- United States

- /

- Hospitality

- /

- NYSE:CCL

Will Cunard’s Queen Mary 2 Spotlight Elevate Carnival (CCL) Brand or Reveal Sector Pressures?

Reviewed by Sasha Jovanovic

- In recent news, Carnival Corporation's Cunard line announced that its Queen Mary 2 flagship will play a lead role in the Sail4th 250 celebrations in New York Harbor on July 4, 2026, offering guests unique experiences amid the largest maritime gathering in decades.

- This major event highlights Carnival's commitment to expanding its fleet and brand visibility, occurring alongside company efforts to boost demand and modernize operations.

- We'll explore how cruise sector cost pressures and cautious outlooks, spotlighted by competitor earnings, affect Carnival's underlying investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Carnival Corporation & Investment Narrative Recap

Carnival Corporation & plc appeals to investors who believe in the long-term growth of leisure travel, robust demand for cruise experiences, and the company's ability to manage costs while modernizing its fleet. While the recent Queen Mary 2 announcement showcases brand strength and market presence, it does not materially impact the biggest near-term catalyst, sustained passenger demand and margin expansion, nor does it alleviate the primary risk of rising operational costs and persistent debt levels.

Among recent announcements, the opening of Celebration Key is particularly relevant. This expansion aligns with Carnival’s strategy to drive high-margin growth and boost onboard spending by investing in exclusive destinations, aiming to enhance customer experiences and reinforce pricing power as the company heads into critical years for fleet and brand development.

Yet, despite these strengths, investors should also consider that, unlike traditional hospitality firms, Carnival’s high capital expenditure requirements mean that free cash flow and returns can be constrained if operational costs rise or modernization efforts prove...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation &'s narrative projects $29.0 billion revenue and $3.7 billion earnings by 2028. This requires 3.8% yearly revenue growth and a $1.2 billion earnings increase from $2.5 billion today.

Uncover how Carnival Corporation &'s forecasts yield a $35.84 fair value, a 27% upside to its current price.

Exploring Other Perspectives

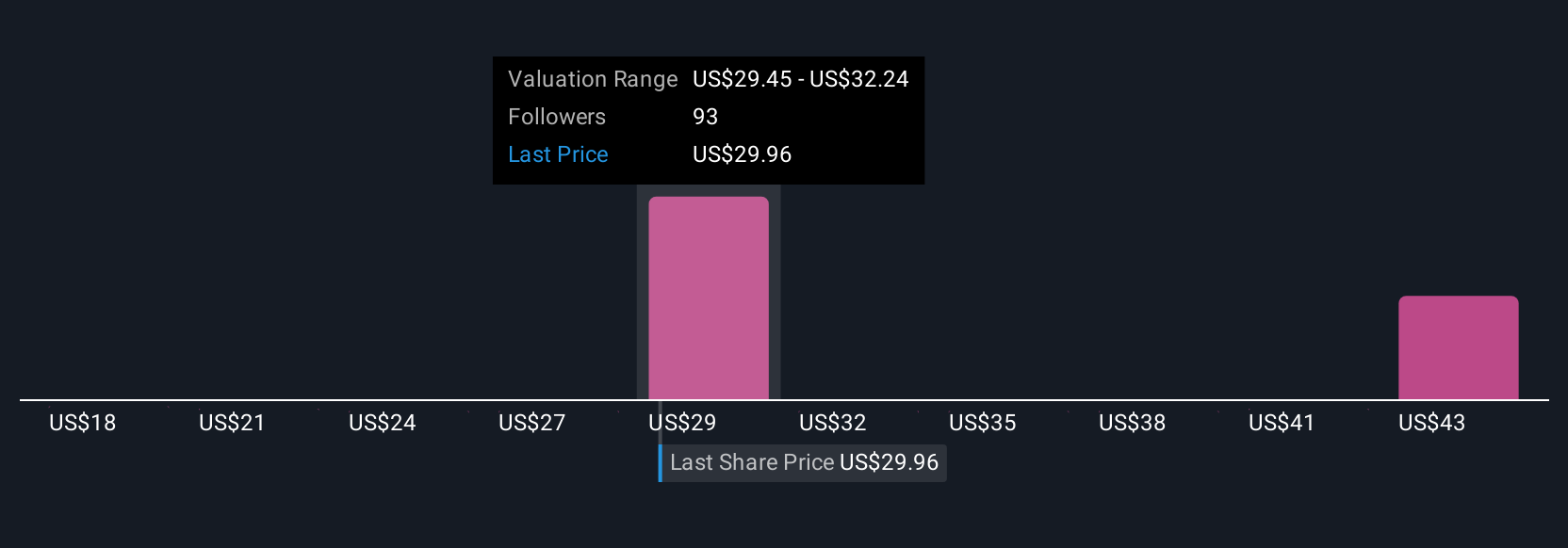

Ten fair value estimates from the Simply Wall St Community range from US$24.61 to US$41.57 per share. While these diverse views highlight the wide spread of retail outlooks, remember that inflation-driven cost pressures remain a central concern for Carnival’s future performance.

Explore 10 other fair value estimates on Carnival Corporation & - why the stock might be worth as much as 47% more than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

No Opportunity In Carnival Corporation &?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives