- United States

- /

- Consumer Services

- /

- NYSE:COUR

Coursera (COUR) Valuation: Assessing the Pullback After a 32% Three-Month Share Price Slide

Reviewed by Simply Wall St

Coursera (COUR) shares have quietly slid about 32% over the past 3 months, even as its revenue and net income trend higher. This has created an interesting gap between business progress and market sentiment.

See our latest analysis for Coursera.

Over the past year, Coursera’s share price return has softened, with the recent 90 day slide to about $7.84 suggesting investors are reassessing near term execution risk, even as revenue and net income continue to improve.

If Coursera’s recent weakness has you reassessing your options in digital learning and software, it may be worth exploring high growth tech and AI stocks for other tech names with compelling growth stories.

With shares trading at a steep discount to analyst targets despite solid revenue and earnings momentum, investors now face a key question: is Coursera undervalued after this pullback, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 35.9% Undervalued

With the most followed narrative pointing to a fair value well above Coursera’s last close of $7.84, the gap between expectations and price is hard to ignore.

The accelerating global need for technology-driven upskilling and reskilling continues to fuel new user growth and broadens Coursera's addressable market, as evidenced by record new learner additions and surging demand for AI, tech, and industry-specific credentials; this is likely to directly impact future top-line revenue expansion.

Curious how steady mid single digit growth, a sharp margin swing, and a premium future earnings multiple can still add up to deep value? The narrative spells out the exact profit trajectory, share dilution path, and discount rate behind that conclusion, but keeps one crucial growth assumption hidden in plain sight.

Result: Fair Value of $12.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and persistent free-to-paid conversion challenges could pressure margins and stall the premium valuation implied by today’s narrative.

Find out about the key risks to this Coursera narrative.

Another View: Market Ratios Flash a Caution Signal

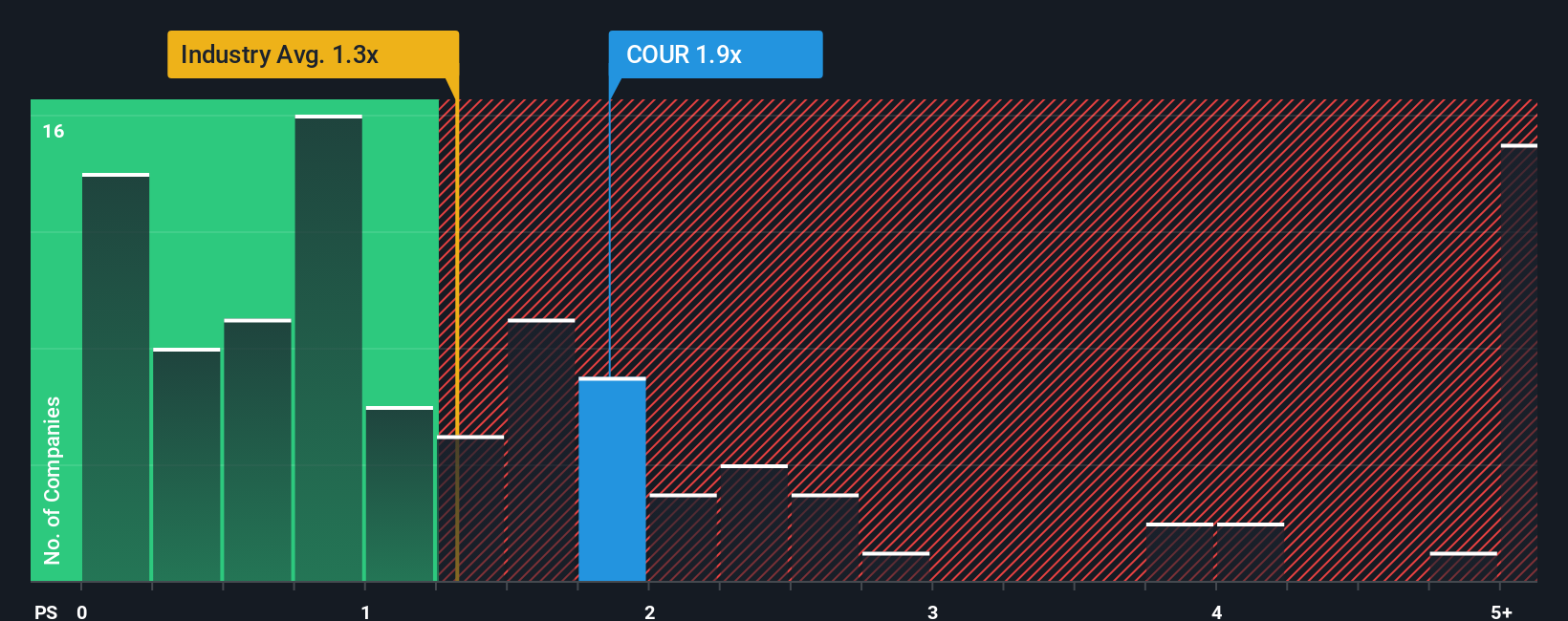

While our narrative suggests deep value, the market is sending a different message. Coursera trades on a price to sales ratio of 1.8x, richer than both the US Consumer Services industry at 1.4x and its peer average of 1.5x, and even above a fair ratio of 1.1x. In practice, that premium leaves less room for error if revenue or margins disappoint, raising the risk that the share price could compress if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coursera Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized Coursera thesis in minutes: Do it your way

A great starting point for your Coursera research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity when the market is full of mispriced potential, use the Simply Wall St Screener to line up your next move.

- Capitalize on market misjudgments by targeting companies trading below their estimated worth through these 913 undervalued stocks based on cash flows and position yourself ahead of the next re rating.

- Ride powerful structural trends in automation and intelligent software by zeroing in on innovators at the forefront of AI with these 24 AI penny stocks.

- Strengthen your income strategy by focusing on reliable payouts and resilient business models via these 13 dividend stocks with yields > 3%, so your portfolio keeps working even when markets stall.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COUR

Coursera

Provides online educational services in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion