- United States

- /

- Hospitality

- /

- NYSE:FLUT

A Fresh Valuation Look at Flutter Entertainment (NYSE:FLUT) After NHL Enters Prediction Markets

Reviewed by Simply Wall St

The National Hockey League has just inked a licensing deal with Kalshi and Polymarket, introducing fresh competition to traditional sports-betting companies such as Flutter Entertainment (NYSE:FLUT). This move has investors reassessing the broader market dynamics and potential effects on Flutter’s stock trajectory.

See our latest analysis for Flutter Entertainment.

Flutter Entertainment’s share price has lost momentum lately, down 12.8% over the past month and 20% over the last quarter, with the latest close at $243.92. Still, the longer-term picture is far more upbeat. Total shareholder return sits at 8.5% over the past year and a remarkable 86% across three years, reflecting solid fundamental growth even as recent news and heightened industry competition add some near-term uncertainty.

If you’re watching industry shake-ups like this and want a broader view, now’s a great time to discover fast growing stocks with high insider ownership.

With Flutter Entertainment now trading at a significant discount from its recent highs and analysts still backing the stock, the key question is whether this dip marks a genuine buying opportunity or if the market is already accounting for future growth.

Most Popular Narrative: 26.6% Undervalued

At $243.92, Flutter Entertainment sits far beneath the prevailing narrative fair value estimate of $332.53, framing the recent price slide as a potential opportunity with plenty of debate over what will drive the next move.

Ongoing expansion of online gambling and iGaming in newly regulated and high-growth markets (e.g., Brazil and the U.S.) is expected to accelerate Flutter's revenue and earnings, leveraging increasing global internet and smartphone penetration and regulatory liberalization. Product innovation, particularly in live betting and personalized betting features (e.g., "Your Way Parlay," Same Game Parlay Live, and platform migrations across Snai and FanDuel), positions Flutter to capture greater user engagement and wallet share, supporting both revenue growth and long-term margin expansion.

Want to know what powers such a bullish price target? See which extraordinary sales growth rates and future profit margins analysts are betting on. Discover how they stack up the numbers to justify this price tag. There is more behind these headline figures than you might expect. The details could upend what you think about this stock's potential.

Result: Fair Value of $332.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased regulatory scrutiny and rising net debt levels remain key risks. These factors could challenge Flutter's growth outlook if conditions worsen.

Find out about the key risks to this Flutter Entertainment narrative.

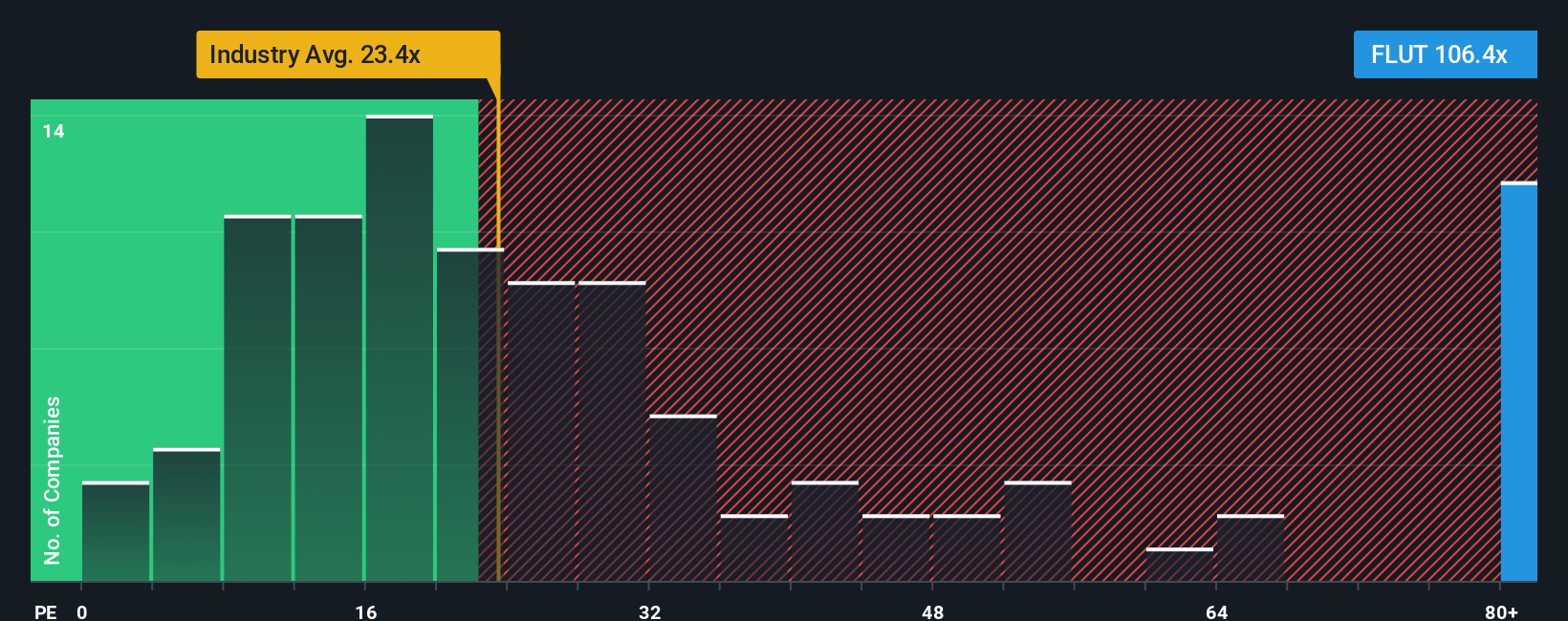

Another View: A Look at Market Multiples

Yet, there is a starkly different message from the market’s price-to-earnings ratio of 116.9x. This figure is more than four times the US Hospitality industry average of 23.9x and much higher than the peer group average of 34.8x. Even compared to the fair ratio of 49x that the market could move toward, Flutter’s valuation appears stretched. While multiples like this sometimes signal optimism for rapid growth, they can also highlight valuation risk if expectations are not met. Could this premium simply be too rich for comfort?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flutter Entertainment Narrative

If the current consensus does not match your perspective or you would rather dig into the details yourself, you can easily build your own view in just a few minutes. Do it your way.

A great starting point for your Flutter Entertainment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge by expanding your research beyond Flutter and exploring some of today’s most compelling stock trends using our smart screeners.

- Spot high-potential opportunities enjoying market buzz by examining these 3567 penny stocks with strong financials geared towards robust growth and financial resilience.

- Tap into the artificial intelligence surge and evaluate remarkable companies at the forefront through these 27 AI penny stocks, uncovering innovators shaping tomorrow’s tech landscape.

- Power up your portfolio with value plays by scanning these 17 dividend stocks with yields > 3% boasting consistent yields and a reputation for rewarding shareholders, even in volatile times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLUT

Flutter Entertainment

Operates as a sports betting and gaming company in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion