- United States

- /

- Hospitality

- /

- NYSE:GENI

Serie A Rights Win and New CFO Could Be a Game Changer for Genius Sports (GENI)

Reviewed by Simply Wall St

- Genius Sports Limited recently announced exclusive multi-year partnerships, securing official data and streaming rights for Italy’s Serie A through the 2028/29 season and select European Leagues, alongside the appointment of seasoned media executive Bryan Castellani as CFO effective October 2025.

- These developments reflect Genius Sports’ ongoing efforts to expand its presence in the global sports betting market, leveraging proprietary technology and high-profile content partnerships to enhance its data rights portfolio.

- We’ll explore how winning the Serie A and European Leagues rights could reshape Genius Sports’ long-term growth narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Genius Sports Investment Narrative Recap

To own Genius Sports, you have to believe that its expanding digital rights portfolio and innovative technology will offset the risks tied to costly content acquisition and intense competition. The recent Serie A and European Leagues wins reinforce the company’s positioning, but do not fully eliminate margin pressure risk, especially given the higher operating and licensing costs tied to such exclusive partnerships, which still represent the biggest short-term concern for the business.

Of all recent announcements, the upward revision of 2025 revenue guidance to approximately US$645 million stands out, reflecting management’s conviction in the earnings potential unlocked by these new football rights. This step directly relates to investor catalysts, highlighting top-line momentum but also putting added focus on the company’s ability to translate growth into sustainable profitability.

Yet, beneath the headlines, investors should keep in mind that future licensing fee negotiations could turn against Genius Sports if leagues seek even more favorable terms…

Read the full narrative on Genius Sports (it's free!)

Genius Sports' narrative projects $928.0 million in revenue and $119.3 million in earnings by 2028. This requires 18.4% yearly revenue growth and a $197.2 million earnings increase from the current -$77.9 million.

Uncover how Genius Sports' forecasts yield a $14.35 fair value, a 16% upside to its current price.

Exploring Other Perspectives

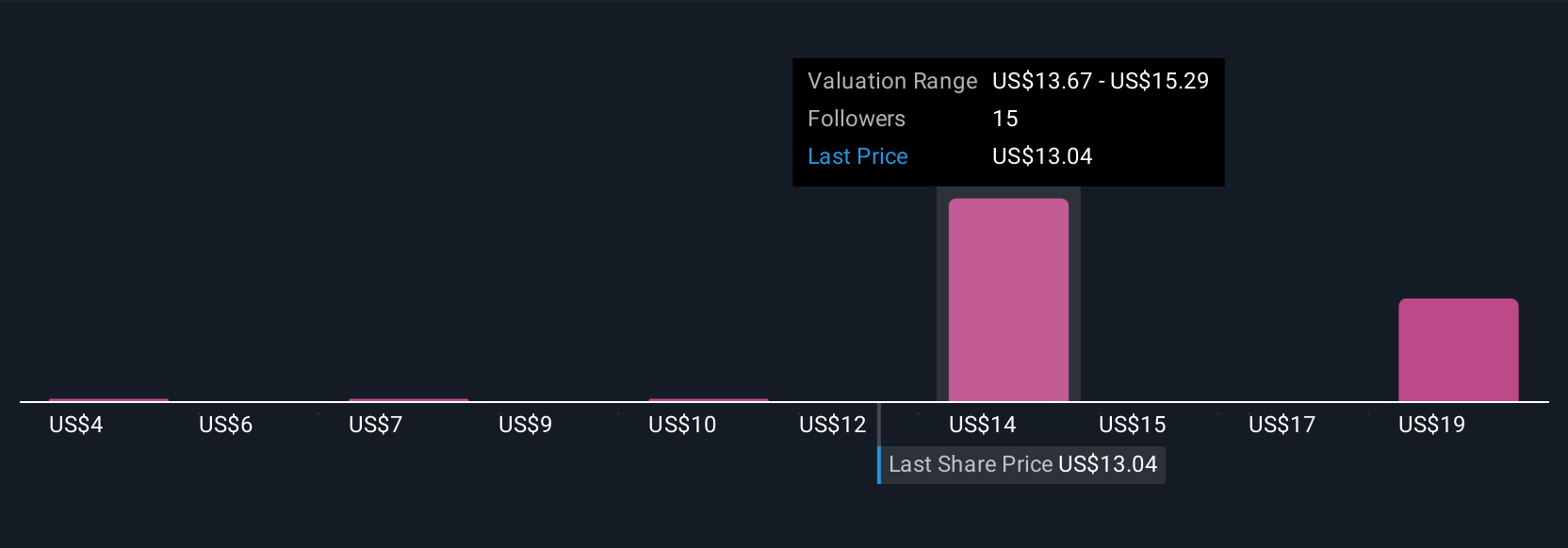

Six retail investors in the Simply Wall St Community placed fair value estimates on Genius Sports ranging widely from US$3.97 to US$20.14 per share. While some see significant upside, others are more cautious, and ongoing dependence on exclusive sports data rights agreements remains a critical consideration as you weigh future performance.

Explore 6 other fair value estimates on Genius Sports - why the stock might be worth less than half the current price!

Build Your Own Genius Sports Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genius Sports research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Genius Sports research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genius Sports' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GENI

Genius Sports

Engages in the development and sale of technology-led products and services to the sports, sports betting, and sports media industries.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives