- United States

- /

- Hospitality

- /

- NYSE:CMG

Chipotle (CMG): Profit Margins Decline to 13% Challenges Outperformance Narrative

Reviewed by Simply Wall St

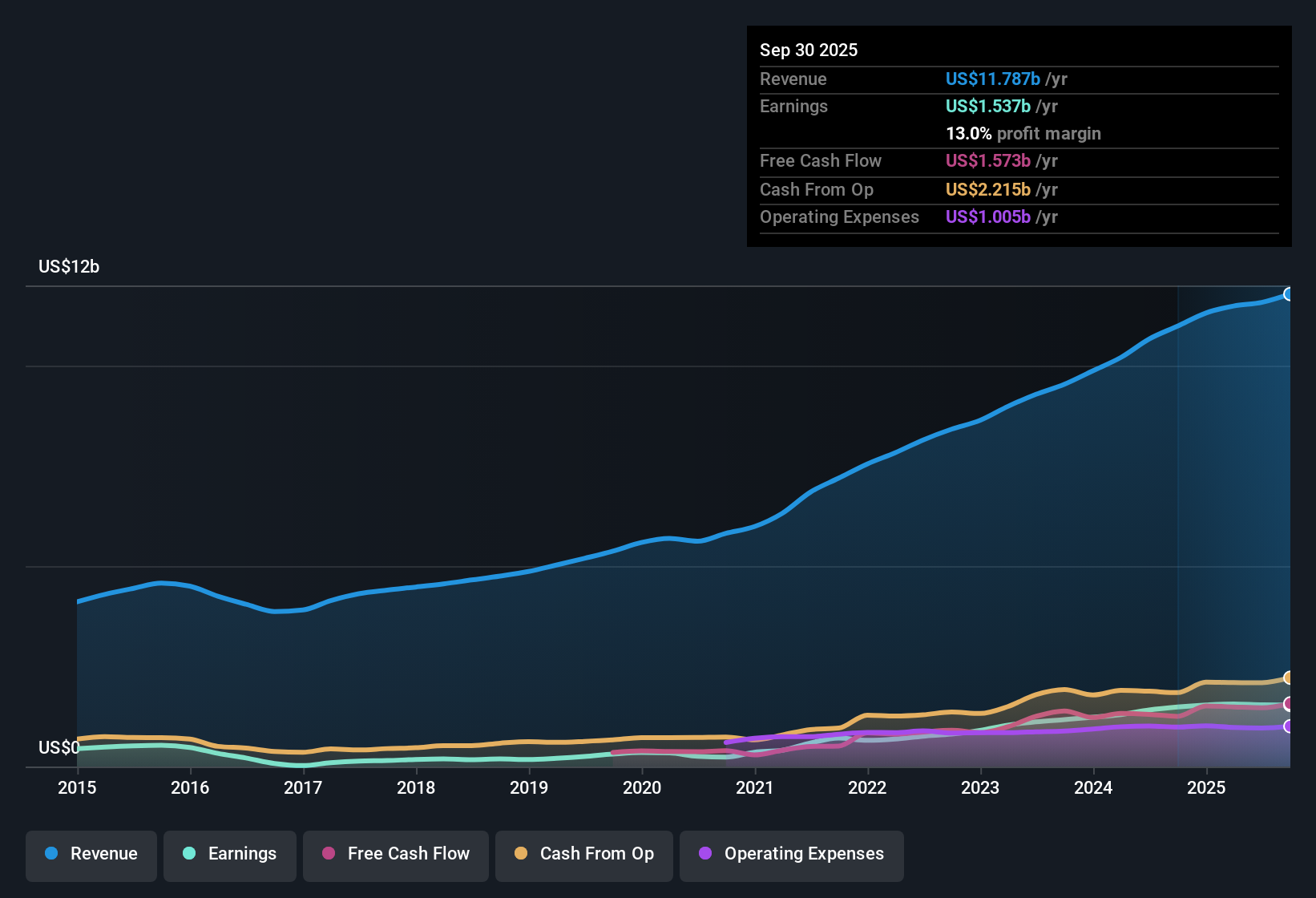

Chipotle Mexican Grill (CMG) posted earnings growth of 3.5% over the past year, a considerable slowdown from its five-year average of 27.4% per year. Profit margins edged down to 13%, compared to 13.5% a year earlier, while forecasts show earnings are expected to grow at 11.1% per year, which is slower than the broader US market’s 15.9% projection. For investors, the core reward is Chipotle’s track record of long-term outperformance and consistent revenue growth, though recent momentum has clearly moderated.

See our full analysis for Chipotle Mexican Grill.Next, we’ll look at how these headline numbers compare to the main market narratives around Chipotle, and where the data might challenge or reinforce the stories investors tend to follow.

See what the community is saying about Chipotle Mexican Grill

Analysts Forecast Higher Margins by 2028

- Consensus estimates see profit margins rising from 13.3% today to 14.2% over the next three years, defying recent downward margin pressure.

- According to the analysts' consensus view, expanded international presence and operational technology upgrades are expected to help offset input cost risks and support the margin improvement trajectory.

- Planned entry into Mexico and Latin America is anticipated to open additional revenue streams even as industry competition intensifies.

- Investments in efficiency technology, such as new produce slicers and kitchen equipment, aim to improve throughput and reduce labor costs. These factors are both critical for reversing last year’s margin dip from 13.5% to 13%.

- Curious if analysts' optimism on margin growth will play out next? Read the full consensus take for Chipotle Mexican Grill. 📊 Read the full Chipotle Mexican Grill Consensus Narrative.

Valuation Sits Between Industry and Peers

- Chipotle trades on a Price-To-Earnings ratio of 28.4x, landing below the peer group average (56.8x) but above the overall US hospitality sector (23.5x).

- Analysts' consensus view highlights that this in-between valuation reflects a balance of historical outperformance and recent momentum loss.

- While the margin of safety is tighter than in previous high-growth years, with five-year annual earnings growth of 27.4% contrasting with last year’s slower 3.5%, the premium to industry is attributed to confidence in future expansion and technology-led margin recovery.

- The share price of $32.53 also sits well below the single allowed analyst price target of $46.24, so upward potential is still on the table if forecasts hold up.

Catering and Menu Innovation Target New Growth

- Chipotle’s catering business, currently only 1.5% of sales, is a focal point for future revenue growth, with new tech and menu pilots aimed at boosting its contribution.

- Consensus narrative suggests that limited-time menu launches like Chipotle Honey Chicken and increased marketing spend are expected to drive transaction growth, even as economic headwinds and competitive pressures persist.

- Raising brand visibility through digital and social campaigns may help Chipotle defend share as the fast-casual space gets crowded.

- However, any slowdown in consumer spending or tariff spikes on ingredients could quickly challenge the upside story.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Chipotle Mexican Grill on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Use your insight to craft a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Chipotle’s recent performance signals cooling growth, tighter profit margins, and less momentum compared to both industry peers and its own long-term average.

Looking for steadier performers? Use stable growth stocks screener (2112 results) to discover companies with proven earnings and revenue growth that have delivered consistency even when leaders like Chipotle have slowed down.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives