- United States

- /

- Hospitality

- /

- NYSE:CHH

Should Choice Hotels International’s (CHH) Africa Expansion Prompt a Fresh Look From Investors?

Reviewed by Sasha Jovanovic

- In November 2025, Choice Hotels International announced its entry into Africa with three directly franchised hotels in Kenya, expected to open in early 2026, and a master development agreement targeting at least 15 more properties across sub-Saharan and southern Africa by 2030.

- This expansion boosts Choice Hotels’ international footprint and strengthens its presence in key growth markets, adding new destinations to its loyalty program and enhancing opportunities for global revenue diversification.

- We'll examine how Choice Hotels' push into Africa, including properties in Kenya and a multi-property development deal, shapes its investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Choice Hotels International Investment Narrative Recap

To invest in Choice Hotels International, you need to believe that its international and franchising-focused model will offset current revenue pressures, particularly as it expands into emerging travel markets. The new Africa announcement is ambitious but may not meaningfully change near-term catalysts, which continue to hinge on recovery in business and international inbound travel; ongoing softness in these segments remains the most significant near-term risk.

Of the company’s recent moves, the massive expansion in France, doubling its portfolio via 50 new hotels in October, puts the African development into context, showing Choice’s commitment to accelerating room growth in international markets. Such growth stories can strengthen future earnings, but they also highlight ongoing execution risks with new markets and master franchise structures.

However, if sluggish international travel persists and weighs on RevPAR through 2026, investors need to know that...

Read the full narrative on Choice Hotels International (it's free!)

Choice Hotels International's outlook suggests revenues of $1.8 billion and earnings of $354.2 million by 2028. This is based on an assumed annual revenue growth rate of 30.6% and a $48 million increase in earnings from the current $306.2 million.

Uncover how Choice Hotels International's forecasts yield a $109.27 fair value, a 20% upside to its current price.

Exploring Other Perspectives

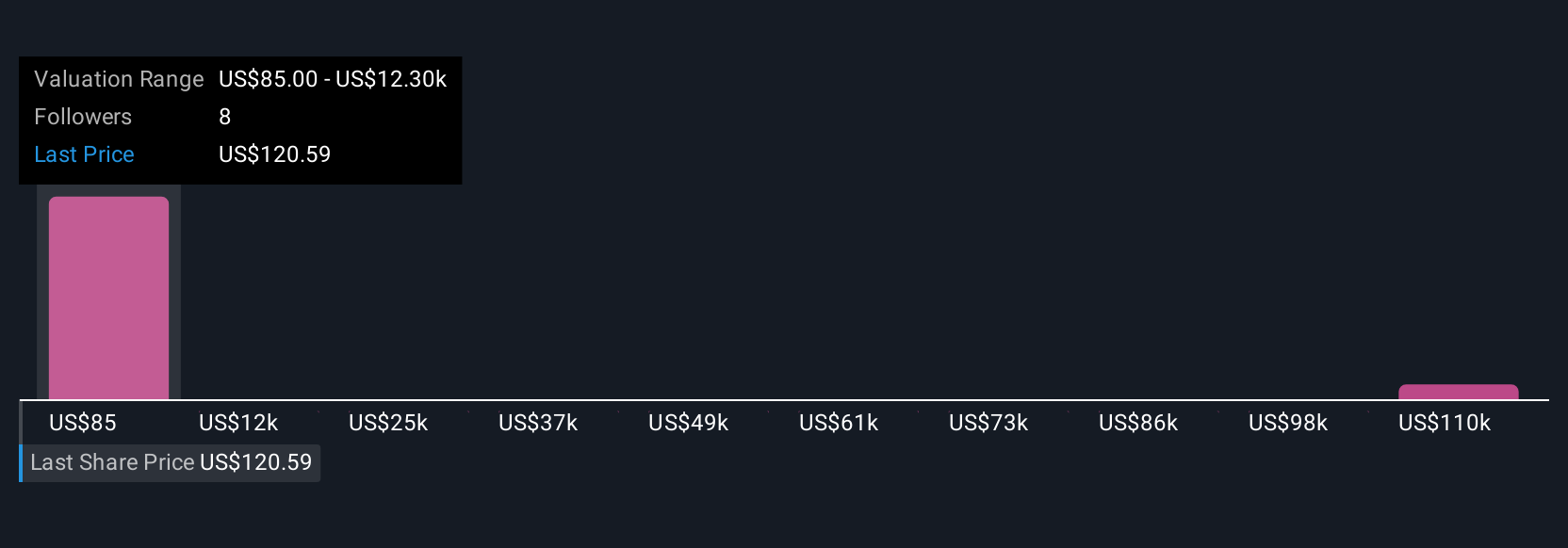

Four individual fair value estimates from the Simply Wall St Community place Choice Hotels International’s shares between US$65 and an outlier above US$122,000. Paired with current risks like underperformance in government and inbound international travel, this signals the importance of reviewing a spectrum of market outlooks before forming your view.

Explore 4 other fair value estimates on Choice Hotels International - why the stock might be worth 29% less than the current price!

Build Your Own Choice Hotels International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Choice Hotels International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Choice Hotels International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Choice Hotels International's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHH

Choice Hotels International

Operates as a hotel franchisor in the United States and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026