- United States

- /

- Hospitality

- /

- NYSE:MTN

A Look at Vail Resorts's Valuation Following Strategic Leadership Appointment and Growth Focus

Reviewed by Simply Wall St

Vail Resorts has named Celeste Burgoyne, an accomplished executive from lululemon, as its next Executive Vice President and Chief Revenue Officer, set to join in January 2026. This leadership appointment is catching the attention of investors curious about the company's growth direction.

See our latest analysis for Vail Resorts.

Vail Resorts’ recent announcement comes after a year where momentum has faded, with the share price declining 19.95% year-to-date and the one-year total shareholder return down 16.33%. While some investors may see renewed executive vision as a potential catalyst, longer-term performance remains under pressure as the three- and five-year total shareholder returns are -35.90% and -41.01%, respectively. This highlights ongoing challenges despite periodic lifts in sentiment.

If this kind of leadership shakeup has you thinking bigger, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets and future growth in focus, investors are now left to weigh whether Vail Resorts is an undervalued opportunity or if its current price already reflects what lies ahead.

Most Popular Narrative: 19.3% Undervalued

The most widely followed narrative places Vail Resorts’ fair value well above the last close, indicating meaningful upside compared to recent trading levels. Here is what is driving this perspective.

Vail Resorts is on track to deliver $100 million in annualized cost efficiencies by the end of fiscal year 2026 through its Resource Efficiency Transformation Plan, which could positively impact earnings by improving net margins. Continued investment in guest experience through lift, terrain, and food and beverage expansions, along with technology upgrades like My Epic App and AI capabilities, are expected to drive higher ancillary revenue and overall customer satisfaction, contributing positively to revenue growth.

Want to know what math drives such a high fair value? This narrative puts the focus on significant cost savings and future profitability assumptions, while emphasizing ambitious margins and transformative new technology. It centers on how these projections add up over the next few years. Curious what numbers lead to this outlook?

Result: Fair Value of $173.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent shifts in guest visitation patterns and unfavorable currency fluctuations could pose challenges to Vail Resorts’ expected growth and affect revenue stability in the future.

Find out about the key risks to this Vail Resorts narrative.

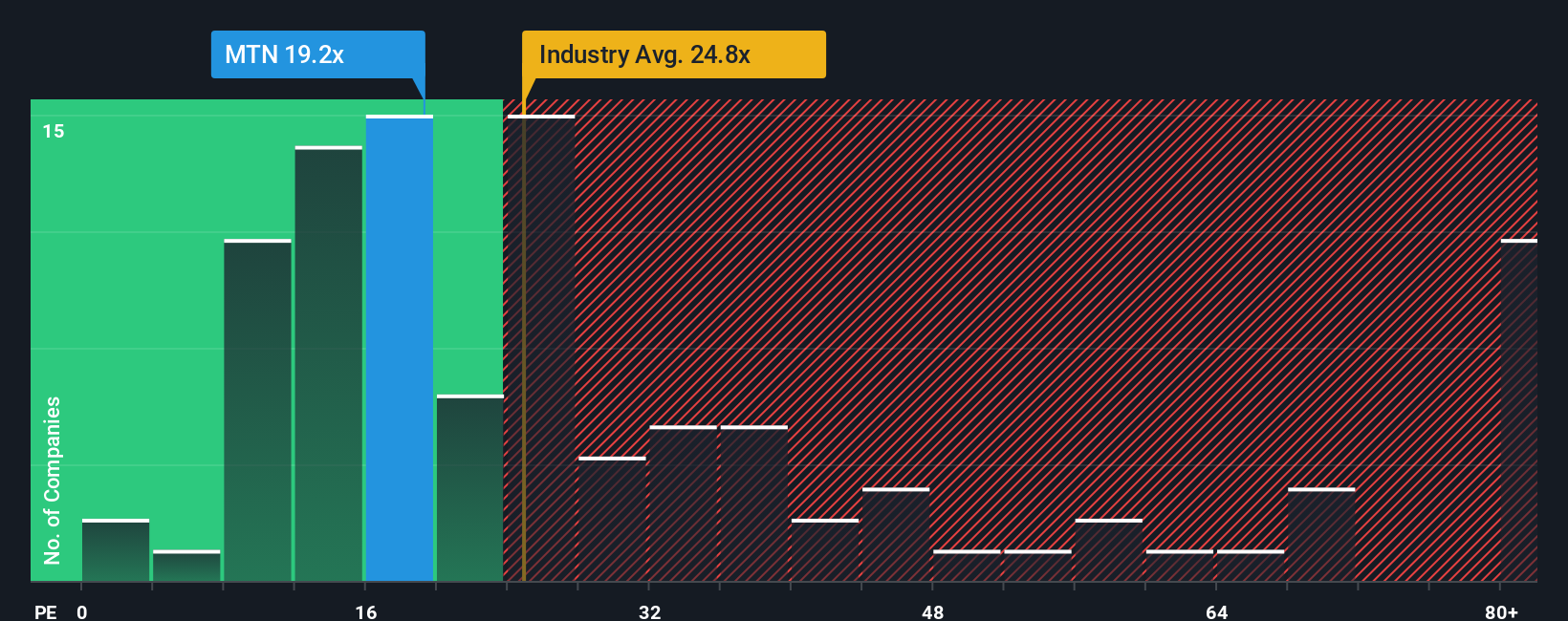

Another View: A Multiples-Based Check

While fair value estimates point to upside, a look at valuation based on the price-to-earnings ratio offers a reality check. Vail Resorts trades at 18x earnings, which is considerably lower than the 35x peer average and the industry average of 21.4x. However, it is slightly above its fair ratio of 16.5x. This gap suggests opportunity, but also hints at some valuation risk if the market reverts toward the fair ratio. Could the current discount signal upside, or does it reflect caution for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vail Resorts Narrative

If you see the story differently or prefer your own perspective, you can dive into the data and piece together your own view in just a few minutes. Do it your way

A great starting point for your Vail Resorts research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know opportunities rarely wait around. Set yourself up for your next win by checking out these standout stock ideas hand-picked for bold portfolios.

- Unlock high-yield potential as you target growth and reliable income among these 15 dividend stocks with yields > 3% yielding over 3%.

- Jump on tomorrow’s hottest tech trends by following these 25 AI penny stocks powering innovation across artificial intelligence and automation.

- Find hidden value before others catch on by targeting these 916 undervalued stocks based on cash flows set to outperform based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTN

Vail Resorts

Operates mountain resorts and regional ski areas in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026