- United States

- /

- Hospitality

- /

- NYSE:HGV

Hilton Grand Vacations (HGV): Examining Valuation After Recent Share Price Movements

Reviewed by Simply Wall St

Hilton Grand Vacations (HGV) shares have seen some movement recently, with the price closing at $39.18. Over the past month, the stock has slipped 4%. Its year-to-date return remains in positive territory at 2%.

See our latest analysis for Hilton Grand Vacations.

After a stretch of positive momentum earlier this year, Hilton Grand Vacations’ recent share price slides suggest that some investors are reassessing risks or locking in profits following a steady climb. While the 1-year total shareholder return remains negative, its longer-term record points to resilience and growth potential.

If you're keen to see what else is gaining traction, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Hilton Grand Vacations trading at a substantial discount to analyst targets and recent earnings showing robust growth, investors must ask: is there a bargain on the table, or is the market already forecasting brighter days ahead?

Most Popular Narrative: 26.7% Undervalued

With Hilton Grand Vacations shares closing at $39.18 and the most widely followed narrative estimating a fair value of $53.44, the market appears to be lagging well behind consensus expectations. This creates a sharp disconnect between current pricing and future potential, according to the underlying assumptions of this popular narrative.

Ongoing strength in HGV Max and integration of Bluegreen and Diamond Resorts are driving sustained contract sales momentum, enhanced customer loyalty, and a rapidly growing, highly engaged membership base. Together with the rollout of additional premium features, this supports higher revenue growth and margin improvement.

The real story isn’t just about premium offerings or integration buzzwords. There is a dramatic transformation forecasted beneath the surface, combining explosive earnings growth, bold profit margins, and rapid shifts in company financials. Curious what assumptions and projections are moving the goalposts for Hilton Grand Vacations’ future value? Get the full picture in the complete narrative.

Result: Fair Value of $53.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising default rates on customer loans and sluggish new owner growth could present challenges for Hilton Grand Vacations’ long-term earnings outlook.

Find out about the key risks to this Hilton Grand Vacations narrative.

Another View: Are Multiples Sending a Different Signal?

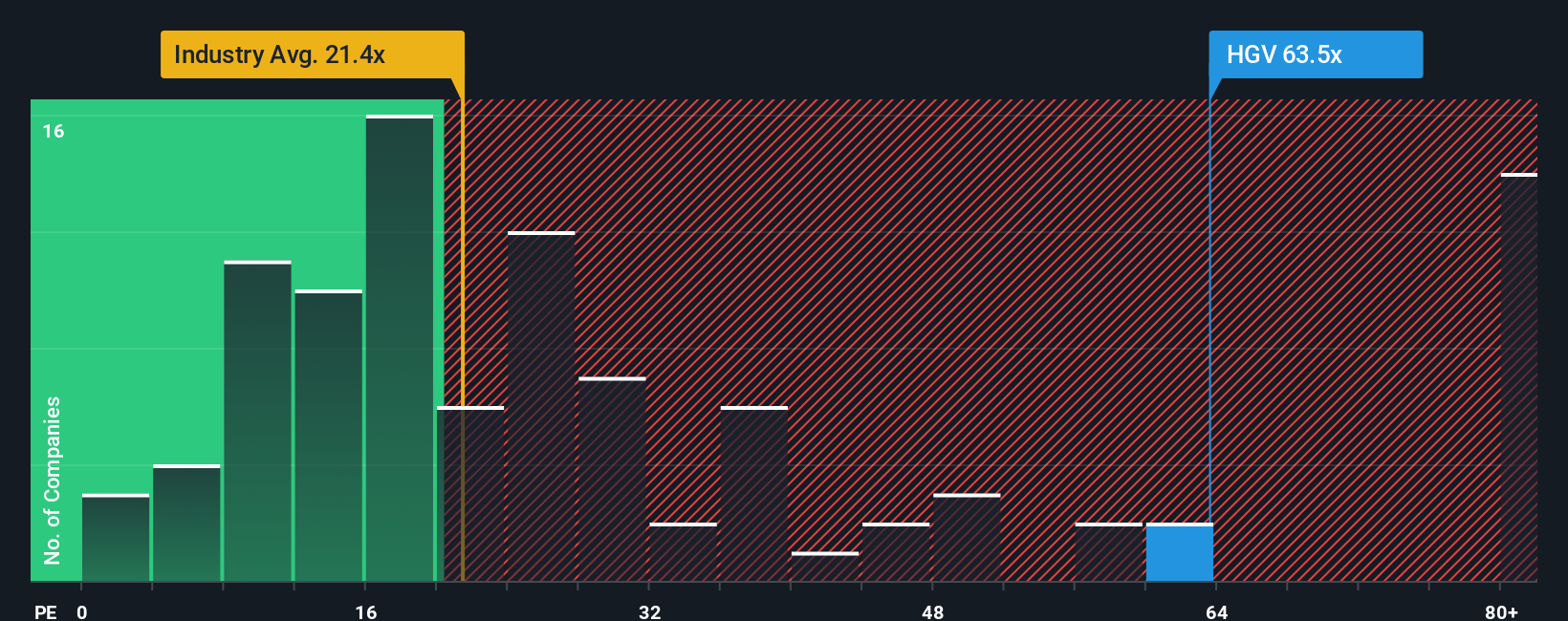

While analysts see Hilton Grand Vacations as undervalued based on future earnings growth, the market’s chosen price-to-earnings ratio of 63.2x is much higher than both the US Hospitality industry’s 21.3x average and its peers’ 11.9x. Even in comparison to a fair ratio of 74.5x, this signals HGV’s valuation is rich by any standard. Is the market right to be so optimistic, or is risk piling up undetected?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hilton Grand Vacations Narrative

If you want a different perspective or enjoy drawing your own conclusions from the numbers, you can build your own view in just minutes. Do it your way

A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act quickly to expand your portfolio by tapping into unique stock opportunities beyond Hilton Grand Vacations. Don’t let these smart investment themes pass you by.

- Boost your income potential by exploring these 15 dividend stocks with yields > 3%, which offers attractive yields above 3% for added cash flow.

- Stay ahead of the curve with these 25 AI penny stocks, which are powering tomorrow’s breakthroughs in artificial intelligence and automation.

- Unlock value plays by searching these 855 undervalued stocks based on cash flows, where shares trade beneath their intrinsic worth according to fundamental analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Grand Vacations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGV

Hilton Grand Vacations

Develops, markets, sells, manages, and operates the resorts, timeshare plans, and ancillary reservation services under the Hilton Grand Vacations brand in the United States and Europe.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives