- United States

- /

- Hospitality

- /

- NYSE:MCD

Is McDonald's Price Drop on Combo Meals Signaling a Long-Term Opportunity?

Reviewed by Bailey Pemberton

Thinking about your next move with McDonald's stock? You are definitely not alone, especially with the company returning 3.9% over the last week, even as its year-to-date climb has softened to 4.4%. Investors have been watching closely as McDonald's shakes up its strategy, from fresh pricing tweaks on combo meals to bold plans for AI innovation over the coming years. These moves, plus headline-making stances on industry wage debates, have all played into the evolving risk and reward dynamics underlying the stock price, which is currently at $305.33.

Over the past three years, the stock has delivered a strong 31% total return, though its one-year number now stands just below the waterline at -0.7%. That back-and-forth says a lot about how investors are digesting McDonald's latest decisions, including lowering meal prices to keep value-seekers coming through the door and leaning into new drinks to capture Gen Z tastes. Meanwhile, the company's value score checks in at 2 out of 6. That means, according to our checklist where one point is earned for each test of undervaluation McDonald's passes, the stock looks undervalued in only two areas so far.

So is this a classic value opportunity, or is the price telling us something about future growth risks? Let us break down what the valuation methods actually say about today's price. Stay tuned, because there is a smarter take on valuation that most investors miss, and we will get there by the end of the article.

McDonald's scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: McDonald's Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today's terms. This approach aims to capture the long-term business potential by focusing on the cash McDonald's is expected to generate for shareholders over time.

Currently, McDonald's reports trailing twelve-month Free Cash Flow (FCF) of approximately $7.23 billion. Analyst estimates suggest that annual FCF will steadily rise, with a projection of $10.6 billion by 2028. Although detailed analyst forecasts only extend five years out, additional projections for the next decade are provided by Simply Wall St, projecting FCF to reach $14.2 billion by 2035.

Based on these numbers and applying the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for McDonald’s stock comes out to $248.56 per share. With the share price currently at $305.33, the DCF model implies the stock is around 22.8% overvalued at today's levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests McDonald's may be overvalued by 22.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: McDonald's Price vs Earnings

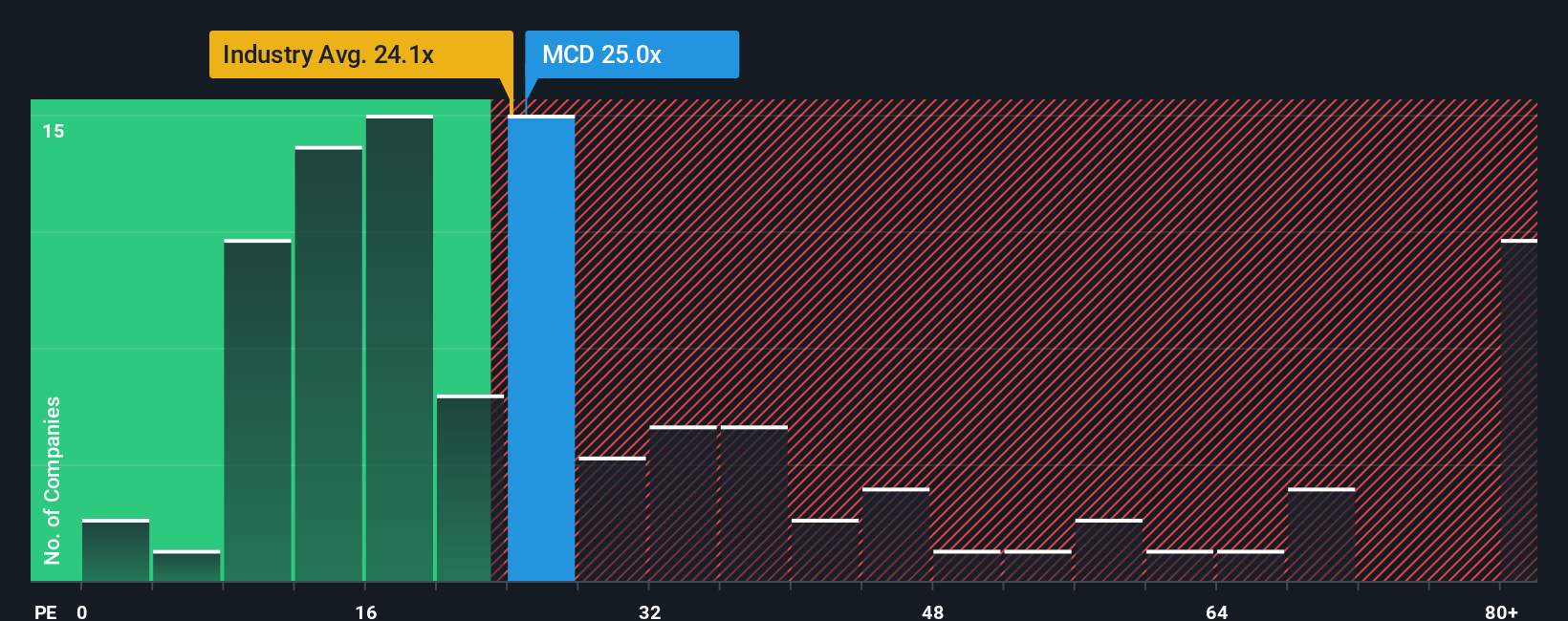

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it gauges how much the market is willing to pay for each dollar of earnings. For stable, well-established businesses like McDonald's, the PE ratio provides a clear snapshot of how investors view the company's future potential and profitability relative to its peers.

Expectations for growth and risk play a major role in shaping what a “normal” or fair PE ratio should be. Companies with higher expected earnings growth or lower risk are typically assigned higher PE ratios, while businesses facing greater uncertainty or slower growth usually trade at lower multiples.

McDonald’s currently trades at a PE ratio of 26x. When compared with key benchmarks, this sits above the hospitality industry average of 23x, but far below the peer group average of 62x. Simply Wall St calculates a Fair Ratio for McDonald's of 31x, which is tailored to the company’s specific growth forecasts, profit margins, market cap, and risk profile. Unlike a one-size-fits-all industry or peer comparison, the Fair Ratio carefully adjusts for these factors and provides a more nuanced valuation baseline.

Currently, McDonald’s PE of 26x is below its Fair Ratio of 31x. This suggests the market is not fully pricing in the company's strengths. This analysis indicates the stock is trading at a modest discount to its fair value.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your McDonald's Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story or perspective on a company, tying together what you believe about its future with actual financial forecasts, such as what revenues, profits, and margins might look like in years to come, arriving at your unique fair value for the stock.

Narratives work by linking your view of McDonald’s business, whether focused on global expansion, digital tech upgrades, or shifting consumer patterns, to projected financials and a resulting valuation. This makes the process transparent and grounded in real numbers. This approach, built into the Simply Wall St platform and used by millions of investors on the Community page, allows anyone to create or follow multiple Narratives, making complex analysis easy and accessible.

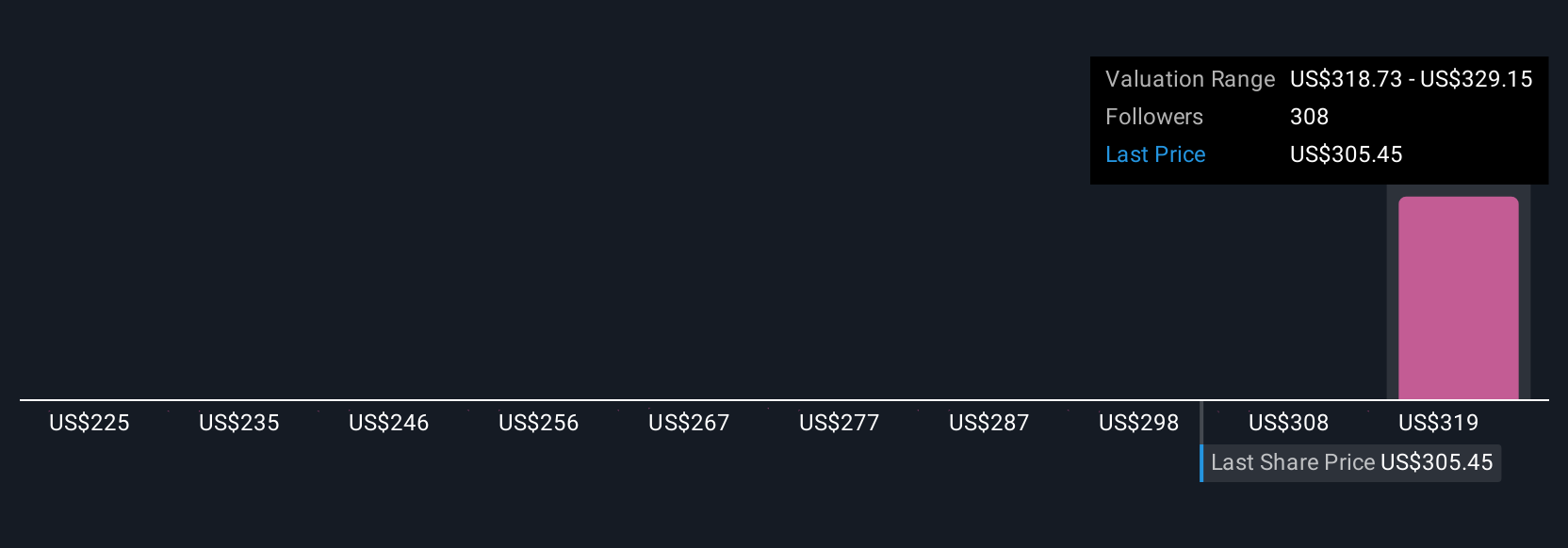

The real power of Narratives comes from helping you decide when to buy or sell, as you can compare your fair value directly to the current price. When fresh information such as quarterly earnings or major news emerges, all Narratives update instantly to reflect the latest outlook. For example, some investors see robust international expansion and tech investment driving McDonald’s fair value up to $373, while others, more focused on competitive risks and margin pressures, set it as low as $260. With Narratives, everyone’s perspective is captured and keeps pace as the story unfolds.

Do you think there's more to the story for McDonald's? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives