- United States

- /

- Hospitality

- /

- NYSE:HLT

Hilton (HLT): Exploring Valuation as Shares Approach All-Time Highs

Reviewed by Simply Wall St

Hilton Worldwide Holdings (HLT) stock has quietly moved higher over the past month, climbing about 4%. Investors are taking notice as the company continues to post steady revenue and net income growth. This reflects ongoing recovery trends in travel and hospitality.

See our latest analysis for Hilton Worldwide Holdings.

Zooming out, Hilton’s share price has delivered a solid 12.1% return so far this year, building on last year’s momentum. Its one-year total shareholder return stands at 9%. The robust three- and five-year total shareholder returns of 100% and 169% respectively hint at durable longer-term growth, even as the stock’s recent upward price action suggests investors are steadily warming to its outlook.

If travel and hospitality’s comeback makes you wonder what else is trending, now’s a perfect time to explore fast growing stocks with high insider ownership.

Yet with shares near their all-time highs and analysts seeing only modest upside from current levels, the question becomes whether Hilton is undervalued or if its strong run means expectations and growth are already baked in.

Most Popular Narrative: Fairly Valued

With Hilton’s current share price of $274.80 just above the narrative’s fair value estimate of $280.92, the market appears to have already priced in much of the optimism about Hilton's prospects. Insights from the most widely followed narrative underscore the strength and ambition behind Hilton’s expansion plans.

The rapid expansion of Hilton's development pipeline, including opening 221 hotels in the quarter and a record 510,000 rooms in progress, with strategic focus on emerging markets (Asia-Pacific, Africa, India), positions Hilton to capture rising demand from growing middle-class travelers worldwide. This supports long-term revenue and earnings growth. Hilton's emphasis on new lifestyle and luxury brands, plus robust conversion activity leveraging its existing portfolio, enables the company to address shifting consumer preferences toward experiential travel and premium accommodations. This is expected to fuel future RevPAR growth and higher net margins.

Want to see what powers Hilton's price? The full narrative unpacks bold expansion targets, huge international ambitions, and some surprisingly aggressive growth assumptions. Which numbers and projections drive this “fair” price? See for yourself. These forecasts might change how you see the company's future.

Result: Fair Value of $280.92 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic headwinds or ongoing softness in RevPAR across key markets could still threaten Hilton’s long-term growth outlook and narrative strength.

Find out about the key risks to this Hilton Worldwide Holdings narrative.

Another View: Is Hilton’s High Multiple a Warning Sign?

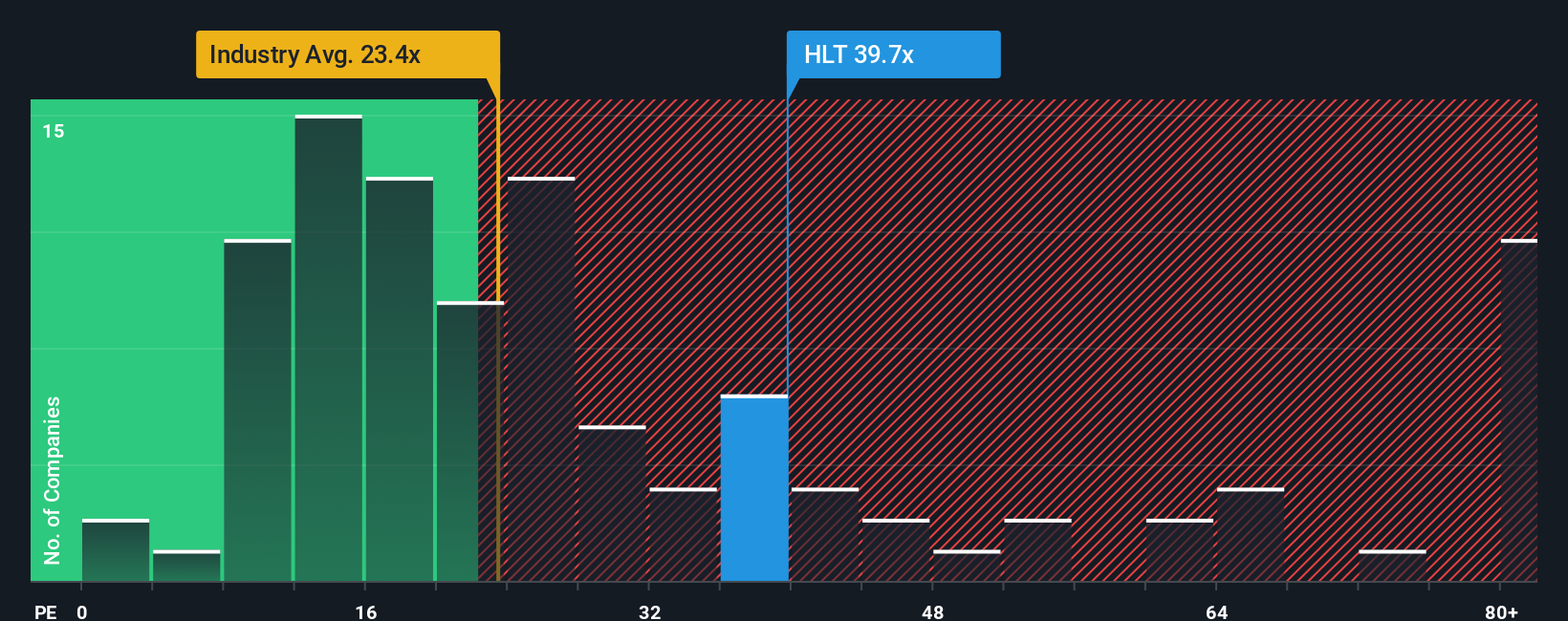

While analyst price targets suggest Hilton is fairly valued, a closer look at its current price-to-earnings ratio (38.4x compared to 22.1x for the US Hospitality industry and a fair ratio of 29x) shows Hilton trading at a significant premium. This signals that investors are paying much more for Hilton’s earnings compared to peers and industry averages, raising the risk if future growth falls short. Is this optimism justified, or is the bar set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hilton Worldwide Holdings Narrative

If you want a different angle or just enjoy hands-on research, you can craft your own Hilton narrative in just a few minutes. Do it your way.

A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity. Give yourself a competitive edge and catch trends early with the next wave of stocks on your radar.

- Boost your income potential by targeting companies with above-average yields using these 14 dividend stocks with yields > 3% for dividend stocks paying more than 3%.

- Capitalize on the AI revolution by picking from these 25 AI penny stocks that are powering breakthroughs in automation and intelligent software.

- Position yourself for outperformance with these 865 undervalued stocks based on cash flows which are trading below their true cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives