year growth in revenue, earnings, and club expansion, and the company recently announced a multi-year partnership with Hockey Canada to engage Canadian communities through fitness initiatives tied to hockey culture.

- This collaboration highlights Planet Fitness's drive to broaden its reach by connecting with new member segments and leveraging sports partnerships to reinforce its community-centered and accessible approach to fitness.

- We'll explore how the Fortune 100 listing and new Hockey Canada partnership might influence Planet Fitness's growth-focused investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Planet Fitness Investment Narrative Recap

To be a shareholder in Planet Fitness, you need to believe that its expanding club network, growing member base, and focus on accessible, community-driven fitness experiences will drive recurring revenue and long-term profit growth. The recent recognition on Fortune's 100 Fastest-Growing Companies list and the new partnership with Hockey Canada reinforce brand momentum and broaden market reach, but neither fundamentally changes the short-term catalyst, which remains how well the company manages member retention and churn amid new digital cancellation policies. The biggest risk continues to center on elevated attrition rates if the click-to-cancel feature leads to persistently higher member turnover, impacting recurring revenue predictability.

Among recent announcements, the multi-year partnership with Hockey Canada most closely connects with Planet Fitness’s growth ambitions, as it leverages sports affiliations to attract Canadian members and deepen community engagement, supporting ongoing efforts to diversify its member segments and increase brand relevance. While this partnership provides positive visibility and may aid member growth, it does not directly address the core challenge of member retention in a competitive and shifting fitness industry.

Yet, in contrast to the company’s growth story, investors should be aware that higher-than-historical attrition rates could still pressure Planet Fitness’s...

Read the full narrative on Planet Fitness (it's free!)

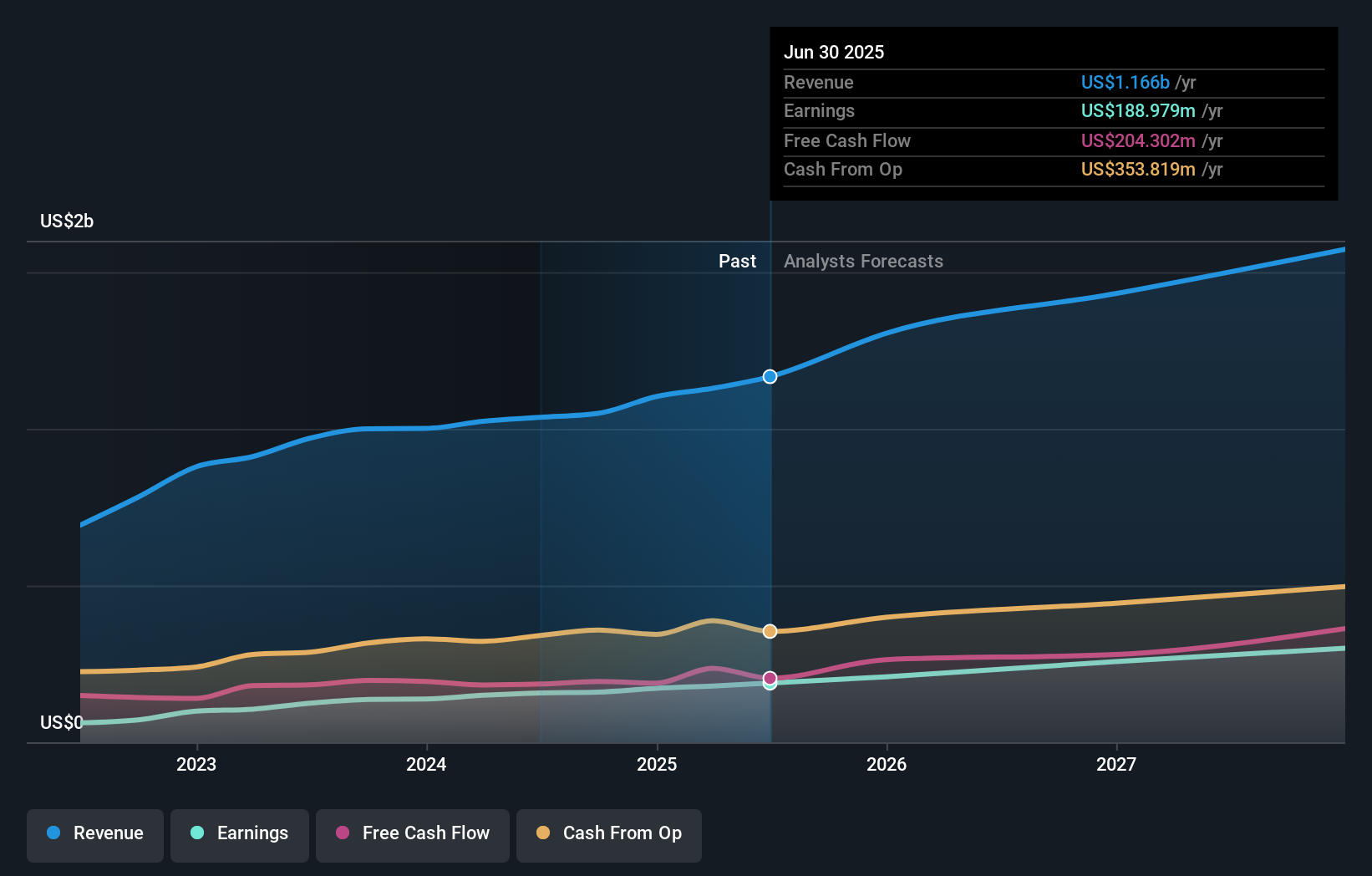

Planet Fitness' narrative projects $1.6 billion in revenue and $312.8 million in earnings by 2028. This requires 11.6% yearly revenue growth and a $123.8 million increase in earnings from the current $189.0 million.

Uncover how Planet Fitness' forecasts yield a $122.81 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Planet Fitness range widely from US$37.05 to US$122.81. While many see international partnerships as a catalyst, concerns around persistently higher churn rates remain a key watchpoint for future performance.

Explore 3 other fair value estimates on Planet Fitness - why the stock might be worth as much as 28% more than the current price!

Build Your Own Planet Fitness Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Fitness research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Fitness research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Fitness' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives