- United States

- /

- Consumer Services

- /

- NYSE:LRN

Is Stride Set for More Growth After Surging Over 100% in the Past Year?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Stride stock? You are not alone. Investors have watched Stride make some serious moves in recent years. If you had gotten in five years ago, you would be sitting on a gain of 386.3%, and even the past year alone has brought an impressive rise of 114.3%. These numbers are not just blips either, as the stock is up 203.0% over three years and 32.3% since January. Of course, not every week is a winner, as shown by a dip of 2.8% over the past seven days, but the overall trend is hard to ignore.

So, what is driving this performance? Beyond the day-to-day headlines, many investors see Stride's long-term growth potential shining through. There have been shifts in the broader market that made investors more comfortable with companies focused on digital learning, helping to fuel the rally. That said, with all this momentum, the question now is whether there is still value left in Stride at its current price of $140.68, or if the market has already priced in all the good news.

That is where looking at valuation really matters. Using a straightforward score that adds one point for each of six key checks where a company appears undervalued, Stride notched a value score of 4 out of 6. In other words, by several measures, the stock still looks appealing, but we need to get specific before making any bold calls. Let’s break down each valuation approach and see which really matter. I will share one method at the end that I think tells the most complete story.

Approach 1: Stride Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is one of the most widely used valuation methods for companies like Stride. It works by projecting the company’s future cash flows and then discounting them back to today to estimate what those future dollars are really worth in current terms.

For Stride, the latest twelve months’ Free Cash Flow stands at $360.2 million, with analysts only providing explicit estimates for the next few years. Looking further into the future, Simply Wall St extrapolates those projections and expects Free Cash Flow to grow to roughly $573.6 million by 2035. For context, the 2027 Free Cash Flow is forecast to reach $427 million, showing a consistent upward trend.

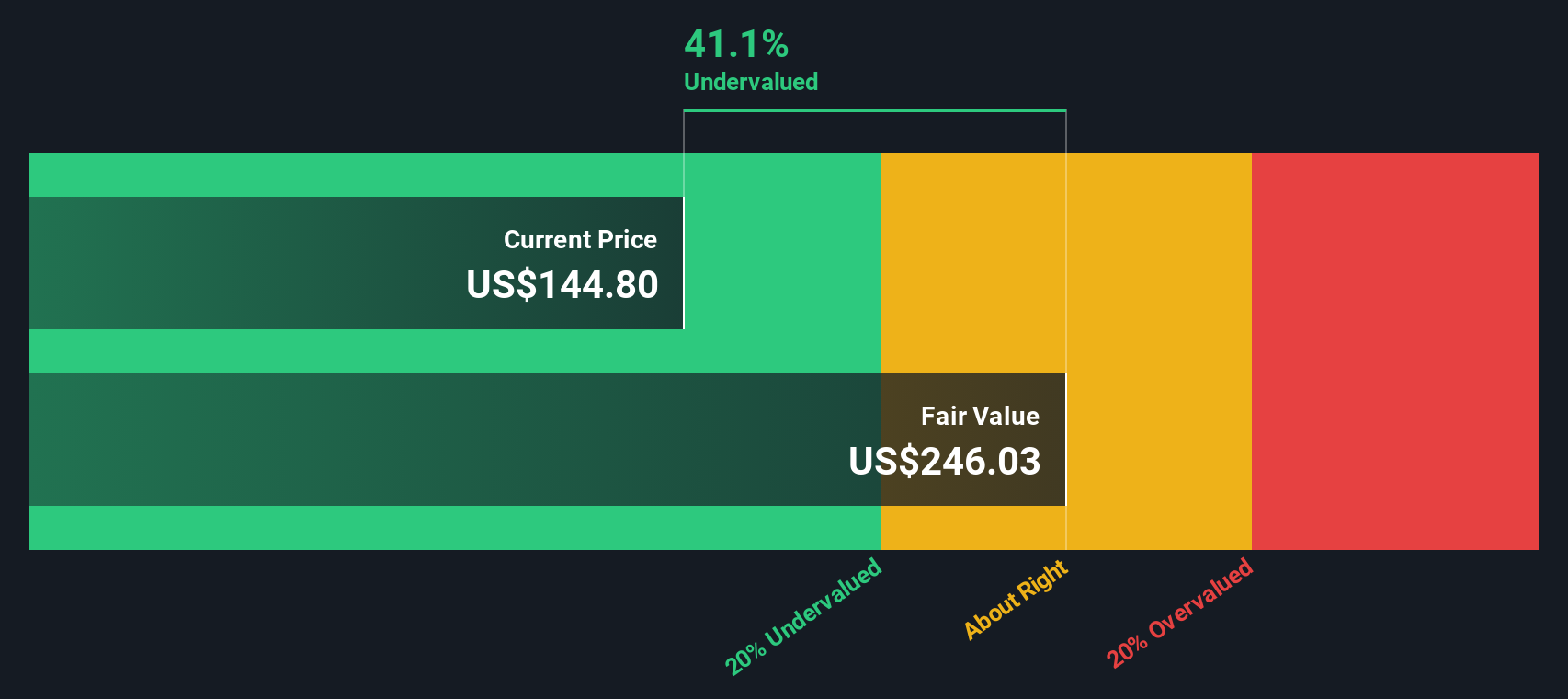

Based on these projections, the DCF model assigns Stride an intrinsic value of $247.06 per share, significantly higher than its current market price of $140.68. This means the DCF model indicates a 43.1% discount, suggesting the stock is notably undervalued compared to what its future cash flows are worth today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Stride is undervalued by 43.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Stride Price vs Earnings

For profitable companies like Stride, the Price-to-Earnings (PE) ratio is a go-to valuation metric. It provides a clear, easy-to-understand snapshot of how much investors are paying for each dollar of earnings, making it especially relevant for established firms generating consistent profits.

It is important to remember that a “normal” or “fair” PE ratio is not one-size-fits-all. Higher growth companies typically command higher PE ratios, as investors are willing to pay more for accelerating earnings. Conversely, businesses facing higher risks or slower growth generally warrant a lower PE multiple.

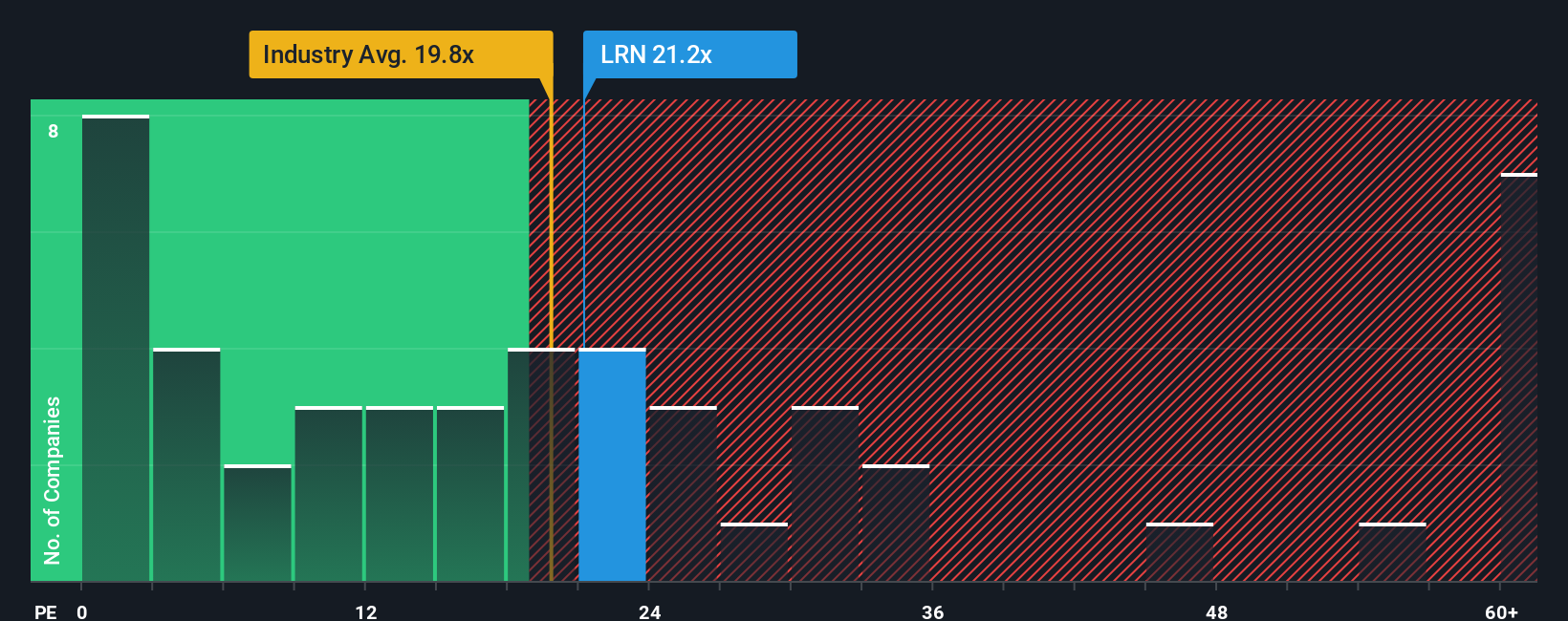

Right now, Stride trades at 21.0x earnings. That is above the Consumer Services industry average of 17.5x, but still well below the average of its peers at 35.8x. To add another layer, Simply Wall St calculates a “Fair Ratio” of 24.1x for Stride, factoring in not just industry averages and peers, but also the company’s earnings growth, profit margins, market cap, and specific risks.

The Fair Ratio is a more useful guide than raw peer or industry averages because it tailors expectations to Stride’s unique profile and outlook. This metric smooths out sector idiosyncrasies and ensures growth potential or challenges are genuinely reflected in the valuation assessment.

With Stride’s PE at 21.0x and a Fair Ratio of 24.1x, the stock currently trades a little below what would be expected based on its fundamentals and risk profile. This suggests shares are undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Stride Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personalized story about a company, connecting your assumptions for future revenue, margins, and growth with your view of what the company is truly worth.

Instead of just charting numbers, Narratives link Stride’s unique journey, such as new partnerships or product launches, to your personalized financial forecast and an estimated Fair Value. This approach makes it much easier to see if the stock is a buy, hold, or sell. Narratives are available on Simply Wall St's Community page, where millions of investors explore, share, and update their own perspectives as new earnings or news emerge, ensuring your view always stays relevant.

For example, on Stride, some investors believe its technological edge and fast-growing digital education market justify a Fair Value as high as $247. Others, more cautious about regulatory and funding risks, see a fair price closer to $164. Narratives let you compare your conviction directly with the current share price, giving you a powerful tool to decide when to add, hold, or exit your position based on real-time information and your own outlook.

Do you think there's more to the story for Stride? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LRN

Stride

Provides proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives