- United States

- /

- Hospitality

- /

- NYSE:HLT

Hilton (HLT): Exploring Valuation as New Loyalty Upgrades Target High-Value Travelers

Reviewed by Simply Wall St

Hilton Worldwide Holdings (HLT) just unveiled changes to its Hilton Honors loyalty program. The company is introducing a new top-tier Diamond Reserve status and making elite status more accessible for loyal guests. These updates could give the brand extra appeal with frequent travelers.

See our latest analysis for Hilton Worldwide Holdings.

Hilton’s recent loyalty program overhaul follows new luxury hotel openings and a high-profile industry conference appearance, helping fuel steady investor interest. The latest enhancements signal Hilton’s push for long-term guest growth. While the 1-year total shareholder return is a modest 5.2%, long-term holders have enjoyed a remarkable 151.8% total return over five years. This suggests momentum may be building for those who take a long-term perspective.

If Hilton’s moves have you thinking about what else is out there, now’s the perfect moment to discover fast growing stocks with high insider ownership.

Given Hilton's extended run of strong returns and recent efforts to strengthen customer loyalty, investors may be wondering whether there is untapped value left in the stock or if the market has already factored in the company’s future growth.

Most Popular Narrative: 6.2% Undervalued

Hilton’s prevailing narrative points to a fair value of $281.83, which is about 6% higher than the last close of $264.32. This sets the tone for bold expectations driven by aggressive expansion and a premium market push.

“Aggressive global expansion and a focus on lifestyle and luxury offerings position Hilton to capture demand and shift toward premium travel experiences. Enhanced digital infrastructure, loyalty growth, and an asset-light model drive higher margins, pricing power, and resilient long-term profitability.”

What is really fueling this valuation? It is not just industry buzz, but a projection model that counts on strong revenue growth and margin resilience. One core driver, and nearly impossible to ignore, is how analysts expect Hilton’s profits to unfold over the next few years. Curious to see the dramatic numbers making this possible? Step in and uncover what could reshape expectations for Hilton’s future.

Result: Fair Value of $281.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in key travel markets and persistent economic headwinds could challenge Hilton's ability to sustain its current momentum and growth projections.

Find out about the key risks to this Hilton Worldwide Holdings narrative.

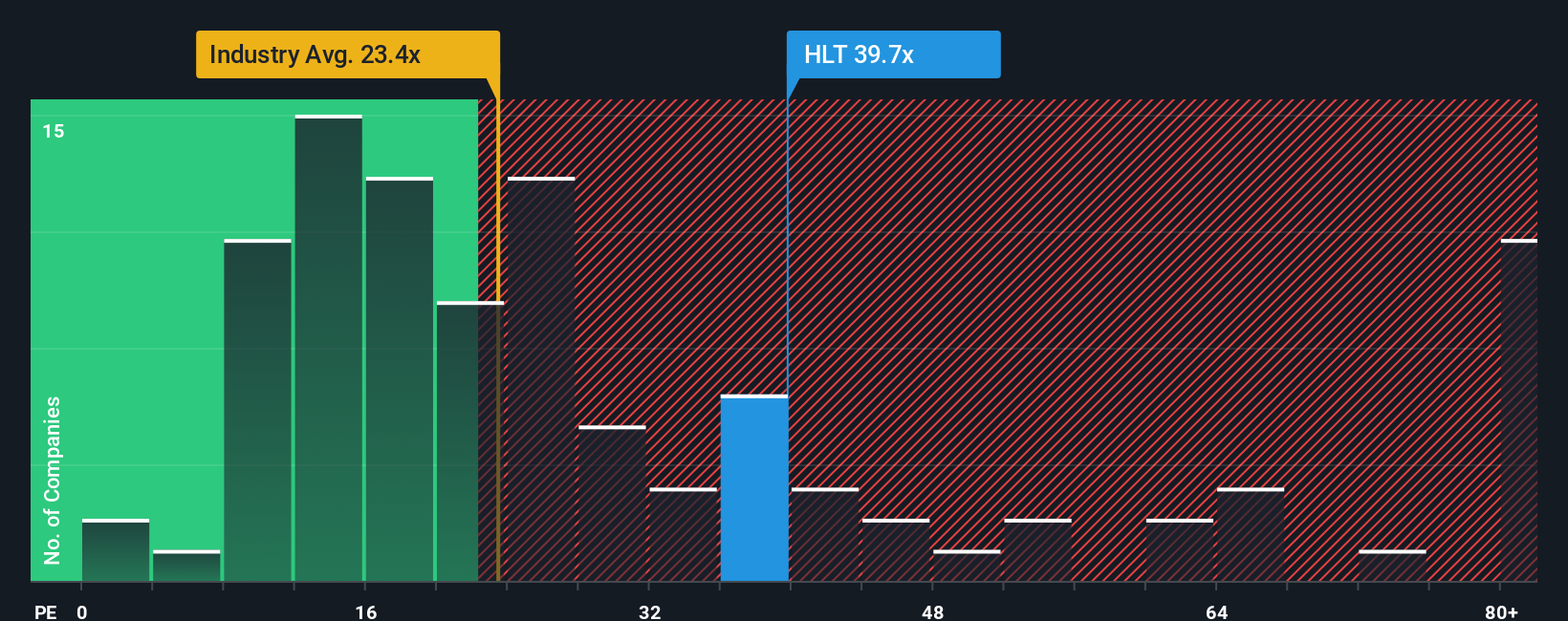

Another View: Price Multiples Point to Caution

Looking from a different angle, Hilton’s stock is trading at a price-to-earnings ratio of 36.9x. This is notably higher than both the peer average of 23.1x and the industry average of 20.7x. Even when compared to its fair ratio of 28.9x, the stock appears pricey, suggesting there is a valuation premium built in. Does this indicate a risk that investors are overpaying, or is it a sign that the market expects Hilton’s growth to outperform peers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hilton Worldwide Holdings Narrative

If you have your own take or want to investigate the story yourself, it is quick and easy to build a personal view on Hilton’s numbers and outlook. Do it your way.

A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great investors never settle for just one opportunity. Give yourself the edge by checking out these hand-picked ways to spot tomorrow’s winners before the crowd does.

- Unlock the power of steady income streams by choosing these 16 dividend stocks with yields > 3% with robust yields and financial resilience.

- Catalyze your growth strategy and get ahead of the curve with these 26 AI penny stocks as they shape the future through cutting-edge innovation.

- Seize early-mover potential by scanning these 3595 penny stocks with strong financials with strong financials and the potential to break out.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives