- United States

- /

- Hospitality

- /

- NYSE:CMG

Assessing Chipotle Mexican Grill (CMG) Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Most Popular Narrative: 29.5% Undervalued

According to the most popular narrative, Chipotle Mexican Grill’s stock is seen as significantly undervalued relative to its projected financial growth and anticipated performance over the next several years.

Chipotle is expanding its international presence with plans to open restaurants in Mexico by 2026. The company is also exploring further expansion in Latin America and Europe. This international expansion is expected to drive future revenue growth.

Why is this narrative viewed as so optimistic? Analysts are focusing on a combination of accelerating growth, operational improvements, and an ambitious profit outlook to justify a valuation that is considerably higher than its current level. The specifics of these projections and the market assumptions behind them could change your perspective on Chipotle’s future potential.

Result: Fair Value of $58.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slowdown in consumer spending or new tariffs on key ingredients could present challenges to Chipotle’s projected international growth and profit margin improvements.

Find out about the key risks to this Chipotle Mexican Grill narrative.Another View: How Does the Market Compare?

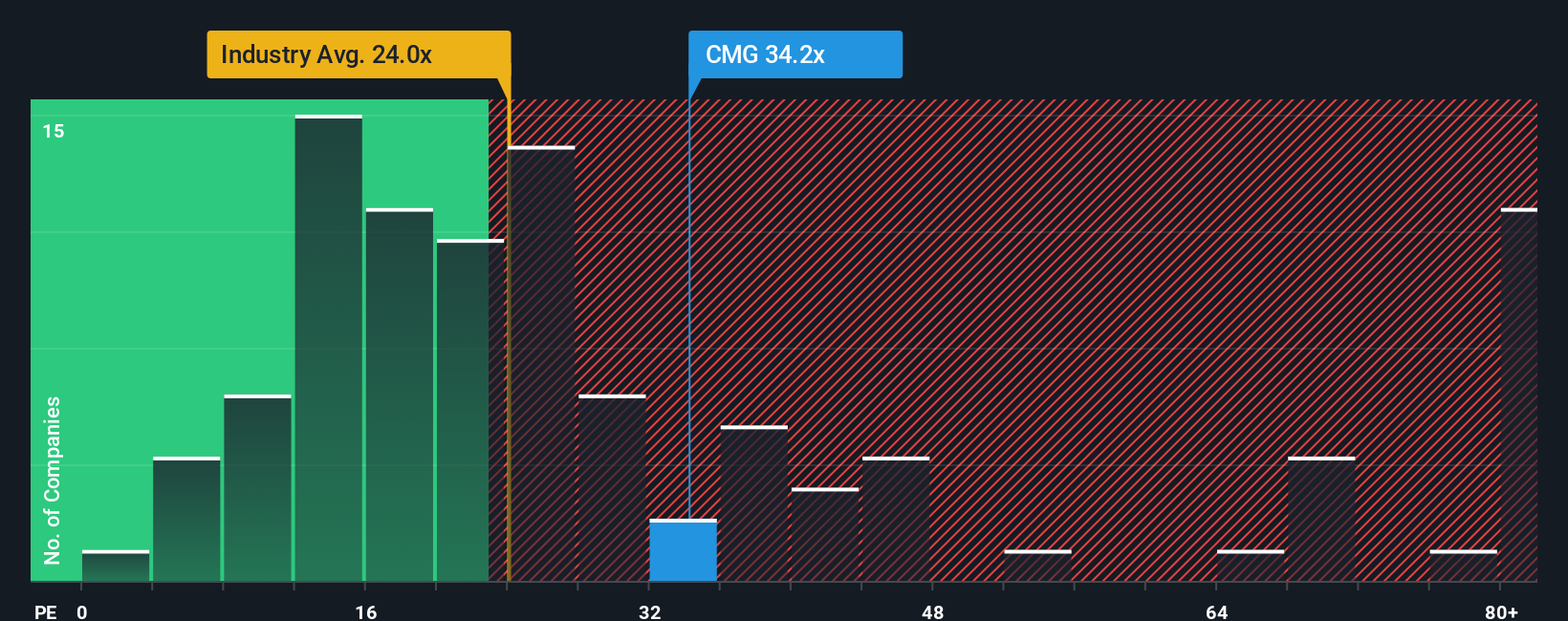

Taking a step back from analyst forecasts, a look at the current price-to-earnings ratio versus the rest of the industry suggests Chipotle shares may actually be expensive compared to similar US companies. This could signal caution, or the market may perceive hidden strengths.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chipotle Mexican Grill Narrative

If the current viewpoint does not align with your own or you feel there is more story to uncover, you can quickly assemble your own narrative in just a few minutes, and Do it your way.

A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take the next step toward smarter investing by checking out stocks with high potential using our tailored tools. You could find opportunities others are missing and make your portfolio stand out.

- Spot companies offering standout yields and steady income by using our selection of dividend stocks with yields > 3%.

- Hunt for overlooked gems that trade below their true worth with our picks for undervalued stocks based on cash flows.

- Get ahead of technology trends with our latest list of AI penny stocks shaking up the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success