- United States

- /

- Hospitality

- /

- NYSE:GENI

Genius Sports (GENI): Revenue Forecast to Outpace Market Growth, Undervalued Versus $20.13 Target

Reviewed by Simply Wall St

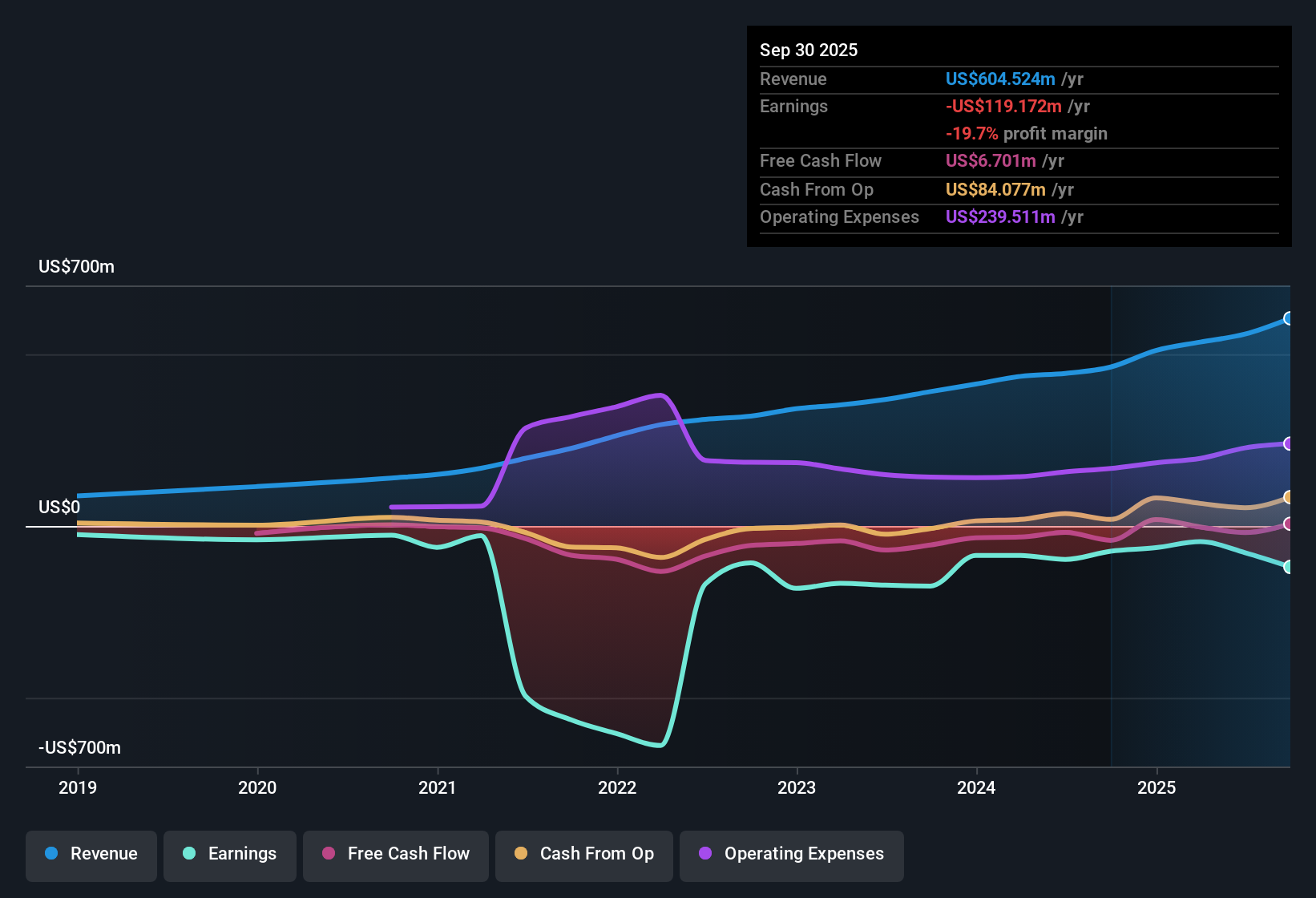

Genius Sports (GENI) continues to operate at a loss, but over the last five years, it has managed to cut annual losses by 26%. While the company remains unprofitable, analysts project impressive earnings growth of 100.48% per year and expect profitability within three years. With revenue forecast to climb 15% annually, which is higher than the broader US market forecast of 10.5%, investors have a front-row seat to a transition story fueled by rapid top-line expectations and progressively narrowing losses.

See our full analysis for Genius Sports.Now, let’s see how Genius Sports’s latest results compare to the broader narratives circulating among investors and analysts. Some beliefs may get reinforced, while others could face new scrutiny.

See what the community is saying about Genius Sports

Margins Expected to Flip: -13.9% to 13.0%

- Analysts project that Genius Sports’ profit margin will shift from -13.9% today to a positive 13.0% within three years, marking a significant anticipated turnaround in its core business strength.

- According to the analysts' consensus view, this margin change is linked directly to:

- Ongoing expansion into new regulated markets and exclusive rights deals, which are aimed at stabilizing revenue streams and reducing cost volatility.

- Deployment of proprietary technologies like GeniusIQ, which aims to boost efficiency and broaden high-margin recurring revenue opportunities, potentially lessening the company’s historic volatility in earnings.

- Results such as this dramatic margin transformation highlight why many analysts see the company on the cusp of a new phase of growth. However, they caution that increased competition or regulatory changes could rapidly reverse this progress.

- If margins reach the expected level, Genius Sports could shift perceptions from a perennial loss-maker to a tech-enabled growth platform, challenging long-standing skepticism about its earnings durability. See what the broader analyst community thinks and discover the full consensus narrative for Genius Sports. 📊 Read the full Genius Sports Consensus Narrative.

Premium Price-to-Sales Ratio: 4.4x vs Peers’ 1.3x

- Genius Sports trades at a price-to-sales (P/S) ratio of 4.4x, well above both the US hospitality sector average of 1.6x and direct peer average of 1.3x, even as it remains unprofitable today.

- Analysts' consensus narrative highlights a core valuation debate:

- The company’s rapid top-line growth and trading at $11.25, below an analyst price target of $15.00, suggests investors see strong future upside if growth targets are met.

- However, paying a premium P/S for an unprofitable company assumes above-market revenue growth will be sustained and that competitive threats or higher costs, including future rights deals, do not erode future margins.

Share Dilution Expected: 7.0% More Shares per Year

- Analysts expect Genius Sports’ number of shares outstanding to increase by 7.0% annually for the next three years, as the company funds ongoing investments and expansion.

- Consensus narrative points to a tradeoff for shareholders:

- Raising capital via share issuance can fuel growth and enable the costly build-out of technology, but it also means existing investors will be diluted if per-share earnings do not outpace share count expansion.

- This dynamic will be a crucial factor in determining whether the company meets ambitious earnings-per-share forecasts and achieves re-rating by the market in the future.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Genius Sports on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? In just a few minutes, you can build your own story and see how your narrative stacks up. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Genius Sports.

See What Else Is Out There

While Genius Sports is expected to achieve rapid growth, its ongoing losses, high share dilution, and high price-to-sales ratio raise questions about long-term earnings stability.

If steady financial performance matters more to you, use our stable growth stocks screener (2077 results) to discover companies with proven, consistent growth and less volatility in their results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GENI

Genius Sports

Engages in the development and sale of technology-led products and services to the sports, sports betting, and sports media industries.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives