- United States

- /

- Metals and Mining

- /

- NYSE:AMR

3 Growth Companies With High Insider Ownership Seeing Earnings Up To 105%

Reviewed by Simply Wall St

As the U.S. stock market grapples with renewed concerns over AI valuations and a government shutdown impacting economic data, investors are increasingly cautious about where to place their bets. Amidst this uncertainty, growth companies with high insider ownership can offer a compelling narrative, as such ownership often aligns management's interests with those of shareholders and may indicate confidence in the company's long-term potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 51% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hyatt Hotels (H) | 11.3% | 52.3% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Duolingo (DUOL) | 14.2% | 30.1% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| AST SpaceMobile (ASTS) | 11.8% | 64.8% |

| Astera Labs (ALAB) | 11.9% | 25.9% |

| Accelerant Holdings (ARX) | 24.9% | 66.1% |

We're going to check out a few of the best picks from our screener tool.

Root (ROOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Root, Inc. offers insurance products and services in the United States with a market cap of approximately $1.37 billion.

Operations: Root, Inc. generates its revenue through the provision of insurance products and services within the United States.

Insider Ownership: 11.6%

Earnings Growth Forecast: 22.1% p.a.

Root, Inc. has demonstrated significant growth potential with its earnings forecasted to grow at 22.1% annually, outpacing the US market average. Despite a volatile share price and recent quarterly net losses of US$5.4 million, Root's revenue increased to US$387.8 million from US$305.7 million year-on-year for Q3 2025. The company's innovative data-driven insurance model expanded into Washington, enhancing its market reach and offering personalized pricing based on driving behavior through advanced mobile technology.

- Click here and access our complete growth analysis report to understand the dynamics of Root.

- The valuation report we've compiled suggests that Root's current price could be inflated.

Alpha Metallurgical Resources (AMR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alpha Metallurgical Resources, Inc. is a mining company that produces, processes, and sells metallurgical and thermal coal in Virginia and West Virginia, with a market cap of approximately $2.27 billion.

Operations: Alpha Metallurgical Resources generates revenue through the production, processing, and sale of metallurgical and thermal coal in Virginia and West Virginia.

Insider Ownership: 11.9%

Earnings Growth Forecast: 105.3% p.a.

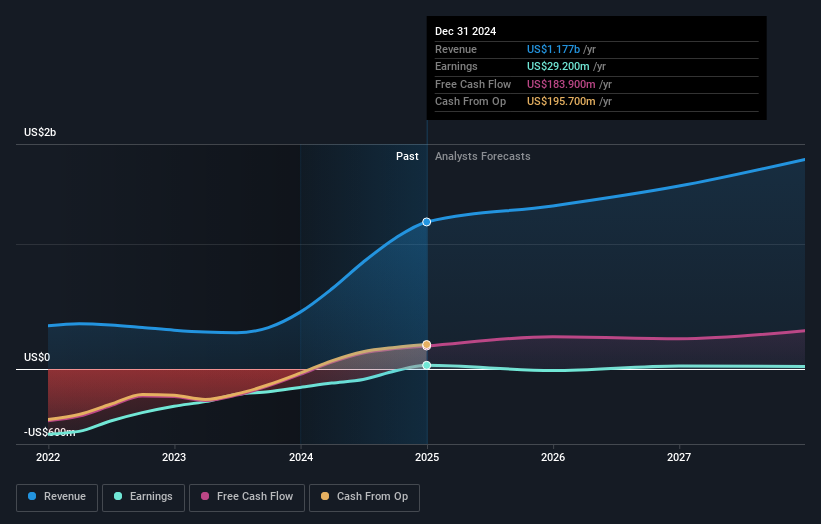

Alpha Metallurgical Resources exhibits potential for growth with forecasted annual earnings growth of 105.32%, surpassing the US market average. Despite recent quarterly net losses and reduced shipment guidance, insiders have been buying more shares than selling, indicating confidence in the company's future. The stock trades significantly below its estimated fair value, suggesting a possible undervaluation. While revenue is expected to grow at 11.9% annually, it remains slower than desired high-growth benchmarks.

- Unlock comprehensive insights into our analysis of Alpha Metallurgical Resources stock in this growth report.

- Our comprehensive valuation report raises the possibility that Alpha Metallurgical Resources is priced lower than what may be justified by its financials.

Hyatt Hotels (H)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hyatt Hotels Corporation is a hospitality company that operates hotels and resorts in the United States and internationally, with a market cap of approximately $13.18 billion.

Operations: Hyatt's revenue is primarily derived from its hotel and resort operations both domestically and abroad.

Insider Ownership: 11.3%

Earnings Growth Forecast: 52.3% p.a.

Hyatt Hotels is positioned for growth with forecasted annual revenue growth of 21.6%, surpassing the US market average. Despite recent net losses, insiders have been buying more shares than selling, reflecting confidence in its long-term prospects. The stock trades at a significant discount to its estimated fair value, suggesting potential undervaluation. However, Hyatt's debt coverage by operating cash flow remains a concern. Recent expansions and strategic initiatives indicate an ongoing commitment to enhancing global presence and offerings.

- Take a closer look at Hyatt Hotels' potential here in our earnings growth report.

- The analysis detailed in our Hyatt Hotels valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 197 companies by clicking here.

- Contemplating Other Strategies? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMR

Alpha Metallurgical Resources

A mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives