- United States

- /

- Hospitality

- /

- NYSE:CCL

Why Carnival (CCL) Is Up 9% After Return to Profitability In Strong Second Quarter - And What's Next

- Carnival Corporation announced strong second quarter results, with sales of US$2.22 billion and net income of US$565 million, marking a significant rise from the prior year's performance over the same period.

- The company’s turnaround is further emphasized by a move from a net loss of US$123 million in the first six months last year to a net profit of US$486 million this year, highlighting a clear return to profitability.

- We'll explore how Carnival's return to profitability in the second quarter could shift analyst expectations for future earnings and growth.

Carnival Corporation & Investment Narrative Recap

For Carnival Corporation, holding shares means believing in the continued rebound of global travel demand and the company's ability to drive yield growth while managing costs and financial obligations. The recent surge to US$565 million net income in Q2 2025 offers clear evidence of a return to profitability, strengthening the core catalyst of improved operating performance. However, this momentum does not materially change the biggest near-term risk: vulnerability to swings in consumer discretionary spending and macroeconomic activity.

Among the latest announcements, the new US$4.5 billion multi-currency revolving credit facility stands out. While not directly translating into immediate operating gains, this facility boosts Carnival's financial flexibility and underpins its ongoing refinancing efforts, a critical factor as the company seeks to lock in stronger margins and address its high debt load, a recurring concern for the stock’s short-term outlook.

By contrast, with consumer demand showing signs of volatility, investors should be aware of...

Read the full narrative on Carnival Corporation & (it's free!)

Exploring Other Perspectives

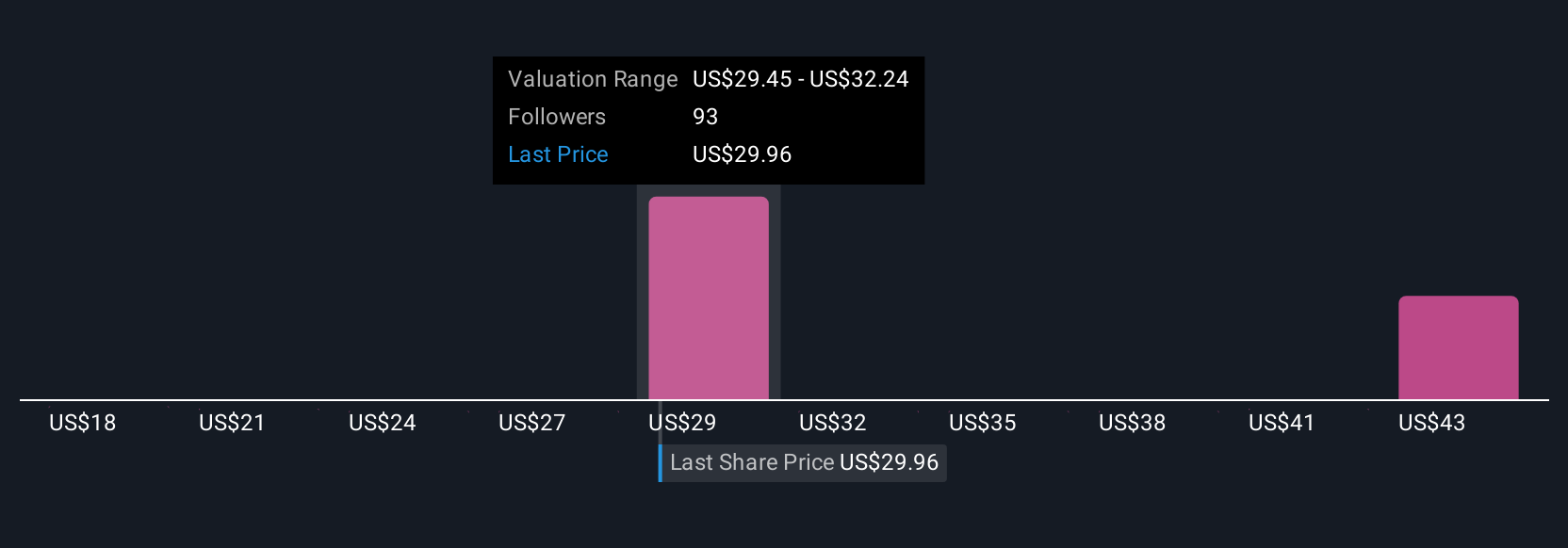

Six fair value estimates from the Simply Wall St Community range from US$21.99 to US$43.24 per share. Although recent earnings indicate profitability, continued success depends on Carnival’s ability to manage consumer demand risk, explore these independent perspectives to see how outlooks can vary widely.

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Sasha Jovanovic

Sasha is an Equity Analyst at Simply Wall St with 15 years financial markets experience. He is a CFA Charterholder and holds Bachelor degrees in Mathematics and International Studies from the University of Technology, Sydney, Australia. He worked at CommSec Investment Management as an Investment Analyst from 2014 and later at Sequoia Financial Group as a Portfolio Analyst from 2018.

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives