- United States

- /

- Hospitality

- /

- NYSE:CHH

A Look at Choice Hotels International’s Valuation as It Expands Across Africa with Major New Deals

Reviewed by Simply Wall St

Choice Hotels International is making headlines with its latest move to enter the African market. The company is launching three new hotels in Kenya and has committed to opening at least 15 additional properties across sub-Saharan and southern Africa by 2030.

This expansion continues a pattern of international growth for Choice Hotels. It reinforces the brand’s footprint outside the U.S. and signals further opportunity for investors to watch in coming years.

See our latest analysis for Choice Hotels International.

While Choice Hotels continues to extend its reach globally, shares have struggled this year, with a year-to-date share price return of -34.95% and a one-year total shareholder return of -38.73%. Despite the negative momentum, investors appear to be balancing the company’s ambitious international expansion with concerns about competitive pressure and debt. This suggests both risk and potential long-term growth stories are present.

If you’re curious about how other fast-growing companies with strong insider support are performing, consider exploring fast growing stocks with high insider ownership.

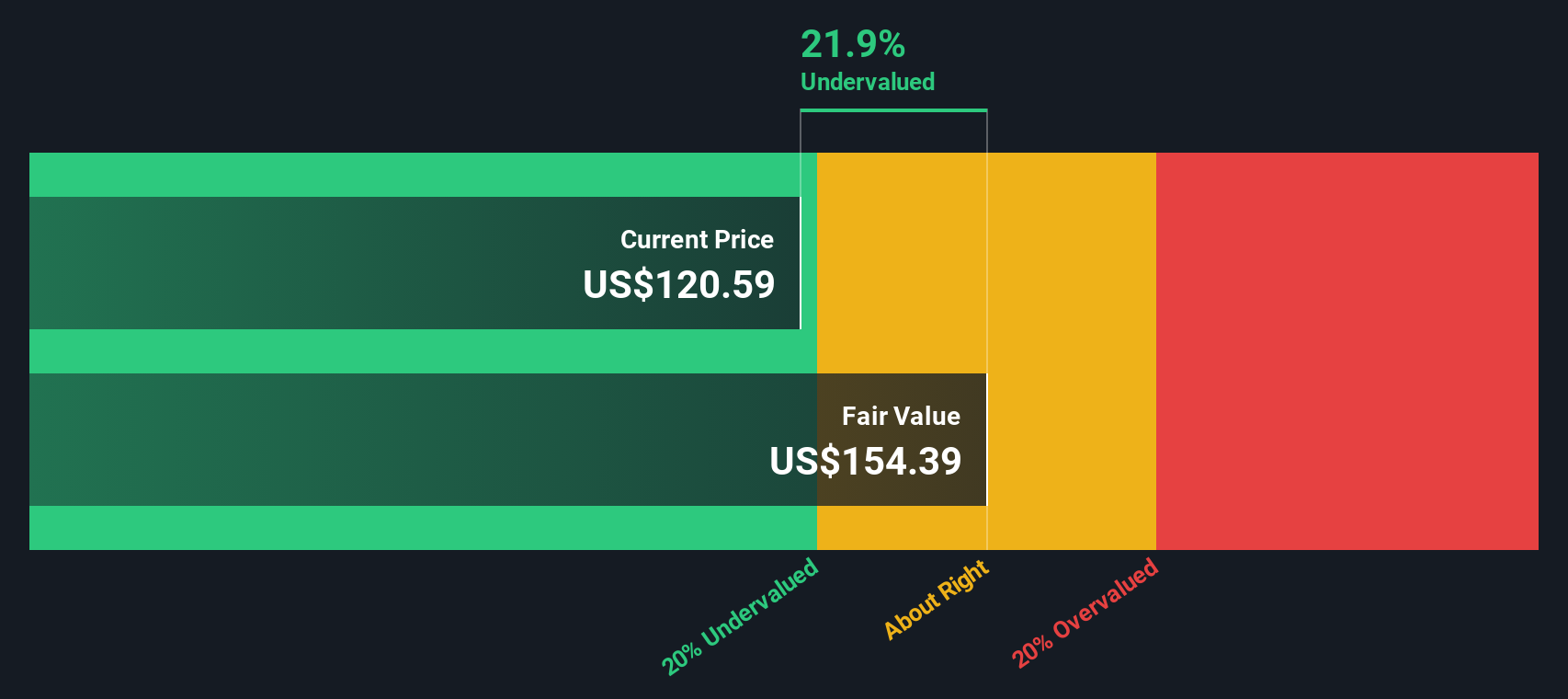

With shares trading about 22% below analyst targets, but ongoing concerns about slower earnings growth and debt, the question remains: does this pullback offer a compelling entry point, or is future expansion already reflected in the price?

Most Popular Narrative: 20% Undervalued

According to the prevailing narrative, Choice Hotels International’s last close of $92.16 sits well below its estimated fair value, highlighting a major disconnect that has captured investor attention. The stage is set for a fierce debate over whether these discounted prices reflect temporary headwinds or a lasting opportunity.

Strong international expansion, including new direct franchising in Canada, a master franchising deal in China targeting 10,000 rooms, and increased presence in EMEA and South America, is set to capture rising global travel demand from growing middle-class populations. This is expected to drive future revenue and EBITDA growth relative to historical expectations.

Ever wonder what assumptions justify a fair value that leaves today’s share price in the dust? Behind this bold projection are aggressive calls on global growth and impressive profit expectations few saw coming. Curious about the numbers and the logic behind these bullish forecasts? Dive into the full narrative and see what could be fueling the next big move.

Result: Fair Value of $115.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in domestic and international travel, or a slower-than-expected recovery in key markets, could challenge the bullish outlook on Choice Hotels International.

Find out about the key risks to this Choice Hotels International narrative.

Another View: SWS DCF Model Tells a Different Story

Looking through the lens of our DCF model, the picture shifts. Rather than strong upside, the SWS DCF model estimates fair value at $83.74, suggesting the current price may actually be a bit high. Does this reveal hidden risk, or is it simply a case of cautious assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Choice Hotels International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Choice Hotels International Narrative

If you see things differently or want to dig deeper into the data yourself, you can quickly craft your own perspective using our tools in just a few minutes. Do it your way.

A great starting point for your Choice Hotels International research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Use the Simply Wall Street Screener now to discover stocks outside your radar and sharpen your investing edge.

- Tap into growth potential by checking out these 26 AI penny stocks, which are transforming the landscape with artificial intelligence innovation.

- Find overlooked bargains among these 925 undervalued stocks based on cash flows, which show strong fundamentals yet trade below their intrinsic value.

- Seize high yields in the market with these 14 dividend stocks with yields > 3%, offering attractive dividends above 3%, ensuring income alongside returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHH

Choice Hotels International

Operates as a hotel franchisor in the United States and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success