- United States

- /

- Hospitality

- /

- NYSE:LVS

Las Vegas Sands (LVS): Margin Decline Challenges Bullish Profit Growth Narratives

Reviewed by Simply Wall St

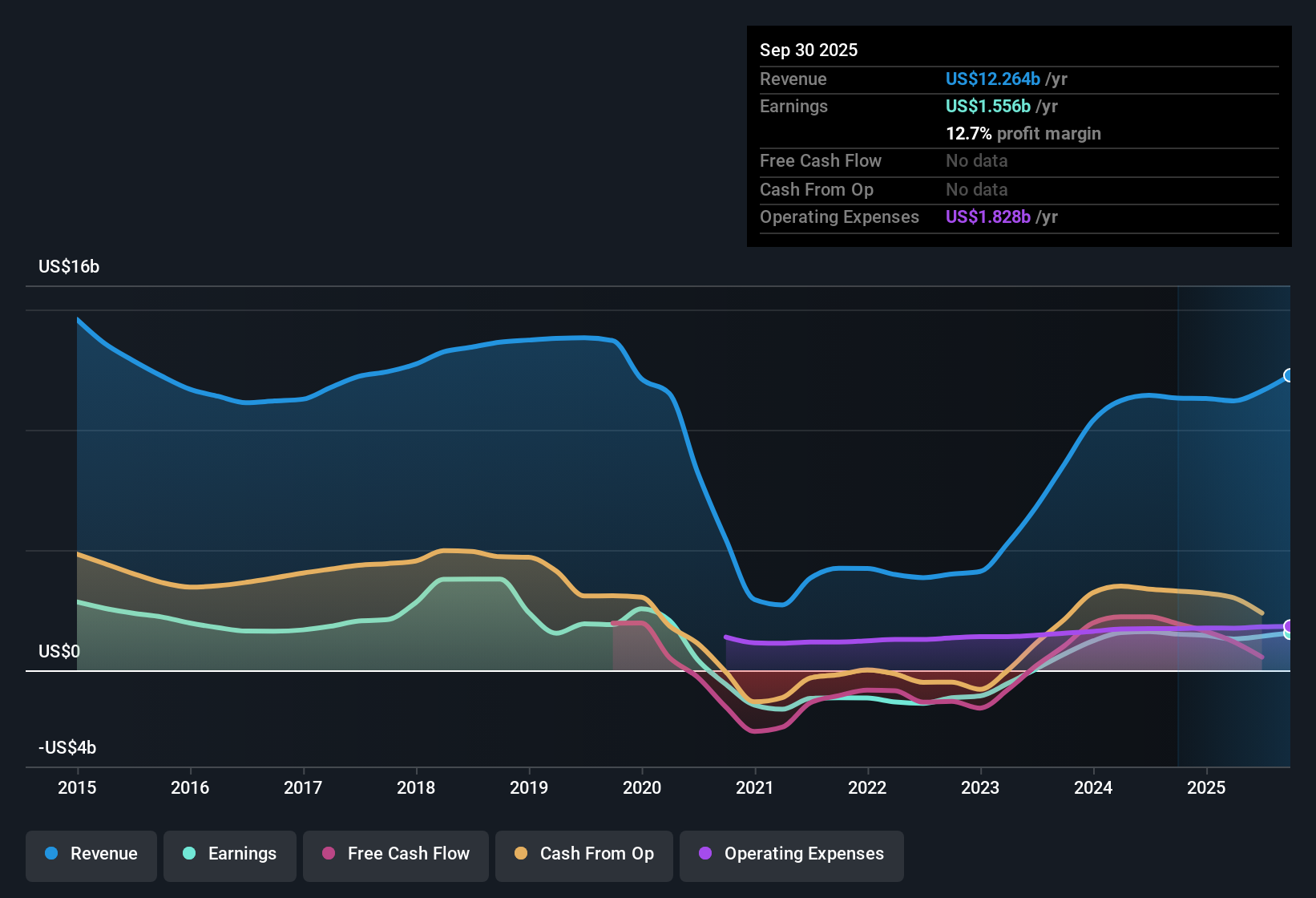

Las Vegas Sands (LVS) reported net profit margins of 12.7%, slightly below last year's 13.3%, as recent earnings growth came in at 3.5% compared to the company’s five-year average annual gain of 62.5%. Despite the moderation, the company remains profitable with high quality earnings and forecasts pointing to annual earnings growth of about 15.05%, along with revenue growth of 5.6% per year, which trails the broader US market’s 10% pace.

See our full analysis for Las Vegas Sands.Next, we’ll see how these latest figures compare to the broader narratives investors follow, and where market perceptions might shift as a result.

See what the community is saying about Las Vegas Sands

Londoner Macao Opens Up Scale Advantage

- The full opening of The Londoner in Macao, with 2,405 rooms and suites, is expected to boost revenues and cash flow by leveraging scale and quality in a highly competitive regional market.

- According to the analysts' consensus view, this investment is forecast to significantly improve cash flows and drive long-term growth, but competition remains intense in Macao.

- Consensus narrative notes that Marina Bay Sands in Singapore has already reported record EBITDA, highlighting that these property upgrades can directly impact revenue when tourism rebounds.

- What is surprising is that even with new facilities coming online, EBITDA margins in Macao are under some pressure from lower-than-expected hold in certain casino segments, which puts the spotlight on operational execution.

- Analysts' consensus expectations sharpen this narrative, revealing how Las Vegas Sands is balancing reinvestment in its assets with the reality of intense regional competition and margin pressure. 📊 Read the full Las Vegas Sands Consensus Narrative.

Buybacks Target Earnings Growth

- Share repurchases have ramped up, with buyback authorization increased to $2 billion and analysts projecting a 5.32% decrease in shares outstanding annually over the next three years.

- Consensus narrative argues these buybacks are intended to drive stronger EPS growth and boost returns for shareholders, but elevating EPS through share reduction must be matched by sustained profitability improvements.

- The narrative notes that analysts expect earnings to reach $2.5 billion (EPS of $3.89) by 2028, up from $1.4 billion today, driven in part by fewer outstanding shares as well as operational gains.

- However, critics highlight the continued need for profit margin improvement, with consensus expecting margins to grow from 12.2% to 17.7% over three years or else buybacks risk over-promising on long-term value creation.

Low Price-to-Earnings Signals Possible Value

- Las Vegas Sands currently trades at a 25.1x price-to-earnings ratio, which is well below its peer average of 58.8x and only slightly above the US hospitality industry average of 24.3x.

- Applying analysts' consensus narrative, the current share price of $56.89 remains noticeably under the DCF fair value of $94.69, while the consensus price target sits at $64.73, suggesting potential upside exists if forecasts for higher revenue and profit margins are realized.

- What is notable is that analysts expect the company will need to trade at a future PE of 18.3x by 2028 to justify these targets, bringing the company’s multiple below industry averages and highlighting valuation tension.

- The consensus also acknowledges risks around the company’s financial position and dividend sustainability, creating a scenario where the discounted valuation could persist if these issues are not addressed.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Las Vegas Sands on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on the numbers? Take just a few minutes and shape your perspective by building your own narrative, Do it your way.

A great starting point for your Las Vegas Sands research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Las Vegas Sands’ high-profile upgrades, the company continues to struggle with margin pressure, competitive threats, and ongoing questions around its balance sheet strength.

If you’re seeking companies with stronger financial foundations and fewer balance sheet concerns, check out solid balance sheet and fundamentals stocks screener (1984 results) that are built for resilience and long-term success.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVS

Las Vegas Sands

Owns, develops, and operates integrated resorts in Macao and Singapore.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives