- United States

- /

- Hospitality

- /

- NYSE:H

How Hyatt’s China Studio Franchise Deal Could Shape the Growth Path for Hyatt Hotels (H)

Reviewed by Sasha Jovanovic

- Hyatt Hotels Corp and China's Homeinns Hotel Group recently announced a master franchise agreement to develop and launch 50 Hyatt Studios-branded extended-stay hotels across China over the coming years.

- This move reflects Hyatt’s intention to grow its presence in China’s upper-midscale segment and signals the company’s ambitions in the region’s fast-growing travel market.

- We'll examine how Hyatt's entry into China’s extended-stay market through this partnership affects its investment narrative and growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hyatt Hotels Investment Narrative Recap

To be a Hyatt Hotels shareholder, an investor needs to believe in the company's ability to capture growth from global travel recovery, brand expansion in new markets, and asset-light strategy adoption. The new China franchise agreement targets revenue opportunities in the upper-midscale extended-stay segment but does not immediately mitigate the most important short-term catalyst, confirmation of top-line growth through improved RevPAR, or reduce risks from slowing booking rates in key markets.

Recent analyst upgrades, such as Morgan Stanley's shift to "Overweight" and increased price targets, are closely linked to optimism around Hyatt's growth prospects and international expansion narrative. However, this positivity often hinges on the pace of demand returning in core markets and whether initiatives like the deal in China actually translate to increased revenue in the periods ahead.

By contrast, investors should be aware that slowing booking rates in core markets remain a critical risk with...

Read the full narrative on Hyatt Hotels (it's free!)

Hyatt Hotels' narrative projects $8.4 billion in revenue and $551.3 million in earnings by 2028. This requires a 37.6% yearly revenue growth and a $119.3 million earnings increase from the current earnings of $432.0 million.

Uncover how Hyatt Hotels' forecasts yield a $158.74 fair value, a 7% upside to its current price.

Exploring Other Perspectives

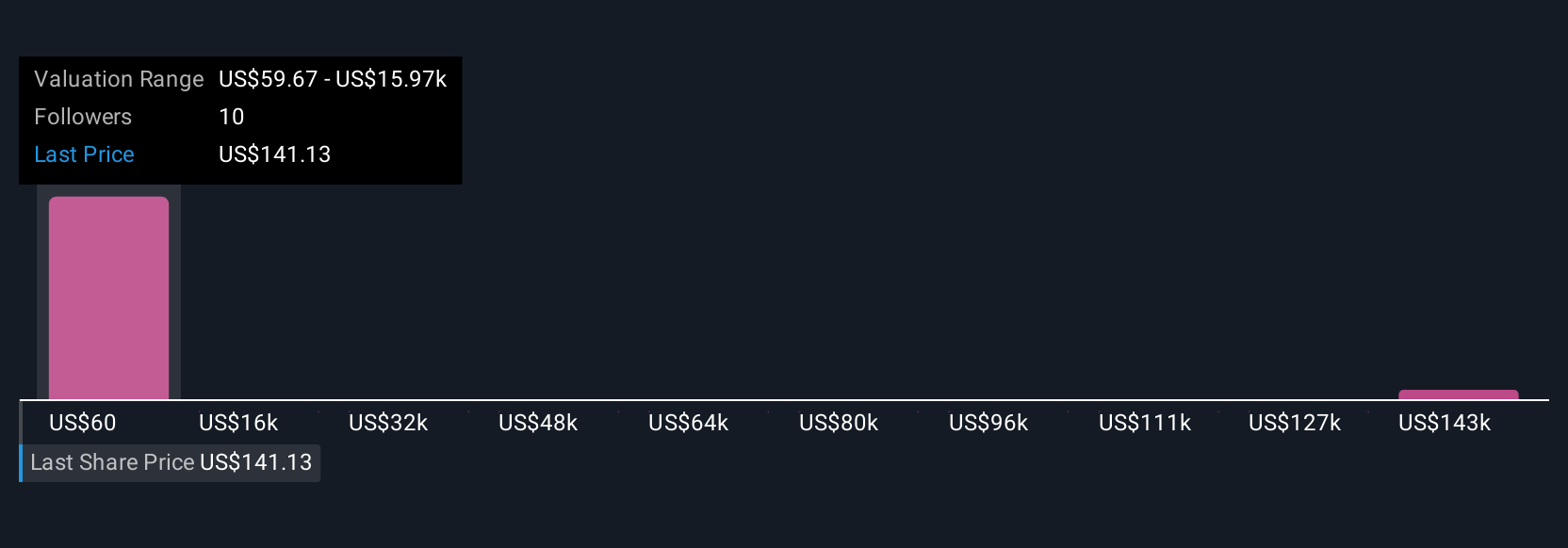

Five fair value estimates from the Simply Wall St Community range from US$111 to an outlier at US$159,128. While analyst consensus focuses on expansion catalysts, the risk of weakening demand in key segments continues to shape debates on future performance.

Explore 5 other fair value estimates on Hyatt Hotels - why the stock might be a potential multi-bagger!

Build Your Own Hyatt Hotels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hyatt Hotels research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Hyatt Hotels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hyatt Hotels' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:H

Hyatt Hotels

Operates as a hospitality company in the United States and internationally.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives