- United States

- /

- Consumer Services

- /

- NYSE:COUR

Coursera (COUR): Valuation Insights Following Raised Guidance, Consumer Growth, and New Anthropic Partnership

Reviewed by Simply Wall St

Coursera (COUR) delivered its Q3 results with notable momentum in the Consumer segment, alongside stronger cash conversion. Management also raised full-year revenue guidance, which reflects further confidence in product integrations and new content partnerships.

See our latest analysis for Coursera.

After a quick rally earlier this month, Coursera’s share price has eased back to $8.43. Its 1-year total shareholder return of 19.07% still outpaces its 1-year price movement, signaling that reinvested benefits have boosted overall investor gains. The recent positive guidance update and partnerships point to building momentum even as the stock pulls back from recent highs.

If Coursera’s tech-driven progress has you looking for the next opportunity, now’s an ideal time to explore See the full list for free.

With analysts maintaining a bullish outlook and the stock trading nearly 40% below average price targets, investors have to ask if Coursera is undervalued at current levels or if the market is already pricing in its growth story.

Most Popular Narrative: 31% Undervalued

The narrative positions Coursera’s fair value well above its latest closing price of $8.43, highlighting a substantial gap between implied worth and what the market currently reflects. With this difference, a closer look is warranted at what is driving such a positive outlook.

Continuous product innovation, especially through AI-powered features like personalized tutoring (Coach), AI-driven catalog expansion, and advanced go-to-market strategies (localized pricing, onboarding enhancements), is expected to drive higher conversion rates, increase paid user retention, and boost engagement, positively influencing both revenue growth and margin leverage.

Curious about the aggressive growth assumptions behind this bold valuation? One part of the story is a mix of game-changing technology and shifting expectations for future profitability. For those interested in which future earnings leaps and margin gains could support this number, the full narrative reveals the projections that most investors are missing.

Result: Fair Value of $12.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from low-cost alternatives and possible skepticism toward online credentials could limit Coursera’s revenue growth and delay improvements in profit margins.

Find out about the key risks to this Coursera narrative.

Another View: Market Multiples Raise a Flag

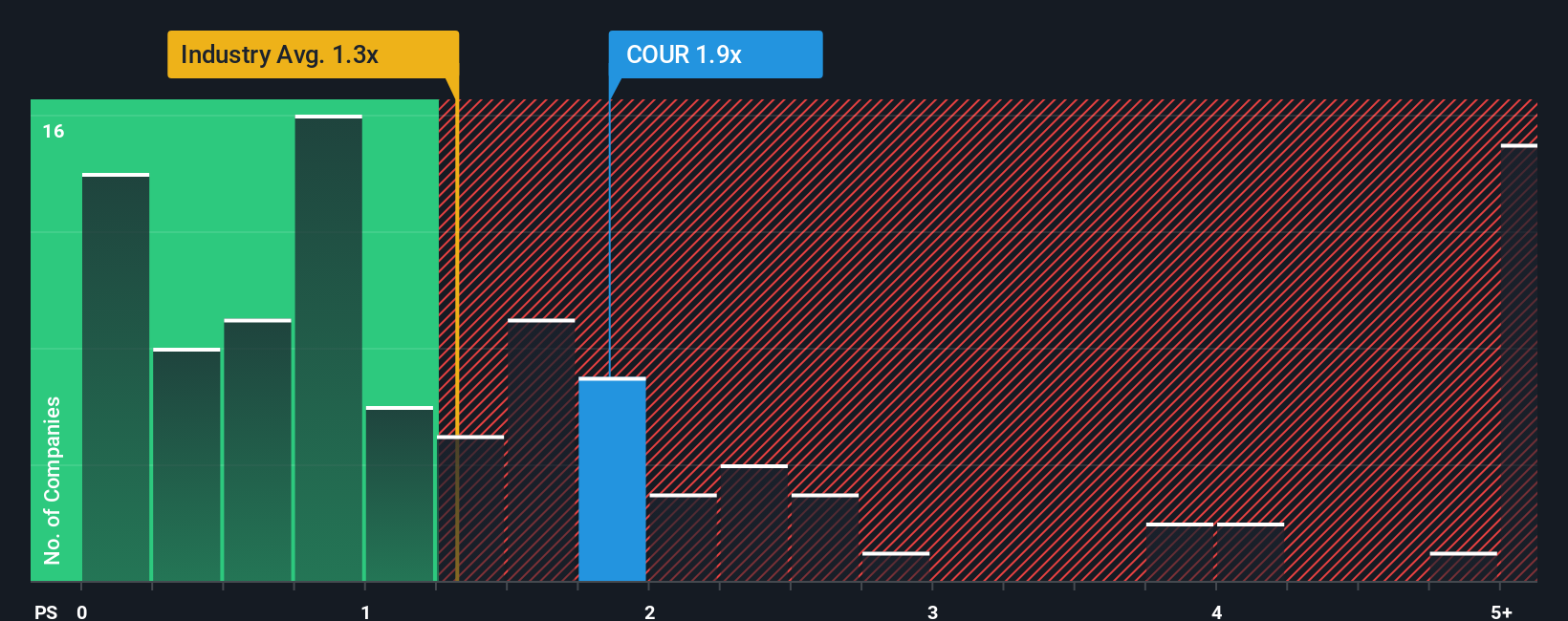

While our narrative points to undervaluation, a look at Coursera’s price-to-sales ratio tells a different story. At 1.9x, Coursera trades well above both the Consumer Services industry average of 1.4x and the peer average of 1.6x. Even compared to its fair ratio of 1.2x, the shares appear expensive by traditional benchmarks. This gap could signal valuation risk if market sentiment shifts. How much confidence should we have that future growth will justify today’s premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coursera Narrative

If you see things differently or want to dig deeper on your own terms, it only takes a few minutes to build your own view with Do it your way

A great starting point for your Coursera research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let fresh opportunities pass you by. Boost your portfolio with stocks other smart investors are watching, handpicked from cleverly filtered lists on Simply Wall St.

- Capitalize on growth by targeting companies reshaping healthcare through artificial intelligence, starting with these 31 healthcare AI stocks.

- Secure resilient income streams and tap into financial strength with these 15 dividend stocks with yields > 3% yielding over 3%.

- Get ahead of the curve by spotting tomorrow’s breakthroughs in computing power from these 27 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COUR

Coursera

Provides online educational services in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives