- United States

- /

- Hospitality

- /

- NYSE:CMG

Chipotle Mexican Grill (CMG): Assessing Valuation After Recent Share Price Steadies

Reviewed by Simply Wall St

See our latest analysis for Chipotle Mexican Grill.

After a sharp decline earlier in the year, Chipotle’s share price has been relatively steady this week. This likely reflects a pause as the market digests both past losses and the potential for a turnaround. While the 1-day share price return sits at an encouraging 4.22%, the year-to-date share price return is down 47.19%, and its 1-year total shareholder return stands at -48.99%. This highlights that momentum has cooled for now and puts the current valuation in sharper focus.

If you’re curious what else is setting the pace in the market, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With those numbers in mind, investors are left to ask the big question: is Chipotle now trading at a bargain, or is the market already factoring in all of its potential for growth?

Most Popular Narrative: 26.8% Undervalued

Chipotle’s most widely-followed narrative puts a fair value well above its recent closing price, suggesting a sizable disconnect and high expectations for future growth.

Chipotle is expanding its international presence with plans to open restaurants in Mexico by 2026 and is exploring further expansion in Latin America and Europe. This international expansion is expected to drive future revenue growth.

Curious what numbers could justify this aggressive price target? The fair value relies heavily on rapid expansion abroad and a projected jump in profits. Want to know what financial assumptions are fueling the bullish outlook? The full story reveals what it takes for Chipotle’s valuation to reach these heights.

Result: Fair Value of $43.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic uncertainty and intensified competition in fast-casual dining could challenge Chipotle’s growth assumptions and put pressure on future earnings.

Find out about the key risks to this Chipotle Mexican Grill narrative.

Another View: Multiples Tell a Slightly Different Story

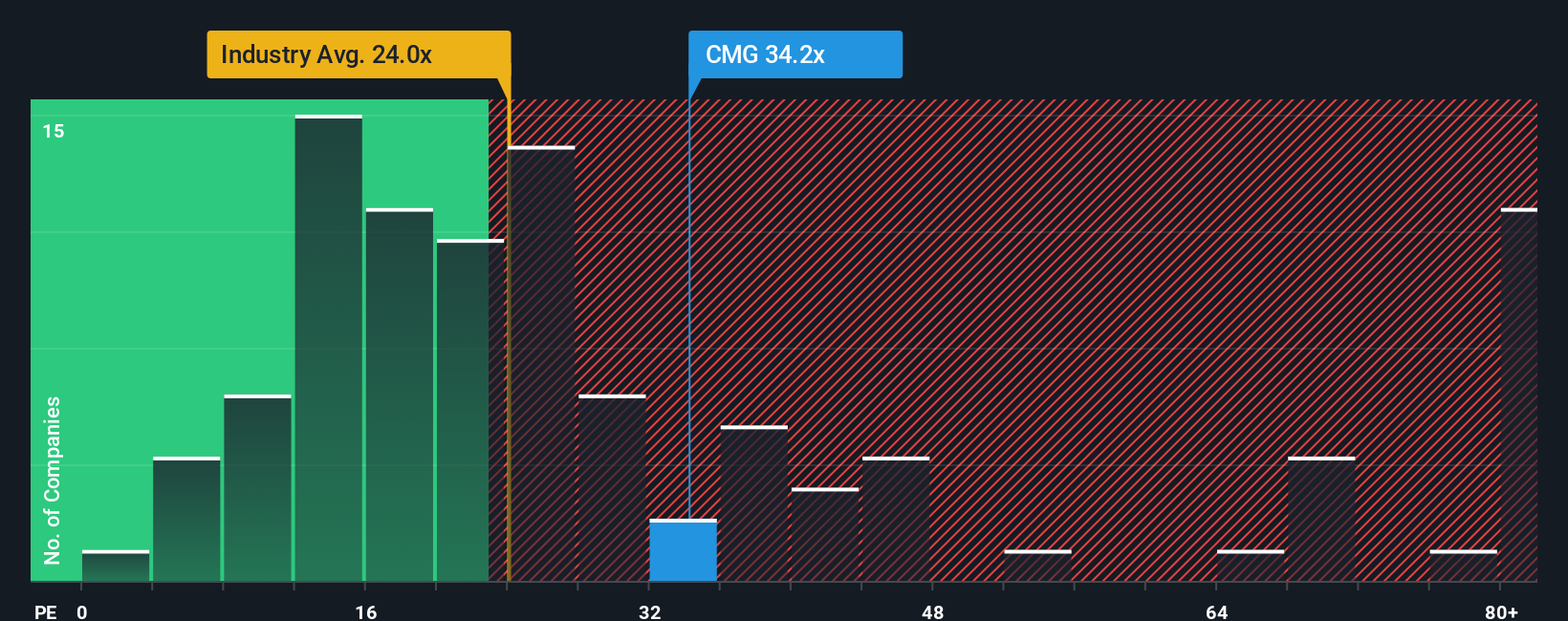

Looking at Chipotle through the lens of price-to-earnings, its current ratio is 27.2x, which is higher than the US Hospitality average of 20.8x but notably lower than the peer group average of 41.8x. The fair ratio sits closer to 26.1x. Does the stock’s current pricing reflect renewed optimism, or does it heighten valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chipotle Mexican Grill Narrative

Whether you see things differently or want to dig into the details yourself, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors look beyond headlines. Expand your portfolio with hand-picked opportunities you may be missing if you stick to the usual stock picks.

- Unlock the potential of future medicine by starting your research with these 30 healthcare AI stocks, where new breakthroughs are transforming patient care and diagnostics.

- Strengthen your income stream and shield your gains with these 16 dividend stocks with yields > 3%, featuring top-yield options boasting reliable performance and robust financials.

- Stay a step ahead in digital innovation. Review these 81 cryptocurrency and blockchain stocks to spot companies benefiting from blockchain adoption and the evolution of financial technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives