- United States

- /

- Hospitality

- /

- NYSE:MCD

Do Themed Promotions Reveal McDonald's (MCD) Secret Recipe for Brand Relevance?

Reviewed by Sasha Jovanovic

- McDonald's recently rolled out nationwide holiday promotions, including The Grinch Meal and a Disneyland 70th anniversary Happy Meal collaboration, alongside a limited-edition merchandise drop with BMX athlete Nigel Sylvester.

- These cultural tie-ins and collectible offerings aim to boost customer engagement and reinforce McDonald's longstanding presence in American pop culture during the busy holiday season.

- We'll assess how McDonald's emphasis on themed menu items and collectibles aligns with its ongoing efforts in menu innovation and brand relevance.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

McDonald's Investment Narrative Recap

For McDonald's shareholders, the central belief rests on the company's ability to combine global scale, digital engagement, and menu innovation to offset margin pressure and defend market share, especially as challenging consumer and competitive dynamics persist. The recent wave of holiday promotions and pop culture collaborations may generate buzz, but they do not materially affect the most important short-term catalysts, such as international unit expansion and digital upgrades, or the primary risks, notably ongoing declines in US guest traffic and input cost inflation.

Of the recent announcements, the nationwide launch of The Grinch Meal and the Disneyland 70th anniversary Happy Meal stands out by reinforcing McDonald's emphasis on cultural relevance and collectibles. These initiatives highlight the company’s push to drive higher guest counts via differentiated menu items, supporting its catalyst of brand engagement and menu innovation as a lever for near-term revenue stability.

But in contrast to promotional buzz, investors should also be mindful of longer-term risks lurking beneath the surface, including...

Read the full narrative on McDonald's (it's free!)

McDonald's is projected to reach $30.6 billion in revenue and $10.4 billion in earnings by 2028. This outcome relies on annual revenue growth of 5.5% and a $2 billion increase in earnings from the current $8.4 billion.

Uncover how McDonald's forecasts yield a $331.53 fair value, a 7% upside to its current price.

Exploring Other Perspectives

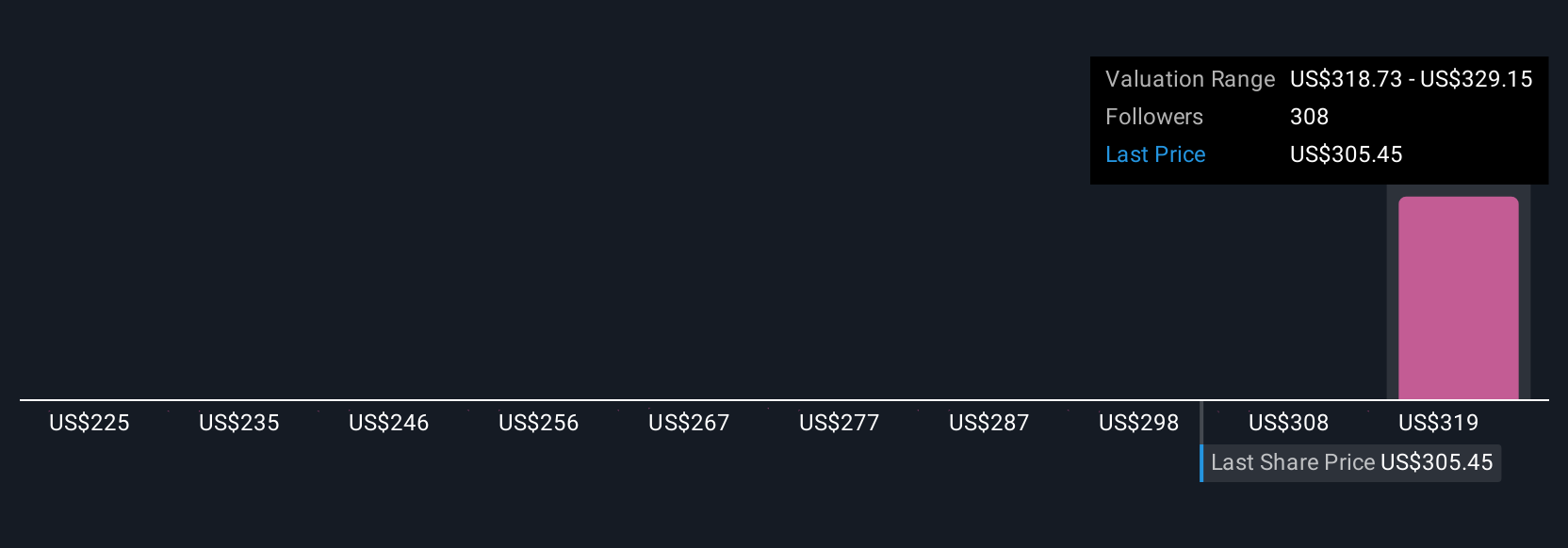

Ten fair value estimates from the Simply Wall St Community range widely from US$264.55 to US$331.53 per share. Against this diversity of opinion, sustained pressure on US guest traffic could have broad implications for McDonald’s revenue trends and market expectations, highlighting how investor viewpoints often reflect very different company outlooks.

Explore 10 other fair value estimates on McDonald's - why the stock might be worth 15% less than the current price!

Build Your Own McDonald's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McDonald's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free McDonald's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McDonald's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success