- United States

- /

- Hospitality

- /

- NYSE:LTH

A Look at Life Time (LTH) Valuation Following Ambitious Gowanus Wharf Expansion Plans

Reviewed by Simply Wall St

Life Time Group Holdings (LTH) just unveiled plans for a major athletic country club at Gowanus Wharf in Brooklyn. This expansive location promises more than 85,000 square feet of innovative health and wellness amenities for members.

See our latest analysis for Life Time Group Holdings.

Life Time’s big Gowanus expansion fits right in with the company’s push to set itself apart in a crowded market, which has caught the eye of investors. After a 21.8% year-to-date share price return and a three-year total shareholder return exceeding 113%, momentum is clearly building. The latest news highlights their ambitions for growth in New York and beyond.

If you're keen to spot similar trends, now is the perfect chance to discover fast growing stocks with high insider ownership and broaden your investing outlook.

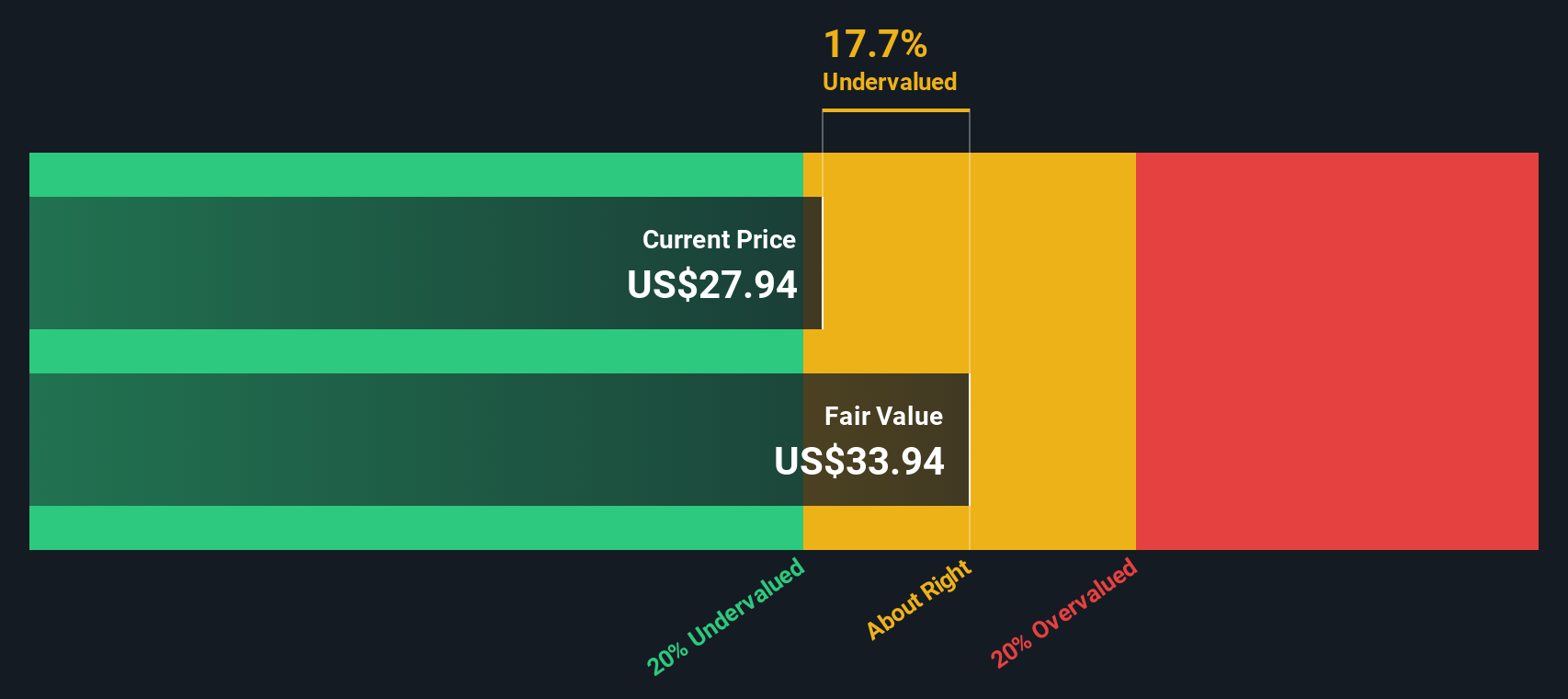

With shares already up significantly this year and a new flagship on the horizon, the real question is whether Life Time’s stock is undervalued in light of its growth plans, or if the market has already factored in these future gains.

Most Popular Narrative: 31.7% Undervalued

With a fair value estimate of $39.91 per share compared to a last close around $27, this narrative points to significant potential upside for Life Time Group Holdings’ stock. This perspective is based on strong operating performance and ambitious expansion strategies that are not fully reflected in the current market price.

Continued investment in technology, highlighted by the growth of Life Time Digital accounts and the launch of new digital and AI-driven wellness tools, enhances member engagement, retention, and cross-sell opportunities. This can increase overall lifetime customer value and support future earnings.

Curious why analysts see so much untapped value? The key factors include forecasts of accelerated revenue, margin expansion, and a future earnings profile that compares to premium industry peers. Interested in learning more about the core assumptions and projections supporting this target? Explore what could drive the next phase for Life Time Group Holdings.

Result: Fair Value of $39.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks to watch include Life Time’s heavy capital needs for expansion, as well as shifting consumer preferences toward digital and at-home fitness options.

Find out about the key risks to this Life Time Group Holdings narrative.

Another View: Using the SWS DCF Model

While the analyst consensus points to a fair value of $39.91, our SWS DCF model arrives at a different conclusion. This model suggests Life Time’s current share price of $27.27 is trading above its estimated fair value of $25.38. The method considers long-term cash flows and future expectations, providing a more conservative picture.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Life Time Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Life Time Group Holdings Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own perspective with just a few clicks. Do it your way

A great starting point for your Life Time Group Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss out on fresh opportunities. Expand your portfolio with companies poised for tomorrow’s growth using these handpicked screens from Simply Wall Street:

- Uncover lucrative income streams with these 14 dividend stocks with yields > 3% which offers attractive yields and stable cash flows for shareholders seeking reliable returns.

- Spot tomorrow’s market leaders by starting your journey into innovation with these 25 AI penny stocks as they transform industries through artificial intelligence breakthroughs.

- Catch early-stage companies before they surge by tapping into these 3565 penny stocks with strong financials that are gaining traction with strong financial health and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026