- United States

- /

- Hospitality

- /

- NYSE:HLT

How Hilton’s Raised Guidance and Shareholder Returns Will Impact Hilton Worldwide Holdings (HLT) Investors

Reviewed by Simply Wall St

- Hilton Worldwide Holdings recently reported its second quarter 2025 results, posting US$3.14 billion in revenue and US$440 million in net income, alongside updates on share repurchases, dividend, and forward earnings guidance.

- Management’s commitment to shareholder returns was underscored by a sizeable share buyback, an affirmed quarterly dividend, and increased net income forecasts for both the next quarter and full year.

- We’ll explore how Hilton’s upward guidance revision could influence the investment narrative around growth and margin expectations.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Hilton Worldwide Holdings Investment Narrative Recap

To own shares of Hilton Worldwide Holdings, an investor typically needs to believe in Hilton’s ability to drive growth through its global hotel development pipeline, maintain strong brand momentum, and protect margins amidst evolving demand trends. The recent quarterly results and higher forward guidance offer reassurance for growth expectations in the near term, but do not materially change the biggest short-term catalyst, continued RevPAR improvement in key markets, or the principal risk of softer travel demand in core segments.

Among Hilton’s recent announcements, the upward revision in earnings guidance stands out. Management now projects full-year 2025 net income between US$1.64 billion and US$1.68 billion (diluted EPS US$6.82–6.99), providing updated targets that will serve as a reference point as investors assess whether Hilton’s global expansion efforts are translating into stronger top-line and margin growth amidst a competitive environment.

Yet even with positive earnings momentum, the risk that group and business travel demand could soften further, especially in the US and China, remains something investors should be mindful of...

Read the full narrative on Hilton Worldwide Holdings (it's free!)

Hilton Worldwide Holdings’ outlook anticipates $14.8 billion in revenue and $2.5 billion in earnings by 2028. This scenario assumes a 45.4% annual revenue growth rate and an earnings increase of $0.9 billion from the current $1.6 billion level.

Uncover how Hilton Worldwide Holdings' forecasts yield a $272.67 fair value, a 4% upside to its current price.

Exploring Other Perspectives

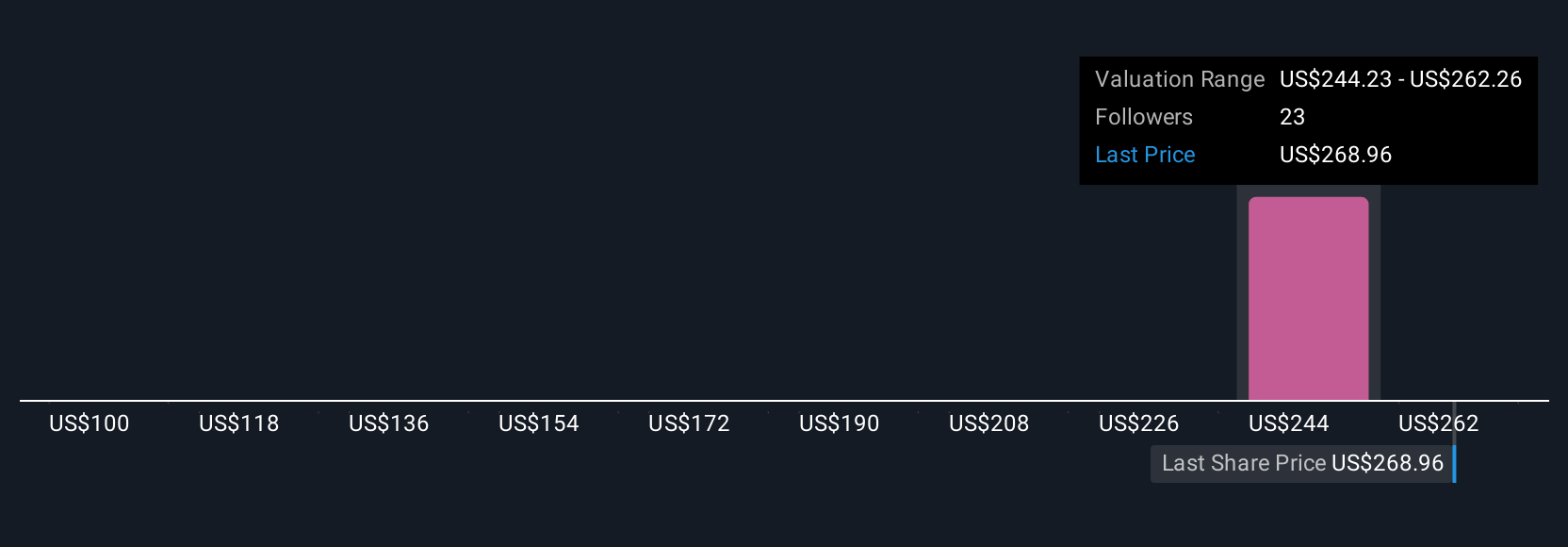

Simply Wall St Community fair value estimates for Hilton range from US$100 to US$280.29 across four individual analyses. While opinions vary widely, ongoing questions about travel demand trends continue to shape expectations for Hilton’s growth and returns, explore several perspectives before forming your own view.

Explore 4 other fair value estimates on Hilton Worldwide Holdings - why the stock might be worth less than half the current price!

Build Your Own Hilton Worldwide Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hilton Worldwide Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Worldwide Holdings' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives