- United States

- /

- Hospitality

- /

- NYSE:NCLH

New Prestige-Class Vessel Order Might Change The Case For Investing In Norwegian Cruise Line Holdings (NCLH)

Reviewed by Sasha Jovanovic

- Earlier this month, Norwegian Cruise Line Holdings announced it had confirmed a newbuild order with Fincantieri to construct a third Prestige-Class vessel for its Regent Seven Seas Cruises brand, set for delivery in 2033, following the debut of two sister ships in 2026 and 2030.

- This move underscores the company’s ongoing expansion in the ultra-luxury cruise market, featuring Regent’s first new ship class in a decade with larger designs and elevated guest experiences.

- We'll now examine how this continued investment in luxury fleet growth could influence Norwegian Cruise Line Holdings' long-term outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Norwegian Cruise Line Holdings Investment Narrative Recap

To own shares in Norwegian Cruise Line Holdings, you need to believe in the continued appeal and profitability of the cruise industry, with a focus on differentiated, ultra-luxury offerings driving growth. While the latest Regent Seven Seas newbuild order supports long-term brand and fleet expansion, it does not materially impact the immediate catalysts or the main short-term headwinds, such as high leverage and debt maturities, currently facing the company.

The recent Q3 2025 earnings announcement is most relevant in the context of ongoing fleet investments. Despite year-over-year revenue growth, the company reported a decline in net income and earnings per share, underlining how cost pressures and financial obligations remain key factors influencing short-term performance even as new luxury ships are ordered for future delivery.

By contrast, investors should be aware of the outsized effect that persistent debt levels and looming euro-denominated maturities could have if refinancing conditions change or...

Read the full narrative on Norwegian Cruise Line Holdings (it's free!)

Norwegian Cruise Line Holdings' outlook anticipates $12.6 billion in revenue and $1.7 billion in earnings by 2028. This forecast is based on an annual revenue growth rate of 9.5% and reflects a $980.8 million increase in earnings from the current $719.2 million.

Uncover how Norwegian Cruise Line Holdings' forecasts yield a $29.74 fair value, a 57% upside to its current price.

Exploring Other Perspectives

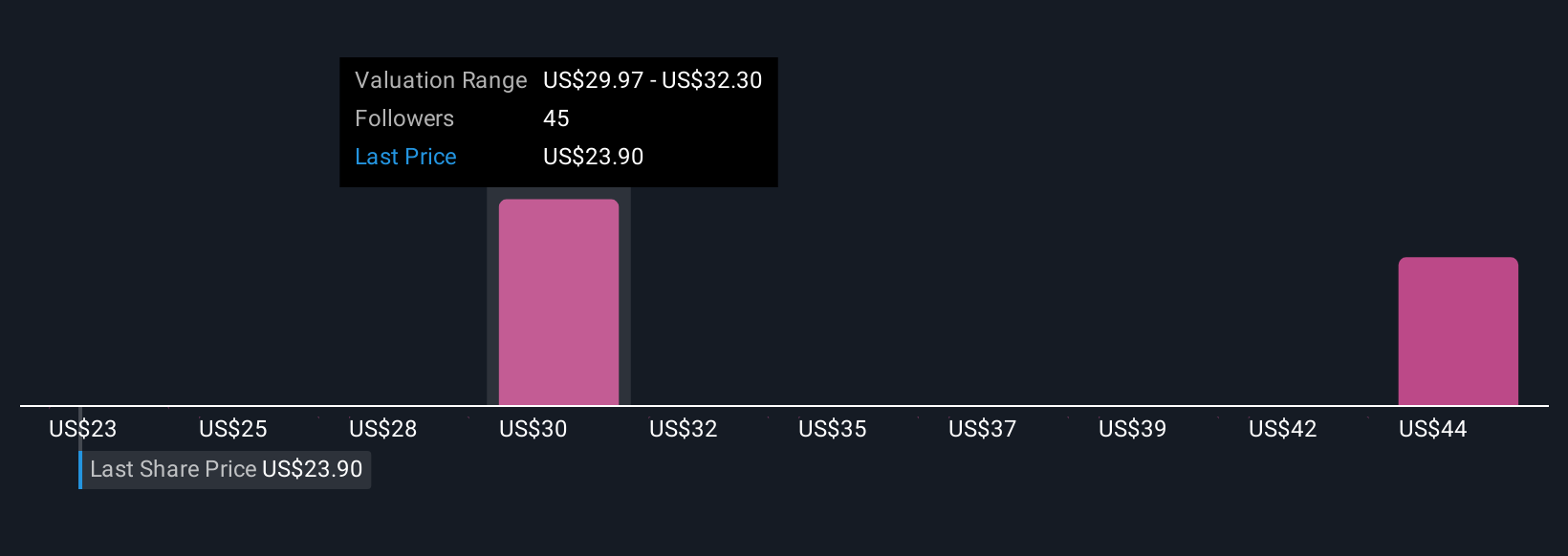

Six recent fair value estimates from the Simply Wall St Community span US$28.40 to US$45.44, indicating opinions diverge widely. Consider this range along with the company's evolving luxury fleet expansion as you assess potential outcomes and outlooks.

Explore 6 other fair value estimates on Norwegian Cruise Line Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Norwegian Cruise Line Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norwegian Cruise Line Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Norwegian Cruise Line Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norwegian Cruise Line Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives