- United States

- /

- Hospitality

- /

- NYSE:MCD

How McDonald’s (MCD) Dividend Growth and AI Investments May Shift Its Investment Narrative

Reviewed by Simply Wall St

- Earlier this week, McDonald’s Board of Directors declared a quarterly cash dividend of US$1.77 per share, payable on September 16, 2025, to shareholders of record as of September 2, 2025.

- This marks nearly five decades of consecutive dividend increases, highlighting McDonald’s consistent focus on shareholder returns even amid recent sales declines.

- We'll assess how McDonald's increased investments in artificial intelligence could enhance its investment case and future growth narrative.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

McDonald's Investment Narrative Recap

For McDonald’s shareholders, the core thesis often hinges on the brand’s ability to drive steady cash flows through its global franchise model, despite economic crosswinds. The recent dividend announcement reinforces McDonald’s prioritization of shareholder returns, but it does not materially shift the short-term focus on stabilizing U.S. traffic and managing margin pressures amid heightened inflation and intensified competition in beverages and chicken. The principal near-term catalyst remains McDonald’s execution on value and menu innovation, while weak sales growth and cost inflation stand out as critical risks.

Among the latest developments, McDonald’s stepped up its artificial intelligence investments, aiming to expand order-verifying systems from 400 restaurants in India to 40,000 globally by 2027. While this move is not directly tied to the dividend hike, it reflects the company’s effort to unlock operational efficiencies and ultimately support margins and traffic, which connect back to the key catalysts and risks for the business. Yet, use of technology alone will not resolve the fundamental concern if...

Read the full narrative on McDonald's (it's free!)

McDonald's narrative projects $30.0 billion revenue and $10.2 billion earnings by 2028. This requires 5.3% yearly revenue growth and a $2.0 billion earnings increase from $8.2 billion.

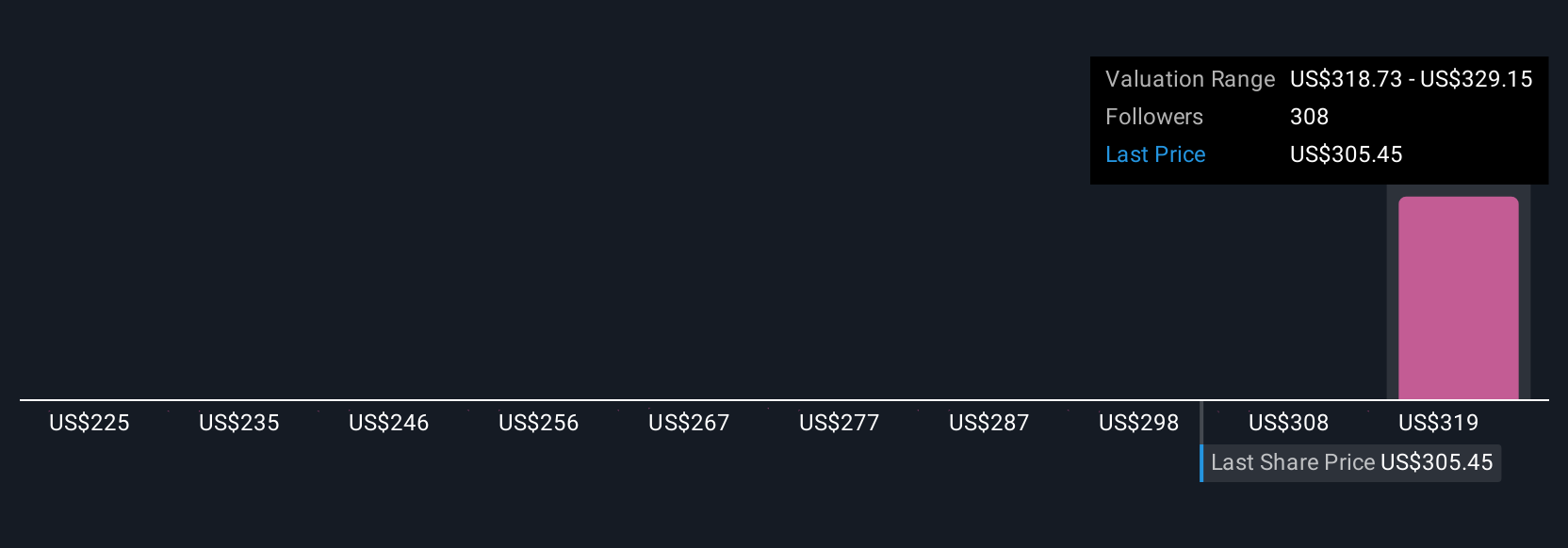

Uncover how McDonald's forecasts yield a $329.15 fair value, a 9% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided 16 fair value estimates for McDonald's stock between US$225 and US$347.75. With opinions ranging widely, keep in mind that cost inflation in core markets may affect future profitability and invite readers to explore multiple viewpoints.

Explore 16 other fair value estimates on McDonald's - why the stock might be worth 26% less than the current price!

Build Your Own McDonald's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McDonald's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free McDonald's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McDonald's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives