- United States

- /

- Hospitality

- /

- NYSE:MGM

Assessing MGM Stock After 11.8% Rally on Digital Gaming Partnership News in 2025

Reviewed by Bailey Pemberton

- Wondering if now is the right time to get into MGM Resorts International? You are not alone, as investors everywhere are questioning whether the stock's current price truly reflects its value.

- Shares have rebounded sharply this week, up 11.8% over the last seven days. Longer-term returns remain mixed, with the stock still down 6.9% over the past year.

- This recent surge comes alongside major headlines about MGM's big push into digital gaming partnerships and new property developments, both of which have sparked investor optimism. However, lingering concerns in the wider leisure industry mean opinions about risk and reward are still divided.

- For those who prefer a numbers-based approach, MGM scores a 2 out of 6 on our valuation checks. This indicates the company appears undervalued on only a couple of metrics. Let's break down how these scores are calculated and explore whether standard valuation measures give the full picture. Then stick around for an even better way to size up MGM’s real value at the end.

MGM Resorts International scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MGM Resorts International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those values back to today. For MGM Resorts International, this means forecasting how much cash the business can generate in the years ahead and calculating what that future potential is worth in today's dollars.

Currently, MGM's free cash flow stands at approximately $1.45 billion. Based on analyst estimates, this figure is expected to rise to around $1.69 billion by the end of 2027. Looking further ahead, cash flows are projected to exceed $2.3 billion by 2035. These longer-term numbers are extrapolated by Simply Wall St beyond what analysts directly provide.

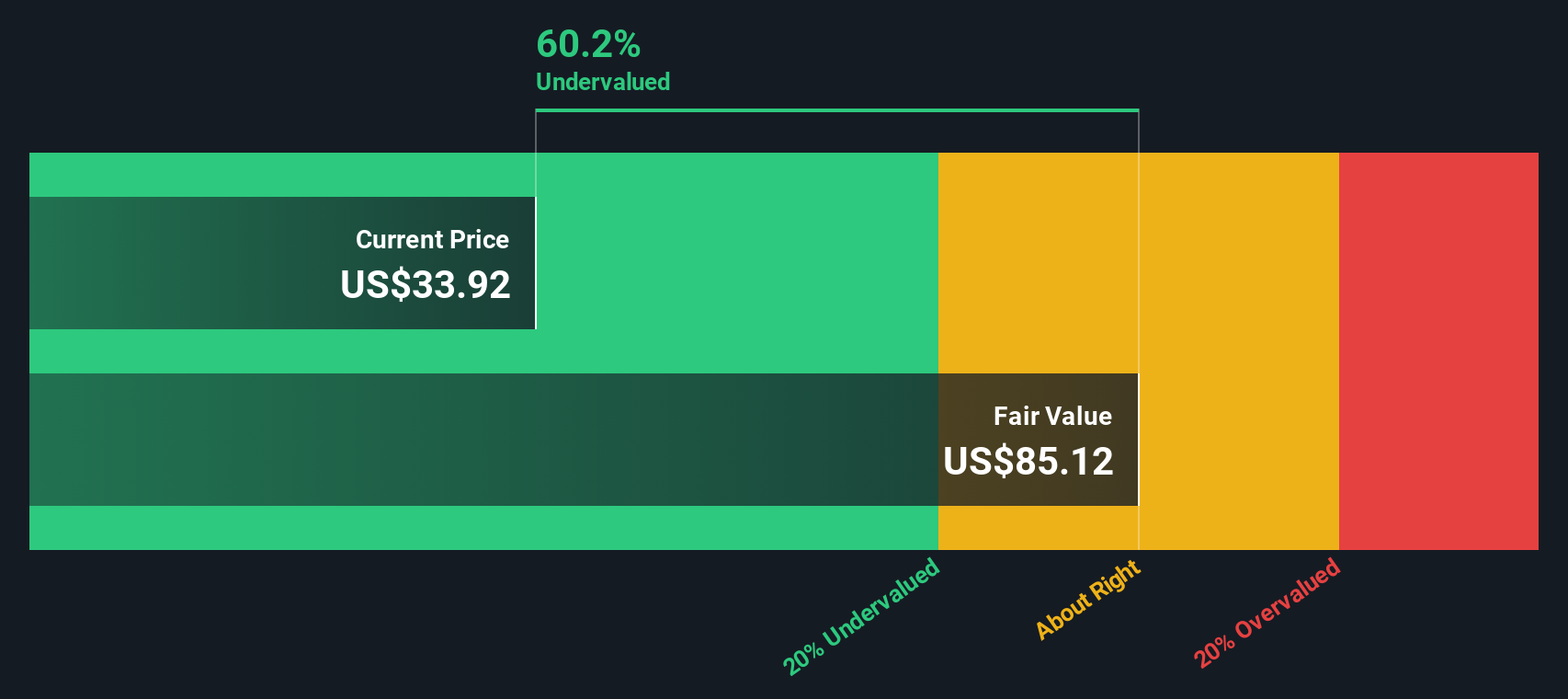

The DCF model used here values MGM using a 2 Stage Free Cash Flow to Equity approach. After discounting all projected future cash flows, the intrinsic fair value is calculated at $67.98 per share. With the current share price almost 49% below this estimate, the model suggests MGM is significantly undervalued based on cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MGM Resorts International is undervalued by 48.8%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: MGM Resorts International Price vs Earnings

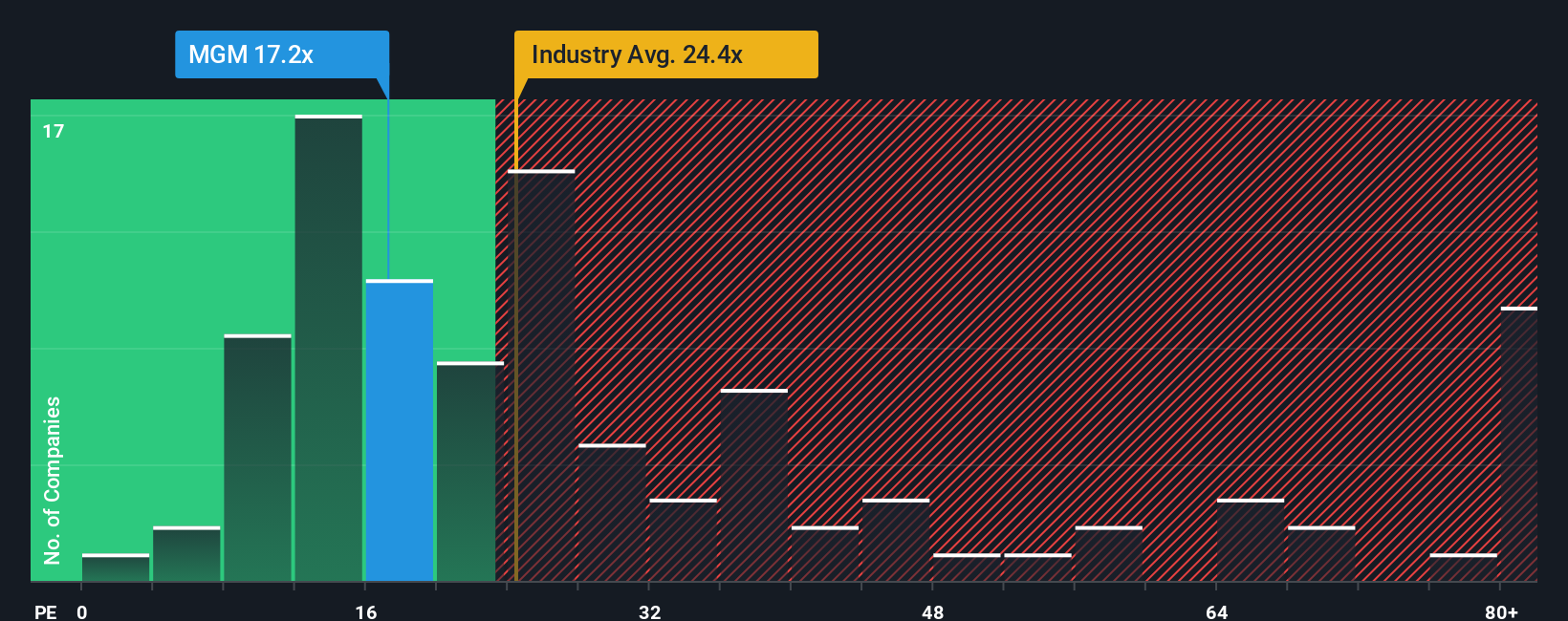

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like MGM Resorts International because it captures how much investors are willing to pay today for a dollar of earnings. Since MGM is generating steady profits, the PE ratio offers an effective lens for determining whether the stock is fairly valued relative to its earnings power.

Typically, a "normal" or "fair" PE ratio depends on factors such as growth prospects, perceived business risk, and the broader industry's outlook. Companies expected to grow faster or with less risk often command higher PE ratios, while those with lower growth or higher risk might trade at lower multiples.

Currently, MGM trades at a PE ratio of 141.6x, which is much higher than both the Hospitality industry average of 21.2x and the average of similar peers at 14.8x. To better account for MGM's unique combination of growth, profitability, risk profile, and market capitalization, Simply Wall St calculates a proprietary Fair Ratio for MGM, which stands at 48.2x. This Fair Ratio provides a more nuanced benchmark than simple comparisons to peer or industry averages because it incorporates not just sector trends but also the company's own financial health and future potential.

Comparing MGM's actual PE of 141.6x to its Fair Ratio of 48.2x suggests that shares are currently trading well above the level justified by the company's fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MGM Resorts International Narrative

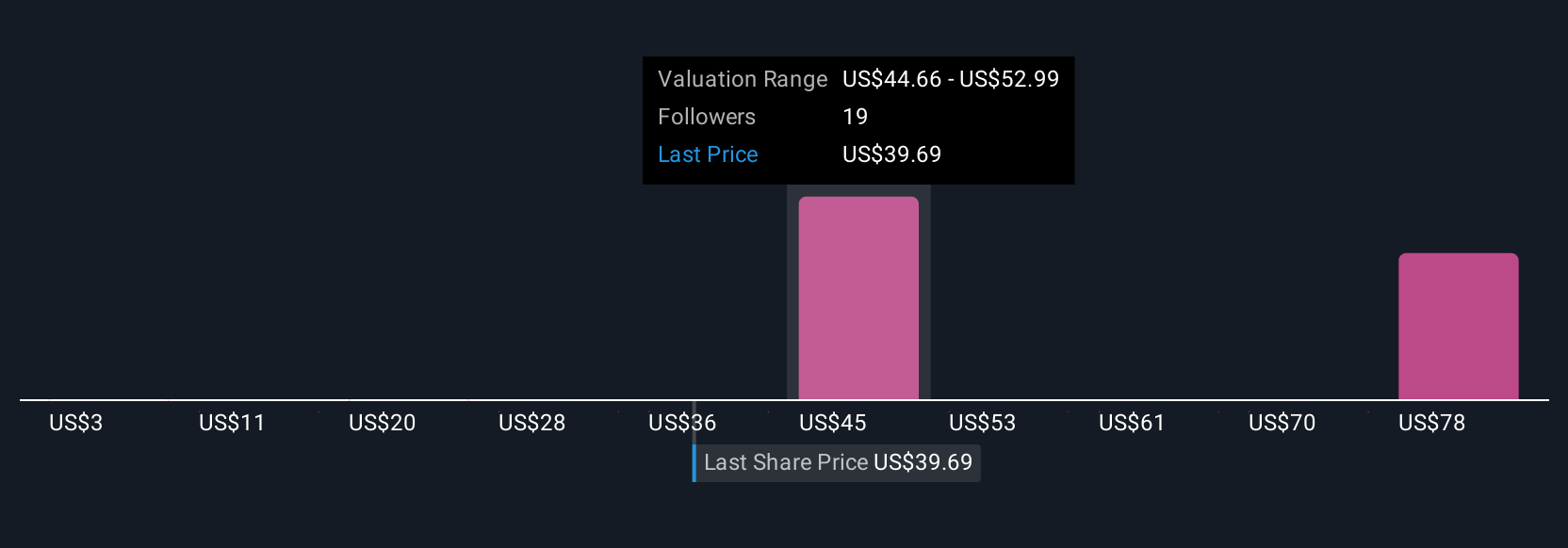

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company, combining your views on its long-term prospects, future revenue, earnings, and margins. This approach allows you to connect what you know about MGM Resorts International to a concrete financial forecast and arrive at your own fair value estimate.

Narratives put you in control by letting you move beyond standard valuation models and directly linking a company's evolving story to dynamic numbers. On Simply Wall St's Community page, used by millions of investors, Narratives make it easy and accessible to create, share, or explore different perspectives.

This tool helps you decide when to buy or sell by clearly showing how your fair value stacks up against the actual share price, while automatically updating your view whenever new news or earnings come out. For example, some investors build Narratives around MGM's international expansion and digital gaming, leading to bullish fair values as high as $58.00. Others focus on structural risks and price targets as low as $37.00, demonstrating how Narratives reflect diverse but data-driven opinions on MGM's future.

Do you think there's more to the story for MGM Resorts International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success