- United States

- /

- Hospitality

- /

- NYSE:CCL

Is It Too Late to Consider Carnival Stock After Its 298.5% Three Year Surge?

Reviewed by Bailey Pemberton

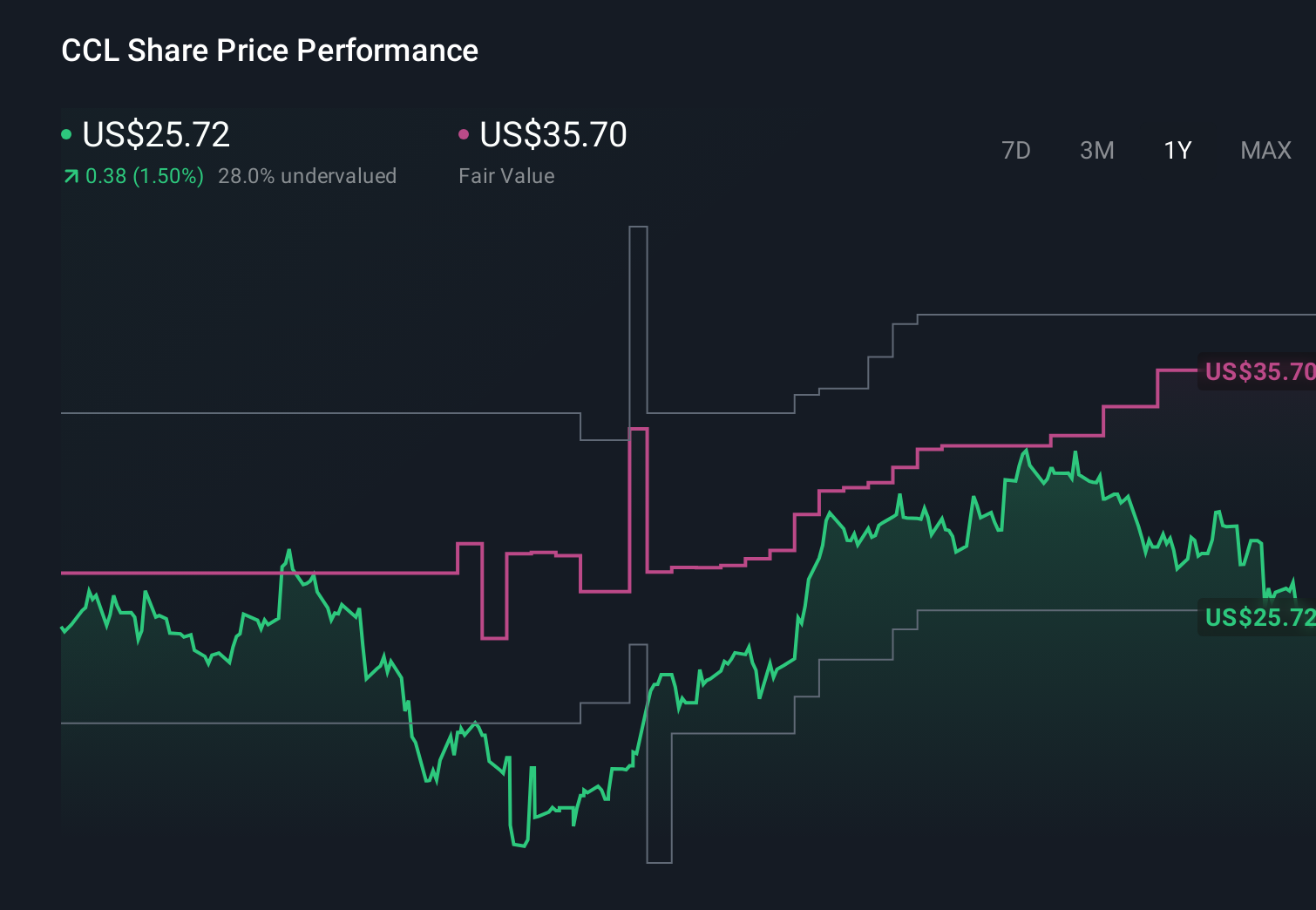

- If you have been wondering whether Carnival Corporation and stock is still a bargain after its rebound, you are not alone. This article will unpack what the current share price really implies about future cruises and cash flows.

- The stock has climbed 12.7% over the last week, 19.3% over the past month, and is now up 24.4% year to date. This builds on a 298.5% gain over three years that has significantly changed how investors view its risk and recovery story.

- Recent headlines have focused on the cruise industry returning to fuller capacity, stronger booking trends across key markets, and continued progress in paying down the heavy debt load taken on during the shutdown period. At the same time, macro concerns around consumer spending and travel budgets are keeping some investors cautious about how durable this recovery is.

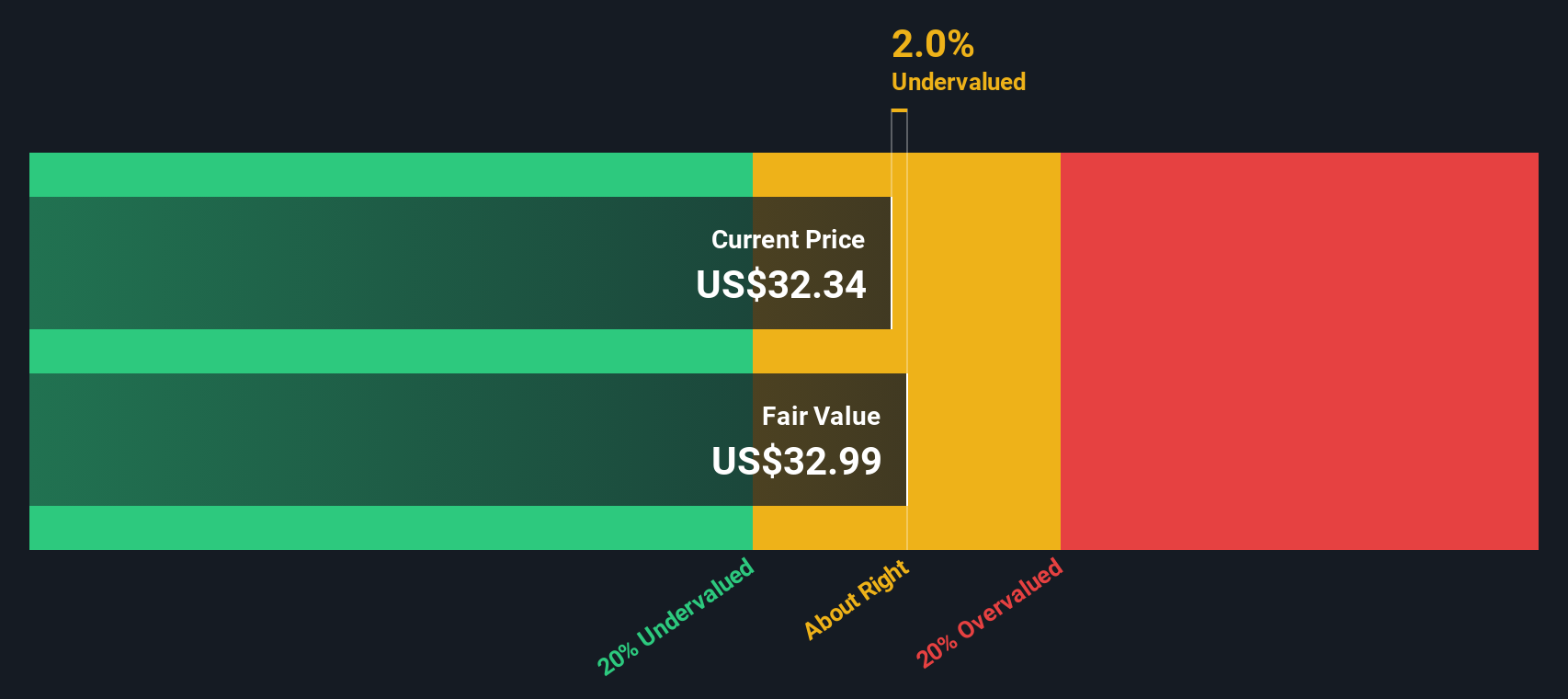

- On our framework, Carnival Corporation and currently scores a 4/6 valuation check. This suggests the shares look undervalued on several metrics but not all. Next we will break down those different valuation approaches while hinting at a more nuanced way to think about value that we will return to at the end.

Approach 1: Carnival Corporation & Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. For Carnival Corporation & the analysis uses a 2 Stage Free Cash Flow to Equity approach based on cash flow projections in $.

The company generated trailing twelve month free cash flow of about $1.6 Billion, and analysts expect this to grow meaningfully over time, with Simply Wall St extrapolating those estimates beyond the normal five year window. By 2029, free cash flow is projected to reach roughly $3.9 Billion, and the longer term projections continue to climb modestly in the following years.

Bringing all of those future cash flows back to today, the model arrives at an estimated intrinsic value of $37.46 per share. Compared with the current market price, this implies the stock is trading at roughly a 16.9% discount and is therefore described as undervalued on a DCF basis, assuming the cash flow path plays out as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Carnival Corporation & is undervalued by 16.9%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

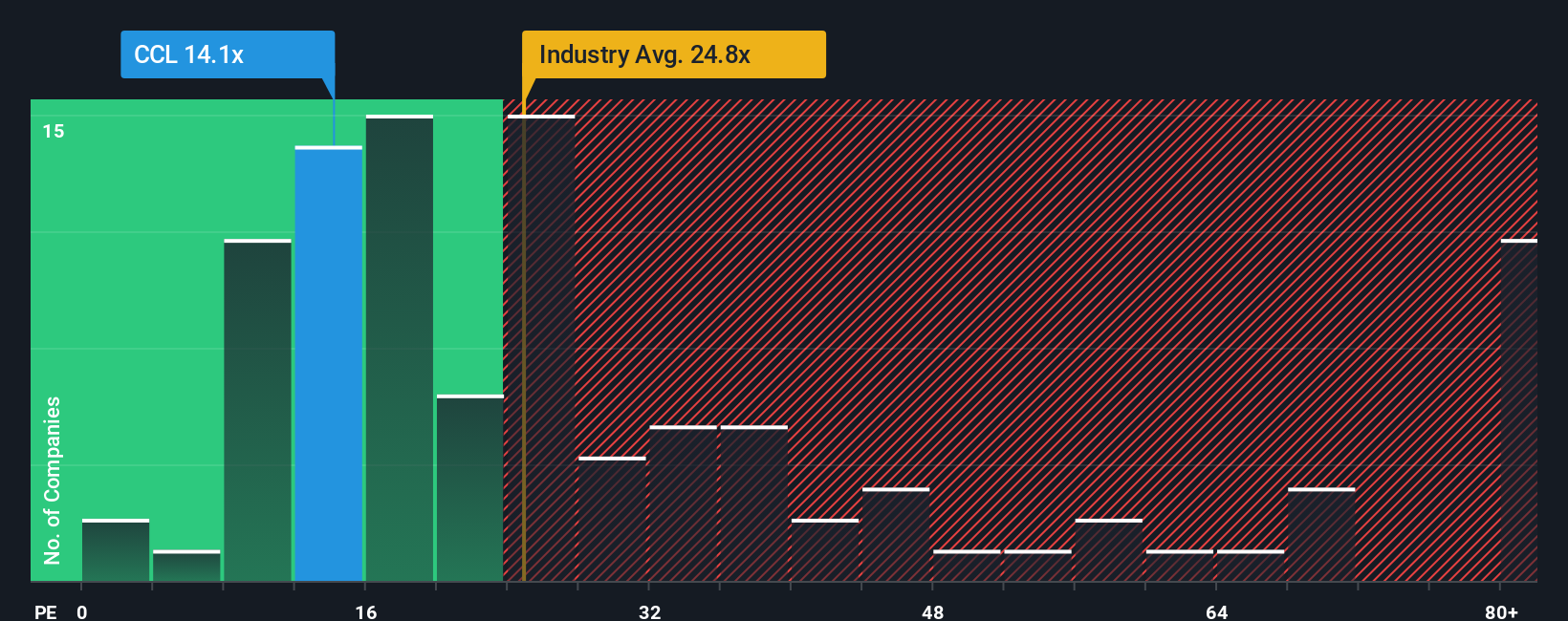

Approach 2: Carnival Corporation & Price vs Earnings

For companies that have returned to consistent profitability, the price to earnings ratio is often the go to valuation yardstick because it links what investors are paying directly to the earnings the business is generating today. In simple terms, faster and more reliable earnings growth usually justifies a higher PE multiple, while higher risk or more volatile profits tend to push a fair PE lower.

Carnival Corporation & currently trades on a PE of around 14.8x, which sits well below both the Hospitality industry average of about 23.5x and the peer group average of roughly 22.6x. Simply Wall St also calculates a proprietary Fair Ratio of 26.4x for Carnival Corporation & based on its specific mix of earnings growth prospects, margin profile, industry positioning, market capitalization and risk factors. This Fair Ratio is more tailored than a simple comparison with peers or the sector because it attempts to capture what investors should reasonably pay for this company in particular, rather than for cruise lines or hotels in general.

With the shares on 14.8x compared with a Fair Ratio of 26.4x, the preferred multiple analysis points to the stock being materially undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1466 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carnival Corporation & Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your own story about a company, backed up by your assumptions for its future revenue, earnings, margins and ultimately fair value. A Narrative on Simply Wall St links what you believe about Carnival Corporation & its destinations, demand, competition, debt and execution, to a forecast of the financials and then to a clear fair value per share that you can compare with today’s price to help inform your decision. Narratives are available to everyone inside the Community page on Simply Wall St, they are easy to create, and they automatically refresh when new news, earnings or guidance arrive so your view is never static. For example, one Carnival Corporation & Narrative might build a case that its expanding Caribbean destinations and improving margins point to a fair value closer to $43, while a more cautious Narrative might stress debt, regulatory and demand risks and land near $24. Both perspectives are visible side by side so you can see where you agree or disagree and refine your own view.

Do you think there's more to the story for Carnival Corporation &? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion