- United States

- /

- Consumer Services

- /

- NYSE:FEDU

We're Hopeful That Four Seasons Education (Cayman) (NYSE:FEDU) Will Use Its Cash Wisely

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Four Seasons Education (Cayman) (NYSE:FEDU) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Four Seasons Education (Cayman)

How Long Is Four Seasons Education (Cayman)'s Cash Runway?

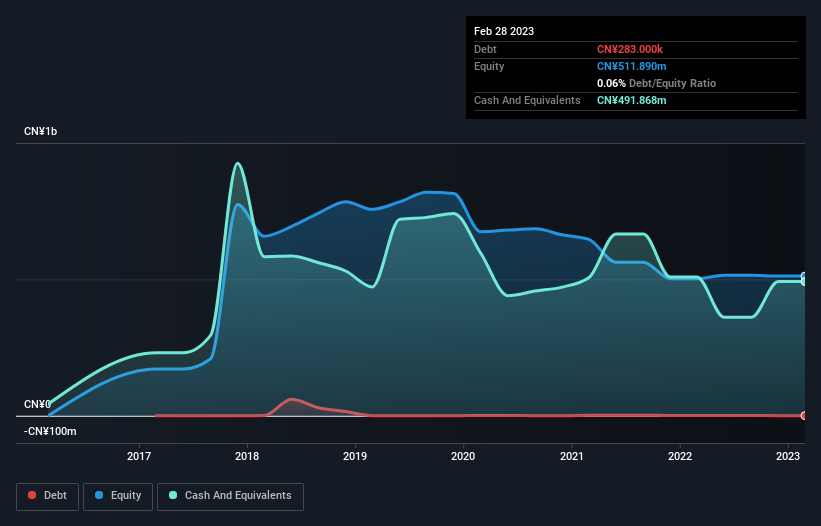

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. Four Seasons Education (Cayman) has such a small amount of debt that we'll set it aside, and focus on the CN¥492m in cash it held at February 2023. In the last year, its cash burn was CN¥34m. So it had a very long cash runway of many years from February 2023. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. The image below shows how its cash balance has been changing over the last few years.

How Well Is Four Seasons Education (Cayman) Growing?

Happily, Four Seasons Education (Cayman) is travelling in the right direction when it comes to its cash burn, which is down 66% over the last year. In contrast, however, operating revenue fell by 86% during that same period. Starkly suboptimal! In light of the data above, we're fairly sanguine about the business growth trajectory. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Four Seasons Education (Cayman) has developed its business over time by checking this visualization of its revenue and earnings history.

Can Four Seasons Education (Cayman) Raise More Cash Easily?

While Four Seasons Education (Cayman) seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of CN¥150m, Four Seasons Education (Cayman)'s CN¥34m in cash burn equates to about 23% of its market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Four Seasons Education (Cayman)'s Cash Burn Situation?

On this analysis of Four Seasons Education (Cayman)'s cash burn, we think its cash runway was reassuring, while its falling revenue has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Four Seasons Education (Cayman)'s situation. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Four Seasons Education (Cayman) (of which 2 shouldn't be ignored!) you should know about.

Of course Four Seasons Education (Cayman) may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FEDU

Four Seasons Education (Cayman)

Provides after-school education services for kindergarten, elementary, and middle school students in the People’s Republic of China and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives