- United States

- /

- Hospitality

- /

- NYSE:H

Does the Recent 3.4% Drop Signal a Better Entry for Hyatt Hotels in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching Hyatt Hotels stock lately, it’s been anything but dull. Whether you’re debating whether to hang on, take some profits, or explore an entry point, there’s been just enough action and news to keep investors on their toes. Let’s cut to the chase: Hyatt’s shares closed most recently at $144.35, and while the last week might have felt a bit bumpy with a -3.4% slide, the past month did sneak in a modest 1.6% gain. Year-to-date returns sit at -7.7%, but step back a bit and you’ll notice the bigger picture looks more robust, with 55.5% growth over three years and a striking 150.3% rise over five.

What’s been driving these moves? Recent headlines suggest a mix of cautious optimism and shifting risk perceptions in the travel sector, as global demand stabilizes and development plans ramp up. Investors seem to be weighing longer-term growth opportunities against near-term uncertainties, all while the competitive landscape intensifies and new market entrants try to carve out their own space.

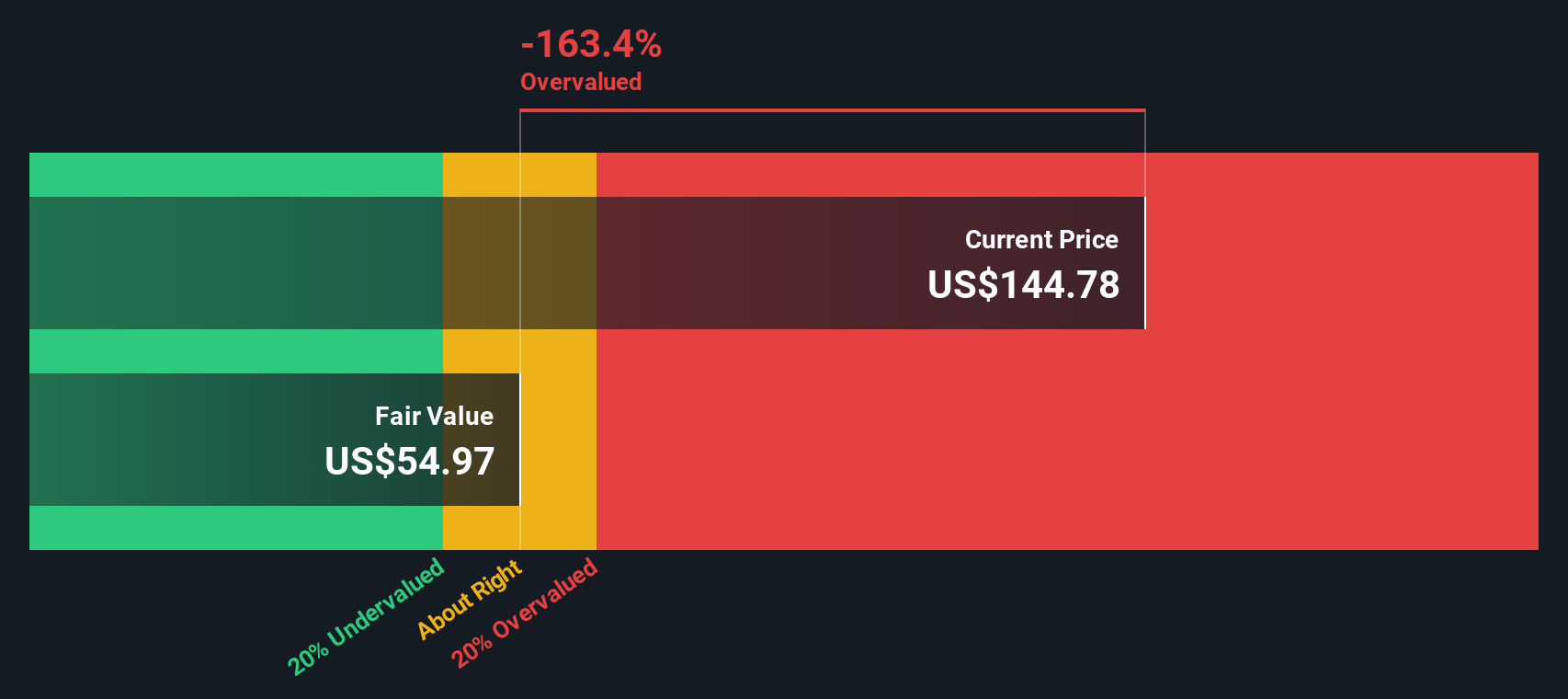

With so much in flux, one thing is striking when looking at valuation. Right now, Hyatt scores a 0 out of 6 on our valuation checks, meaning it isn’t flagged as undervalued on any traditional metric. That’s a bold signal, but does it tell the full story?

Let’s dive into how Hyatt stacks up across different valuation methods. Later, we’ll consider whether the standard approaches are the best way to judge where true value lies.

Hyatt Hotels scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hyatt Hotels Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those expected amounts back to today’s dollars. This approach helps investors judge what a business is really worth, based on its ability to generate cash over time rather than short-term market swings.

For Hyatt Hotels, the most recent Free Cash Flow figure stands at $131 million. Analysts project continued growth, with estimated Free Cash Flow reaching $374 million by 2026 and $493 million by the end of 2027. Long-term forecasts, which extend up to 2035, are based on both analyst estimates and extrapolated growth rates, signaling confidence in Hyatt's ongoing expansion and operational strength.

Despite this steady projected growth in cash flow, the DCF calculation produces an intrinsic value for Hyatt Hotels of $111.14 per share. With shares currently trading at $144.35, the model suggests the stock is trading about 29.9% above its fair value according to cash flow fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hyatt Hotels may be overvalued by 29.9%. Find undervalued stocks or create your own screener to find better value opportunities.

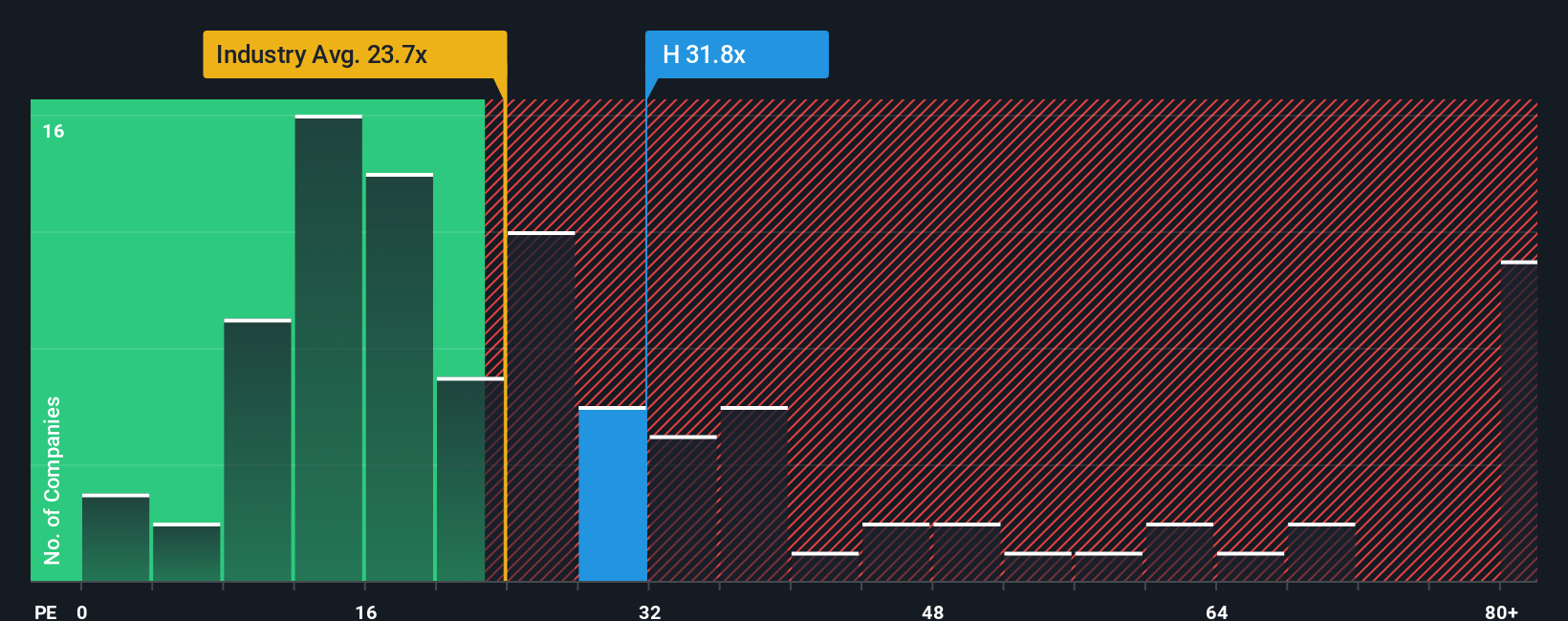

Approach 2: Hyatt Hotels Price vs Earnings

For profitable companies like Hyatt Hotels, the Price-to-Earnings (PE) ratio is a popular way to assess valuation. The PE ratio shows how much investors are willing to pay today for a dollar of current earnings, making it a practical metric to compare stocks with profits. Growth expectations and perceived risk are both significant factors here. Companies with faster expected earnings growth or lower risk tend to justify higher PE ratios, while those with slower growth or higher uncertainty see the opposite.

Hyatt Hotels is currently trading on a PE ratio of 31.9x. For context, the average across its Hospitality industry peers sits at 24.1x, while the broader peer average is 24.7x. That means Hyatt is being valued at a significant premium, and investors are paying more for each dollar of Hyatt’s earnings than they do for similar companies in the sector or peer group.

This is where Simply Wall St’s “Fair Ratio” comes in. It is a more tailored benchmark that considers Hyatt’s unique earnings growth profile, risk factors, profit margins, and market cap, along with its industry. The Fair Ratio for Hyatt is 29.9x, just below its current multiple. This makes it a more nuanced guide than a simple comparison with peers or industry averages, as it adjusts for factors specific to Hyatt rather than relying on broad groupings.

Comparing Hyatt’s actual PE of 31.9x with its Fair Ratio of 29.9x implies the stock is trading above fair value according to this approach. The premium is notable enough to suggest some overvaluation based on underlying fundamentals and risk-adjusted growth potential.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

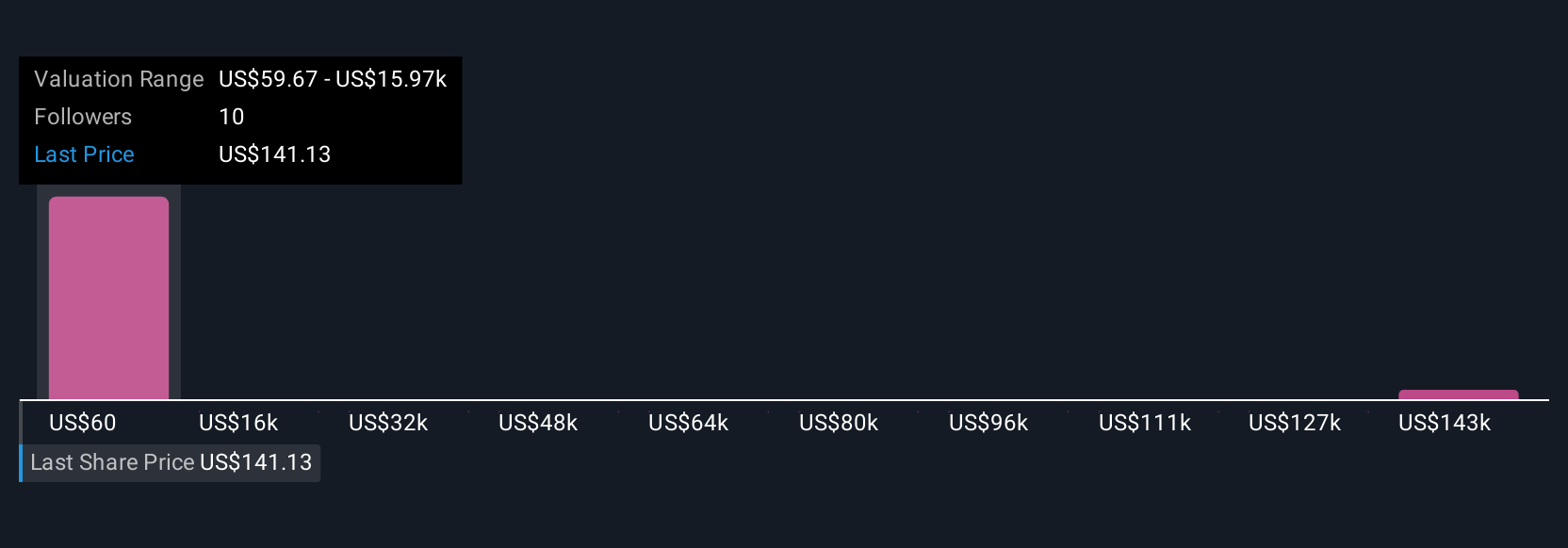

Upgrade Your Decision Making: Choose your Hyatt Hotels Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your unique investment story for a company. It is where you connect the real-world events, business outlook, and your perspective to numbers like future revenue, earnings, and fair value. Narratives let you move beyond one-size-fits-all metrics by linking Hyatt’s journey, such as brand expansion or asset-light strategies, to a tailored forecast of its value.

With Narratives, millions of investors on Simply Wall St’s Community page can easily build, share, and compare scenarios that update automatically as fresh news or quarterly results come in. This helps you decide exactly when Hyatt’s price offers a buying or selling opportunity, since you can instantly see how your fair value stacks up against the market.

For example, some investors who see Hyatt’s brand growth and strong development pipeline forecast a bullish fair value as high as $198.0 per share, while others, concerned about economic risks or acquisition uncertainty, set a more cautious target around $140.0. Narratives put those different outlooks at your fingertips so you are empowered to make investment decisions that truly reflect your own views, not just the averages.

Do you think there's more to the story for Hyatt Hotels? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:H

Hyatt Hotels

Operates as a hospitality company in the United States and internationally.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives